The cryptocurrency market is experiencing a rollercoaster! Bitcoin (BTC) is currently trading below $66,500, and Ethereum is struggling to stay above the $3,300 mark. What’s causing this volatility, and what does it mean for your portfolio? Let’s dive into the latest updates and expert opinions.

Bitcoin’s Price Drop: What’s Happening?

Bitcoin’s recent dip has investors on edge. Here’s a quick rundown:

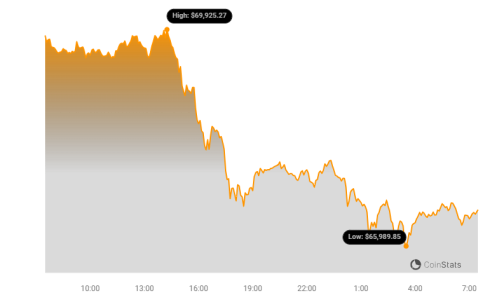

- Price: Bitcoin ($BTC) price dropped by 4.70% in the past 24 hours, now sitting at $66,500.

- Market Impact: The cryptocurrency market dropped by 2.80%, bringing the total market value down to $2.51 trillion.

- Altcoin Performance: Major altcoins like Notcoin ($NOT), ORDI ($ORDI), Worldcoin ($WLD), Solana ($SOL), and Cardano ($ADA) have seen a decline after notable gains recently.

Altcoin Insights and Market Sentiment

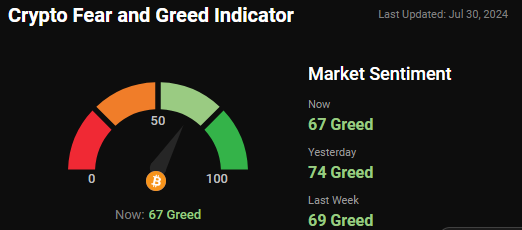

BlackRock CIO Samara Cohen poured some cold water on altcoin enthusiasts, stating that a Solana ETF doesn’t make sense due to limited demand beyond Ethereum (ETH). Meanwhile, the Crypto Fear and Greed Indicator is currently at 67 (Greed), a decrease from 74 yesterday and 69 last week, indicating shifting market sentiment.

Key Market Movers

- Gainers: BOOK OF MEME ($MEME) surged by more than 8.82% in the past 24 hours.

- Losers: Popcat ($POPCAT) experienced a decline of over 14.21% in the past 24 hours.

- Volume: The total crypto market volume in the last 24 hours is $80.75 billion, reflecting a 59.49% increase.

- DeFi: The current DeFi volume is $4.24 billion, representing 5.26% of the total crypto market volume over the past 24 hours.

- Stablecoins: The volume of all stablecoins is now $73.62 billion, accounting for 91.17% of the total crypto market volume in the past 24 hours.

- Bitcoin Dominance: Bitcoin’s dominance is currently at 54.94%, down by 0.61% over the past day.

Worldwide News Impacting Crypto

Several global events are influencing the crypto market:

- US Government Bitcoin Transfer: The US government recently transferred over $2 billion worth of Bitcoin (BTC) seized from the Silk Road, moving approximately 29,800 BTC in two transactions. This follows previous transfers, causing market unrest, especially after Donald Trump’s announcement to embrace BTC.

- BlackRock’s ETF Stance: BlackRock CIO Samara Cohen stated that they are not pursuing a Solana ETF or other crypto ETFs due to technical difficulties and low demand, focusing primarily on Bitcoin and Ethereum.

- Peter Schiff’s Prediction: Peter Schiff predicts that the US government, under President Biden, will sell all its Bitcoin holdings to prevent a potential Trump presidency from using it as a strategic reserve.

- WazirX Controversy: WazirX is facing backlash following a controversial poll on its Withdrawal Management Programme after a $230 million hack, raising questions about its fairness and legality.

- NFT Legal Challenge: Artists Brian Frye and Jonathon Mann have sued the SEC, seeking clarity on whether NFTs fall under its jurisdiction, arguing that treating NFTs as securities would be absurd.

The Million-Dollar Question: What’s Next for Bitcoin?

Will Bitcoin’s price break its all-time high and surge to $100K? Is the recent pullback a sign that bulls will overcome the selling pressure? With Bitcoin dipping from the $70K milestone, are these dips supported? These are the questions on every investor’s mind.

The market is clearly experiencing volatility, driven by a combination of factors ranging from government actions to ETF speculation and shifting market sentiment. Whether these dips present buying opportunities or signal a larger correction remains to be seen.

To stay updated with the latest news and analysis, keep following us at coingabbar. Stay informed, stay vigilant, and navigate the crypto market with confidence!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.