Dogwifhat (WIF), the meme coin sensation, has seen its market cap take a significant hit, dropping by nearly 32% from its recent high. Is this just a temporary blip in the volatile world of crypto, or is there more to this story? Let’s dive into the factors driving this decline and what it means for WIF holders.

Dogwifhat’s Market Cap Decline: A Deep Dive

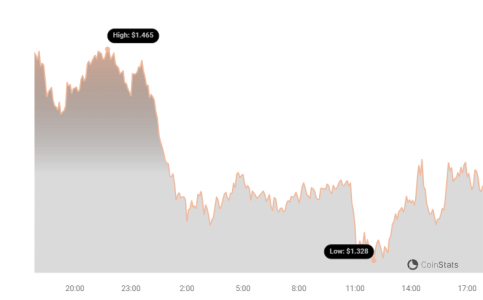

- Significant Drop: Dogwifhat’s market cap has decreased by 31.97% from its local high, reflecting substantial selling pressure. Currently, the market cap sits at $1.34B.

- Broader Meme Coin Trend: This decline mirrors similar trends observed in other prominent meme coins like Shiba Inu (SHIB), Pepe (PEPE), and Dogecoin (DOGE).

- Comparison to Peers: Over the past month, DOGE has fallen by 16%, while PEPE and SHIB have dropped by 36% and 25%, respectively. Dogwifhat’s decline of over 53% since July 22nd is steeper than its peers.

Longs Get Liquidated: What Does It Mean?

Data from CoinGlass reveals that long liquidations in WIF have surpassed short liquidations. Over the last 10 days, over $6.9 million in long positions were liquidated compared to $3.12 million in short positions.

This suggests that many traders anticipated Dogwifhat’s price to continue its upward trajectory after peaking on August 9th. However, these liquidations amplified the downward pressure, leading to a more pronounced price decrease.

Head and Shoulders Pattern: A Bearish Signal?

A classic head-and-shoulders (H&S) pattern has emerged on Dogwifhat’s daily chart, potentially indicating further downside. This pattern consists of three peaks: a higher middle peak (the head) flanked by two lower peaks (the shoulders), all connected by a neckline.

WIF briefly broke the support line on August 5th but quickly recovered. Currently, it’s retesting this support. A successful rebound from this support, surpassing the accumulation phase, would invalidate the H&S pattern.

If the H&S pattern is rejected, WIF’s price could be considered to have bottomed out, potentially retracing towards its previous high. In this scenario, the 50-day and 200-day exponential moving averages could serve as immediate targets.

Key Takeaways and What’s Next for WIF?

- Volatility is Key: Meme coins are known for their extreme volatility. Dogwifhat’s recent decline underscores this risk.

- Technical Analysis Matters: Patterns like the head and shoulders can provide valuable insights, but they are not always definitive.

- Market Sentiment: Overall market sentiment towards meme coins plays a crucial role in their price action.

Dogwifhat’s future trajectory hinges on its ability to overcome the current bearish signals and regain positive momentum. Keep a close eye on the support line and potential breakout points to gauge its next move. Remember to do your own research and invest responsibly.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.