In the vast and ever-expanding crypto universe, finding the next big thing can feel like searching for a needle in a haystack. With thousands of altcoins vying for attention, even seasoned crypto investors can miss out on potential 100x gems. It’s not always about a lack of diligence; sometimes, it’s simply the sheer volume of information to process. But what if there was a way to cut through the noise and identify altcoins that are quietly gaining momentum? A recent analysis from Santiment points to a promising approach: focusing on network activity. Let’s dive into the 6 overlooked altcoins that have caught a crypto analyst’s eye due to their surging network metrics.

Unearthing Hidden Crypto Gems: Network Activity as a Key Indicator

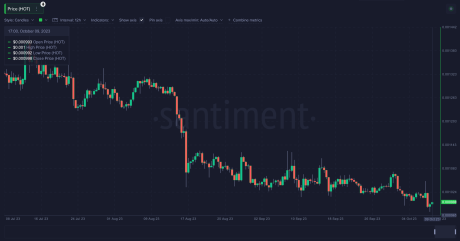

Forget the hype and flashy marketing – a Santiment analyst suggests looking at the blockchain itself for clues. Their recent post highlights six altcoins selected not based on price action alone, but on significant upticks in their network activity. These aren’t necessarily the coins dominating headlines, but they’re showing compelling activity behind the scenes, signaling potential for future growth.

The analyst emphasizes that “extra juicy opportunities” often lie with projects that haven’t experienced dramatic price surges recently, yet are witnessing a surge in crucial network metrics. These metrics include transaction volumes, network growth (new addresses and adoption), and large transaction counts (whale activity). According to the analyst, these activity spikes suggest increased volatility and potential price movement, even if a pump isn’t guaranteed.

So, which altcoins are showing this promising network activity? Let’s explore the list:

1. Bancor (BNT): DeFi Pioneer Showing Strong Fundamentals

Leading the pack is Bancor (BNT), the protocol behind the Bancor Network. This permissionless platform is designed for open-source DeFi innovation. Bancor has demonstrated a remarkable surge across multiple network metrics. Think of it as the engine of a car suddenly revving up – you might expect movement soon.

Key Network Activity Spikes for Bancor (BNT):

- High Transaction Volumes: More BNT is moving around on the network.

- Active Addresses: More users are interacting with BNT, suggesting growing adoption.

- Network Growth: The Bancor network is expanding, attracting new participants.

- Whale Transactions: Large holders are making significant BNT transactions.

- Exchange Inflows: BNT is being deposited onto exchanges, potentially for trading.

- Age Destroyed (Consumed): Older coins are being moved, often a sign of strategic shifts.

2. Cartesi (CTSI): Linux in the Blockchain Realm Gains Traction

Next up is Cartesi (CTSI), a project focused on application-specific rollups, bringing the power of Linux to blockchain development. Like Bancor, Cartesi is exhibiting similar positive network signals. This suggests developers and users are increasingly engaging with the Cartesi ecosystem.

Network Activity Highlights for Cartesi (CTSI):

- High Transaction Volume

- Active Addresses

- Whale Transactions

- Age Destroyed (Consumed)

>

3. Holo (HOT): P2P Applications Spark Whale Interest

Holo (HOT), the fuel for the Holochain platform that empowers peer-to-peer (P2P) applications, makes the list primarily due to significant whale activity. It appears larger investors are accumulating HOT, indicating growing confidence in the project’s potential.

Key Metrics for Holo (HOT):

- Whale Accumulation ($100K – $1M addresses): Addresses holding significant amounts are increasing their HOT holdings.

- High Whale Transactions

- Exchange Inflows

- Age Destroyed (Consumed)

4. Powerpool (CVP): Governance Protocol Attracting Big Players?

Powerpool (CVP) is a protocol focused on decentralized governance solutions. Similar to Holo, Powerpool is experiencing accumulation from larger holders, suggesting growing interest in its governance-centric approach within the DeFi space.

Network Growth Signals for Powerpool (CVP):

- High Active Addresses

- Network Growth

- Whale Accumulation ($100K – $1M): Just like HOT, CVP is seeing accumulation in this whale bracket.

- Age Destroyed (Consumed)

5. Storj (STORJ): Decentralized Cloud Storage Gaining Momentum

Storj (STORJ) aims to revolutionize cloud storage by offering a decentralized, eco-friendlier, and potentially cheaper alternative to traditional providers. This under-the-radar project is showing broad-based network strength.

Storj (STORJ) Network Activity Indicators:

- High Transaction Volume

- Active Addresses

- Network Growth

- Whale Accumulation

- Age Destroyed (Consumed)

6. UniLend (UFT): DeFi Aggregation Platform Seeing Increased Use

Rounding out the list is UniLend (UFT), a protocol designed to bring all decentralized finance (DeFi) trading opportunities into a single, accessible platform via smart contracts. UniLend’s network is also heating up across multiple metrics.

UniLend (UFT) Growth Metrics:

- High Transaction Volume

- Active Addresses

- Network Growth

- Whale Transactions

- Whale Accumulation ($100K – $1M)

- Exchange Inflow

A Word of Caution: Network Activity Doesn’t Guarantee Price Pumps

While these six altcoins exhibit intriguing network activity, it’s crucial to approach this information with a balanced perspective. The analyst himself points out a critical observation: “It appears that 4 out of these 6 highlighted projects are likely getting hot network activity BECAUSE of the price pump.” In these cases, increased activity might be a *reaction* to price movement, not necessarily a predictor of future pumps.

For the remaining two projects, and even for those where activity might be driving price, there are no guarantees. The crypto market is notoriously volatile, and network activity is just one piece of the puzzle.

Key Takeaway: Do Your Own Research!

This analysis provides a starting point for further investigation. As the analyst wisely advises, crypto investors should always “make your own assessments, research these and the many other projects that show similar hot network activity…” Dive deeper into each project, understand their fundamentals, tokenomics, and roadmaps before making any investment decisions.

In Conclusion: Network Activity as a Powerful Tool, But Not a Crystal Ball

Identifying altcoins with strong network activity can be a valuable strategy for crypto investors looking for potential opportunities beyond the mainstream. Bancor, Cartesi, Holo, Powerpool, Storj, and UniLend are six projects currently exhibiting such activity, making them worthy of further research. However, remember that network activity is just one indicator. Combine it with fundamental analysis, market sentiment assessment, and robust risk management to navigate the exciting, yet unpredictable, world of altcoin investing. Happy researching!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.