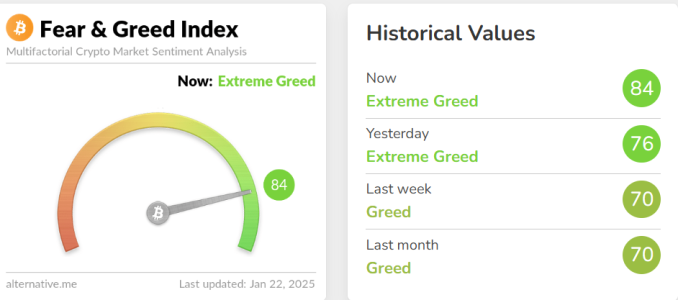

The Crypto Fear & Greed Index, a widely followed indicator of market sentiment, has surged to 84 as of January 22, 2025, marking a significant eight-point jump from the previous day. This score places the market firmly in the “Extreme Greed” zone, signaling a highly optimistic outlook among cryptocurrency investors.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential.

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index, developed by software platform Alternative, measures the sentiment of the cryptocurrency market on a scale from 0 to 100:

- 0-24: Extreme Fear – Investors are highly apprehensive.

- 25-49: Fear – Market sentiment is negative.

- 50-74: Neutral/Greed – Optimism is growing.

- 75-100: Extreme Greed – High market enthusiasm and FOMO (Fear of Missing Out).

This index aggregates data from six key factors:

- Volatility (25%): Measures large swings in price.

- Market Momentum/Volume (25%): Tracks market activity and enthusiasm.

- Social Media (15%): Monitors sentiment and engagement across platforms.

- Surveys (15%): Gathers input from retail investors.

- Bitcoin Dominance (10%): Assesses Bitcoin’s share of the market.

- Google Trends (10%): Analyzes search interest in cryptocurrencies.

Understanding the Rise to 84

The jump to 84 indicates a strong surge in positive sentiment, driven by several factors:

1. Increased Market Momentum

High trading volumes and rising prices contribute to improved market confidence.

2. Social Media Buzz

Platforms like Twitter and Reddit are abuzz with discussions about cryptocurrency gains, fueling optimism.

3. Bitcoin Dominance

Bitcoin’s price stability and gains continue to attract investor interest, further boosting overall sentiment.

What Does Extreme Greed Mean for Investors?

While “Extreme Greed” reflects market enthusiasm, it also serves as a warning. Here’s what it could indicate:

- Bullish Trends: The market is experiencing a strong upward trajectory.

- Overvaluation Risks: Assets may be overpriced due to high demand.

- Increased Volatility: Sudden changes in sentiment could lead to sharp price corrections.

Historical Context: Extreme Greed and Market Cycles

Extreme Greed has historically coincided with bullish phases, but it is often a precursor to corrections:

- Case Study 1: Bitcoin 2021 Bull Run

The index reached similar levels during Bitcoin’s rise to $69,000 in late 2021, followed by a correction. - Case Study 2: Altcoin Season 2022

Altcoins outperformed during a period of Extreme Greed, but a shift to Fear led to market-wide declines.

Strategies for Navigating Extreme Greed

Investors should exercise caution and strategy during periods of Extreme Greed:

- Diversify Holdings

Avoid concentrating investments in one asset class to mitigate risks. - Take Profits

Secure gains to reduce exposure in case of a market correction. - Monitor Sentiment Changes

Keep an eye on the index for shifts that could signal emerging risks or opportunities.

The Role of Volatility in Driving Sentiment

Volatility, which contributes 25% to the index, plays a pivotal role in investor sentiment. High volatility can attract traders looking for quick profits but may deter risk-averse investors. As volatility remains elevated, it’s essential for participants to assess their risk tolerance and strategies.

Conclusion

The rise of the Crypto Fear & Greed Index to 84 highlights growing enthusiasm in the cryptocurrency market. While the “Extreme Greed” zone signals bullish sentiment, it also serves as a reminder for investors to stay vigilant. The potential for overvaluation and heightened volatility underscores the importance of a balanced approach to investing.

For long-term investors, this period offers a chance to reassess portfolios and capitalize on opportunities while managing risks effectively.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential.

FAQs

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index measures cryptocurrency market sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed).

Why is the index at 84 significant?

A score of 84 indicates Extreme Greed, suggesting strong market enthusiasm and potential overvaluation risks.

How is the index calculated?

The index combines six factors: volatility, market momentum/volume, social media, surveys, Bitcoin dominance, and Google Trends.

What are the risks of Extreme Greed?

Extreme Greed can lead to inflated asset prices, increased volatility, and potential market corrections.

How can investors navigate Extreme Greed?

Investors should diversify holdings, consider taking profits, and monitor changes in sentiment to manage risks.

What does the rise in the index mean for the crypto market?

The increase reflects improved sentiment and bullish trends but also highlights the importance of cautious investing.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.