Dogecoin, the cryptocurrency that started as a lighthearted internet joke, is once again capturing the attention of the crypto world. Born in 2013 as a playful jab at the Bitcoin craze by two tech-savvy engineers (one famously known as “Shibetoshi Nakamoto” on X), DOGE has seen a significant surge recently, jumping over 10% in value. Let’s dive into what’s fueling this meme coin’s latest price pump and what it could mean for investors.

What’s Behind Dogecoin’s Recent Price Rally?

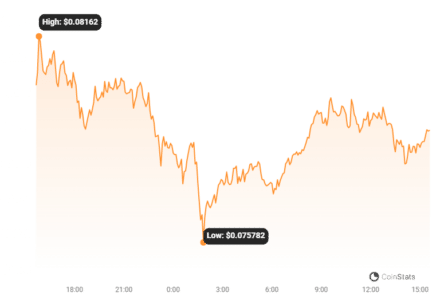

Over the past couple of days, Dogecoin (DOGE) has been on a notable upward trajectory. Starting from a price of $0.0730, DOGE climbed to $0.0813, marking a solid 10% increase. Looking at the bigger picture, this meme coin darling has actually risen for two consecutive days, boasting an impressive 14.74% surge in just the last 48 hours. This kind of momentum in the crypto market always begs the question: what’s driving this surge?

Trading Volume Skyrockets – Is the Hype Real?

To get a sense of the genuine interest behind this price movement, let’s look at trading volume. According to CoinMarketCap, Dogecoin’s trading volume has exploded, increasing by over 15% in the last 24 hours alone! This puts the total trading volume at a staggering $1,150,262,483. Such a massive influx in trading activity suggests a significant level of market participation and interest in DOGE right now.

Decoding Market Sentiment: Greed vs. Fear

While the price is up and trading volume is booming, it’s crucial to understand the overall market sentiment. The Dogecoin Fear and Greed Index, a tool similar to those used for Bitcoin and Ethereum to gauge market mood, currently sits at 68. This puts it firmly in the “Greed” zone. But what does this mean?

A “Greed” reading suggests that the market might be getting a bit overheated. When greed takes over, investors and traders often become more inclined to sell their holdings to lock in profits. This selling pressure can potentially lead to a price correction, causing the price to fall back down.

Dogecoin Fear and Greed Index is 68 – Greed

Current Value: 68

Previous Value: 67

Last Updated: Nov 11, 2023 at 08:15 PM UTC

Source: https://t.co/VKiv1YkyqRhttps://twitter.com/DogecoinFear/status/1723302096915869796?ref_src=twsrc%5Etfw— Dogecoin Fear and Greed Index (@DogecoinFear) November 11, 2023

On the flip side, when the Fear and Greed Index swings towards “Fear,” it often signals a potential buying opportunity. During periods of fear, market participants are more likely to accumulate coins, anticipating future price increases, which can then drive prices upwards.

Read Also: Pika Protocol Announces Retirement of Pika Token

Analyst Insights: Is a Dogecoin Breakout Imminent?

Adding to the analysis, crypto analyst Ali Martinez recently shared insights based on data from on-chain analytics firm IntoTheBlock. According to Martinez, Dogecoin is currently “navigating a tight zone sandwiched by two critical supply walls.” This suggests a potential tug-of-war between buying and selling pressures, which could lead to a significant price movement in either direction.

Martinez highlights a crucial price point: $0.076. He believes that if DOGE can successfully break through this barrier, it could signal a breakout. If this happens, Martinez suggests keeping a close eye on the next key resistance level at $0.084. Overcoming this hurdle could pave the way for further gains.

Key Takeaways & What to Watch For:

- Price Surge: Dogecoin has experienced a significant price increase of over 10% recently.

- Trading Volume: Trading volume is up by more than 15%, indicating strong market interest.

- Greed Zone: The Fear and Greed Index is in “Greed,” suggesting potential market overheating and possible profit-taking.

- Analyst View: Analyst Ali Martinez points to a potential breakout if DOGE surpasses $0.076, with the next target at $0.084.

- Market Sentiment: Keep an eye on the Fear and Greed Index. A shift towards “Fear” might present a buying opportunity.

Disclaimer: Trade with Caution

It’s important to remember that the cryptocurrency market is highly volatile and unpredictable. While Dogecoin’s recent price action is exciting, it’s crucial to approach crypto investments with caution and conduct thorough research before making any decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.