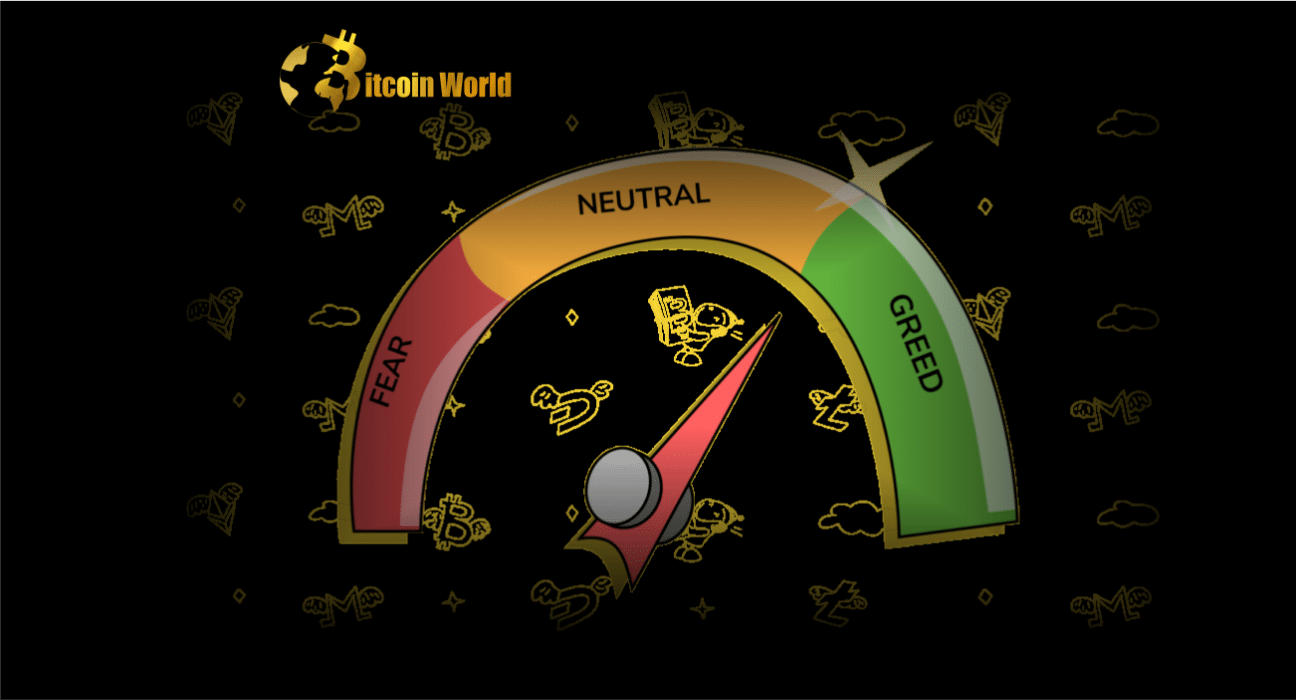

Remember the nail-biting days of crypto winter? Fast forward to today, and the mood in the cryptocurrency market has flipped dramatically! The Crypto Fear and Greed Index, a key barometer of investor sentiment, is flashing a bright signal: Greed is back in town! But is this exuberance justified, or are we getting ahead of ourselves? Let’s dive into what this means for you and your crypto investments.

What Exactly is the Crypto Fear and Greed Index?

Think of the Crypto Fear and Greed Index as a mood ring for the crypto market. It’s designed to gauge the overall sentiment of cryptocurrency investors. This index operates on a scale from 0 to 100:

- 0-24: Extreme Fear: This usually indicates that investors are overly worried, potentially presenting buying opportunities.

- 25-49: Fear: Still cautious, but fear is starting to subside.

- 50-74: Greed: Investors are becoming more optimistic and enthusiastic.

- 75-100: Extreme Greed: Signifies excessive optimism, which could be a sign of a market bubble.

The index crunches data from various sources to determine this score, including:

- Volatility: How wildly prices are swinging. High volatility can breed fear.

- Market Momentum/Volume: How much crypto is being traded and whether prices are trending up or down.

- Social Media Sentiment: What people are saying about crypto online.

- Surveys: Direct polls of crypto investors’ feelings.

- Dominance: Bitcoin’s share of the total crypto market.

- Google Trends: Search interest in Bitcoin and related terms.

Currently, the Crypto Fear and Greed Index has surged to 68, reaching levels not seen since Bitcoin’s all-time high back in November 2021. This jump signifies a significant shift from the “extreme fear” we experienced after the FTX collapse last year, when the index plummeted to a mere 6.

Why the Sudden Shift to Greed? Bitcoin’s Bull Run & Market Dynamics

Several factors are fueling this renewed optimism and pushing the index upwards:

- Bitcoin’s Impressive Rally: Bitcoin has been on a tear! It’s currently trading around $28,200, marking a stunning over 30% increase in just a week. This bullish price action naturally boosts investor confidence.

- Bitcoin Outperforming Traditional Assets: Goldman Sachs recently highlighted Bitcoin as the top-performing asset year-to-date, surpassing both gold and the S&P 500. This outperformance is turning heads and attracting investors seeking higher returns.

- Banking Sector Turmoil: Ironically, the crisis in traditional banking might be benefiting Bitcoin. The failures of Silicon Valley Bank, Signature Bank, and the Credit Suisse saga have shaken faith in traditional financial institutions. Investors are potentially seeking refuge in decentralized assets like Bitcoin as a hedge against these uncertainties.

- Inflation and Interest Rate Concerns: Persistent inflation and rising interest rates by the Federal Reserve are creating pressure on banks holding low-interest bonds. This macroeconomic environment is making alternative assets like Bitcoin more attractive to some investors.

In essence, while traditional markets grapple with banking instability and economic headwinds, Bitcoin is presenting itself as a potential safe haven and a high-growth opportunity.

Greed vs. Caution: Navigating the Crypto Market

While a high Fear and Greed Index indicates positive sentiment, it’s crucial to remember that it’s just one piece of the puzzle. Experts caution against using it as the sole basis for investment decisions. Here’s a balanced perspective:

Points to Consider:

- Don’t Get Carried Away by the Hype: Extreme greed can sometimes precede market corrections. It’s essential to remain grounded and avoid impulsive decisions driven by FOMO (Fear of Missing Out).

- Do Your Own Research (DYOR): Always conduct thorough research before investing in any cryptocurrency. Understand the technology, the project’s fundamentals, and the risks involved.

- Diversification is Key: Don’t put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

- Long-Term Perspective: Consider your long-term investment goals. Crypto markets are volatile, and short-term gains can be quickly wiped out.

- Heed Expert Advice, but Decide for Yourself: While expert opinions are valuable, ultimately, your investment decisions should align with your own risk tolerance and financial situation.

Bitcoin: “The Index” of the Future?

Cory Klippsten, CEO of Swan Bitcoin, makes a bold statement, calling Bitcoin “the index” and suggesting that altcoins are merely a “call option on all future cryptocurrency technology.” This perspective highlights Bitcoin’s dominance and its potential as the foundational layer of the crypto ecosystem. While altcoins offer innovation and potentially higher returns, they also come with significantly higher risks.

The Road Ahead: Optimism Tempered with Prudence

The Crypto Fear and Greed Index reflects a palpable shift in market sentiment towards optimism. Bitcoin’s recent surge and its outperformance against traditional assets are certainly reasons for enthusiasm. However, the ongoing uncertainties in the global financial markets and the inherent volatility of cryptocurrencies demand a balanced approach.

Key Takeaway: Enjoy the renewed optimism in the crypto market, but don’t let “greed” cloud your judgment. Stay informed, do your research, and invest wisely. The crypto journey is a marathon, not a sprint!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.