Buckle up, crypto enthusiasts! The market rollercoaster continues its wild ride, and this time, Dogecoin (DOGE), the beloved memecoin, is feeling the G-force. Just when you thought things were settling down, DOGE took a nosedive, losing a significant 20% of its value in the past week. Ouch! But is this just a temporary dip, a chance to snag some DOGE at a discount, or are we looking at a deeper correction? Let’s dive into the details and see if DOGE can pull a rabbit (or should we say, a Shiba Inu?) out of the hat and reverse this trend.

Dogecoin’s Rough Week: What Happened?

The crypto market hasn’t been for the faint of heart lately. A sea of red has engulfed the charts, with even the crypto giants Bitcoin (BTC) and Ethereum (ETH) feeling the pressure. This widespread downturn has naturally dragged Dogecoin into the negative territory.

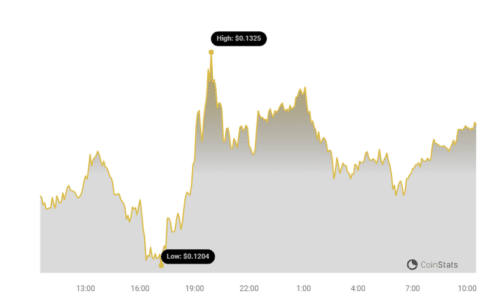

Here’s a quick snapshot of DOGE’s recent performance:

- Last 24 Hours: DOGE sank by over 10%.

- Past 7 Days: A hefty 20% loss.

- Monthly Losses: A staggering 38%+ decline.

Data from Coinstats confirms this downward trend, painting a concerning picture for DOGE holders. This price slump also triggered a wave of liquidations in the derivatives market, with over $15 million worth of DOGE positions wiped out, according to Bitcoinworld, citing Coinglass data.

The 12.5-13 Cent Line: DOGE’s Make-or-Break Level?

Is there a silver lining amidst this bearish cloud? According to prominent crypto analyst Kevin, there might be. He highlighted a critical support zone for DOGE around the 12.5–13 cents level. In a recent post on X (formerly Twitter), Kevin emphasized the importance of this price range, stating that DOGE needs to hold this level to maintain a bullish outlook.

$Doge

12.5-13c is a major support zone, needs to ideally hold here for bullish sentiment to remain.

If we do lose this zone then we will reassess this market. pic.twitter.com/5n9J6J5p3r

— Kevin (@Kev_Capital_TA) April 30, 2024

Essentially, this 12.5-13 cent range is a litmus test for DOGE. Will it act as a sturdy floor, preventing further declines, or will it crumble under selling pressure, potentially signaling more pain ahead? Keep a close watch on this level!

Read More: Doge With Hat (DOGEHAT) Will Rally 5,500%, As Shiba Inu And Bonk Lag

Are Whales Swimming in DOGE Waters?

While the broader market sentiment might seem shaky, some big players are making moves. Interestingly, as DOGE prices dipped, whale activity surged. According to Bitcoinworld’s analysis of Santiment data, large transactions exceeding $100,000 have increased significantly in the last couple of days. This suggests that deep-pocketed investors are taking advantage of the lower prices.

Further reinforcing this trend, data shows an increase in addresses holding substantial amounts of DOGE – between 1,000 and 1 million coins. This accumulation by larger holders could indicate a belief in DOGE’s long-term potential, or simply a strategic dip-buying opportunity.

Adding another layer to this bullish whale narrative, analysis of Hyblock Capital data by Bitcoinworld reveals that the percentage of whale positions longing DOGE has increased from 72.9% to 74.85% in the last 24 hours. This increased long exposure from whales suggests they are betting on a DOGE price rebound.

Could it be that whales possess insights into DOGE’s future that the average investor might be missing? It’s definitely something to ponder!

Social Sentiment: A Sea of Pessimism?

While whale activity paints a potentially optimistic picture, social sentiment surrounding DOGE tells a different story. Social activity around DOGE has indeed increased, with more mentions across crypto channels. However, the overall tone of these conversations appears to be predominantly negative. The Weighted Sentiment for DOGE is trending in the negative territory, indicating that online commentary leans towards pessimism regarding DOGE’s near-term prospects.

This divergence between whale accumulation and negative social sentiment creates an interesting dynamic. Are whales going against the grain, or is the broader market pessimism justified? Only time will tell.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.