Navigating the crypto rollercoaster can be thrilling and, let’s be honest, a bit nerve-wracking! Each week brings a fresh wave of volatility, creating opportunities and challenges in equal measure. Want to stay ahead of the curve? Let’s dive into this week’s crypto market highlights, pinpointing the stars that soared and those that took a tumble. From Helium’s impressive climb to Brett’s unfortunate dip, we’ve got the inside scoop on the week’s biggest crypto movers and shakers.

Who Dominated the Crypto Charts This Week?

This past week witnessed some interesting shifts in the cryptocurrency landscape. While some projects basked in the green glow of significant gains, others faced a less rosy picture. Here’s a quick snapshot of the top performers and underperformers:

- Winners: Helium (HNT), Pyth Network (PYTH), and Jupiter (JUP) took the crown as the week’s top gainers.

- Losers: Brett (BRETT), Lido DAO (LDO), and Notcoin (NOT) experienced the most significant downturns.

Let’s break down what fueled these movements and what it could mean for you.

Biggest Winners: Riding the Green Wave

Helium (HNT): Is the Bull Run Sustainable?

Helium (HNT) has been turning heads recently, and for good reason. Analyzing HNT’s price trajectory reveals a consistent upward trend that began around July 12th. But what exactly drove this impressive surge?

The numbers speak volumes:

- Starting the week around $4.5, HNT quickly jumped over 8% to $4.8.

- Despite minor dips on two days, HNT powered through to close the week at approximately $5.5, marking an overall weekly gain of 18.8%!

- CoinStats hailed HNT as the week’s top performer.

Adding to the bullish momentum, Helium’s Relative Strength Index (RSI) has climbed above 70. This signals strong buying pressure, although it also hints that HNT might be entering overbought territory. Could a correction be on the horizon, or will the bullish trend persist?

At the time of writing, HNT was trading around $5.3, showing a slight pullback of over 2%. However, its market capitalization remains robust at over $860 million, accompanied by a healthy trading volume exceeding $17 million. These key metrics have also seen positive growth in the last 24 hours, suggesting continued investor interest.

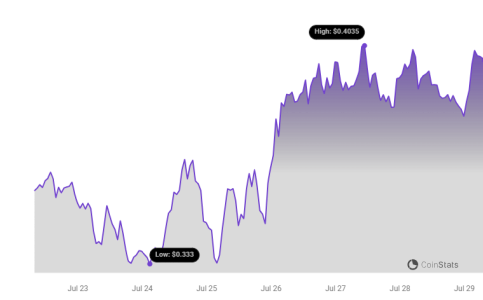

Pyth Network (PYTH): Second Place, But Still Shining Bright

Pyth Network (PYTH) secured the second spot on this week’s winners’ podium, boasting a commendable 9% increase, according to CoinStats. Let’s examine PYTH’s performance:

- PYTH began the week around $0.36 but faced some downward pressure initially.

- The tide turned around July 26th, initiating a positive price trend.

- By week’s end, PYTH had climbed to approximately $0.39 and has since edged past the $0.40 mark.

Pyth Network’s market capitalization is now over $1.4 billion, reflecting a 24-hour growth of over 3%. This indicates growing confidence in the project’s long-term potential.

However, it’s worth noting that PYTH’s trading volume has decreased by about 18% to around $80 million. Could this indicate a cooling off period after the price surge, or simply a shift in trading patterns?

Jupiter (JUP): Rounding Out the Top 3 Gainers

Jupiter (JUP) completes our trio of top gainers, securing the third position with an 8% increase. Let’s analyze JUP’s price movements:

- JUP started the week around $1 and experienced some price fluctuations.

- It dipped to approximately $0.9 mid-week but bounced back strongly.

- JUP reached a weekly high of $1.17, closing the week at about $1.12.

Jupiter’s trading volume saw a massive 80% surge in the last 24 hours, surpassing $234 million! This significant increase in trading activity suggests strong market interest and potential for further momentum.

Furthermore, Jupiter’s market capitalization exceeded $1.5 billion, growing by about 4% in the same 24-hour period. This robust growth in both trading volume and market cap paints a positive picture for JUP.

Biggest Losers: Navigating the Red Sea

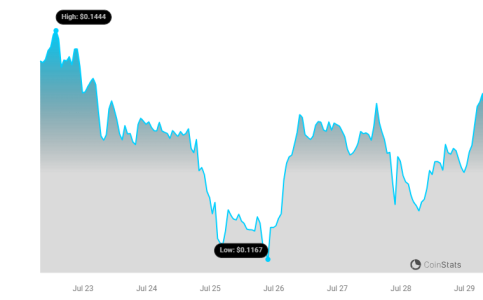

Brett (BRETT): Facing a Downward Spiral?

Brett (BRETT) unfortunately found itself at the bottom of the performance chart this week, recording a substantial 18.14% decline, making it the week’s biggest loser according to CoinStats. What went wrong for BRETT?

- BRETT began the week around $0.15 and experienced consistent price drops.

- By the end of the week, its trading price had fallen to approximately $0.12.

- The downward trend seems to be continuing as the price remains around $0.12.

Despite the price slump, BRETT’s trading volume actually increased by about 16%, reaching approximately $44 million. This could indicate traders attempting to capitalize on the dip, or perhaps increased selling pressure. Its market capitalization currently stands at about $1.2 billion, reflecting a 4% decrease in the last 24 hours.

Lido DAO (LDO): Second Largest Drop, But Signs of Recovery?

Lido DAO (LDO) wasn’t far behind BRETT in terms of losses, experiencing a significant 17.41% decrease in value, making it the second-largest loser this week, as reported by CoinStats. Let’s examine LDO’s week:

- LDO started the week around $1.9 and followed a consistent downward trajectory.

- By the week’s end, the price had dropped to approximately $1.6.

- However, there are hints of a minor recovery as it continues to trade around the $1.6 level.

Lido DAO’s market capitalization is around $1.4 billion. Interestingly, its trading volume has surged to nearly $140 million, marking a substantial 29% increase over the last 24 hours. This significant volume increase alongside a price stabilization could suggest a potential bottom forming for LDO.

Notcoin (NOT): A Week of Downturn

Notcoin (NOT) rounds out our list of losers, experiencing a predominantly negative trend throughout the week, with only a brief positive blip. What contributed to NOT’s 14% decline, making it the third-largest loser?

- NOT began the week already in the red, down nearly 1% at approximately $0.016.

- Apart from a short-lived rise on July 26th, the price consistently declined.

- NOT closed the week around $0.014 and has since dipped further to about $0.013.

Notcoin’s market capitalization has decreased by over 3% in the last 24 hours, now hovering around $1.3 billion. Similar to BRETT and LDO, NOT’s trading volume has also increased significantly, reaching over $158 million, a 17% rise in the last 24 hours. Is this increased trading volume a sign of bottom fishing, or further capitulation?

Key Takeaways and Looking Ahead

So, there you have it – a weekly recap of the crypto market’s top gainers and losers. Helium, Pyth Network, and Jupiter delivered impressive performances, while Brett, Lido DAO, and Notcoin faced headwinds. Remember, the crypto market is known for its volatility. What goes up can come down, and vice versa, sometimes in the blink of an eye!

Actionable Insight: Before making any investment decisions based on weekly performance, always conduct your own thorough research (DYOR). Understand the underlying factors driving price movements, assess the project’s fundamentals, and consider your own risk tolerance. This weekly snapshot is a starting point for your own deeper dive into the dynamic world of cryptocurrency investments.

Stay tuned for next week’s market review to see if these trends continue or if we witness a new set of crypto stars emerge!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.