The crypto world is still reeling from the FTX implosion, and at the heart of it all is Sam Bankman-Fried (SBF). During what’s been dubbed his ‘Apology Tour,’ culminating in an appearance at the prestigious New York Times Dealbook Summit, SBF attempted to paint himself as a victim of circumstance, rather than the architect of the FTX downfall. But is anyone buying it?

Amidst the wreckage of the FTX Derivatives Exchange, a burning question has emerged: were the billions of dollars that vanished from customer accounts used for political influence? Will Manidis, CEO of ScienceIO, ignited this debate with a bold claim on Twitter, suggesting SBF might have pulled off the ‘highest ROI trade of all time’. Let’s dive into this explosive theory.

Did SBF Buy Immunity with Political Donations?

Manidis’s tweet went viral, alleging that SBF strategically donated a substantial sum – around $40 million – to Democratic political campaigns. His point? This ‘investment’ could potentially shield SBF from the legal repercussions of the staggering $10 billion hole left by the FTX collapse.

“SBF donating $40 million to avoid jail for stealing $10 billion+ is one of the highest ROI trades of all time,” Manidis tweeted, sparking intense discussion across the crypto and political spheres.

The fact that SBF is currently walking free, despite the magnitude of the FTX scandal, has indeed raised eyebrows and fueled suspicion. Many in the digital currency ecosystem are starting to wonder if SBF’s connections within Washington’s power circles are his get-out-of-jail-free card.

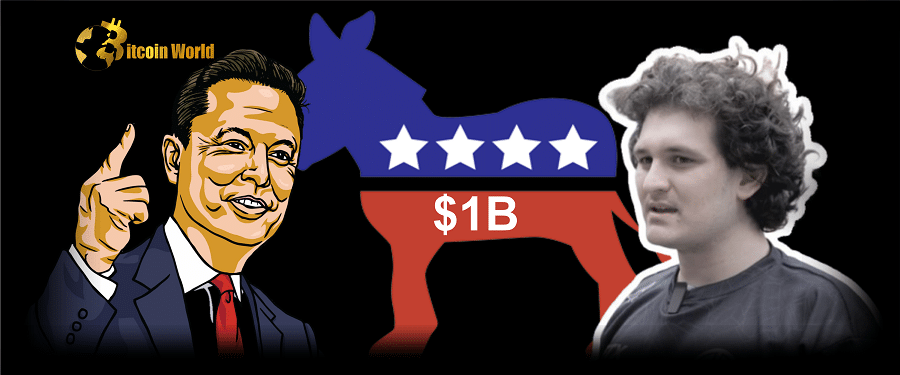

Elon Musk Drops a Billion-Dollar Bombshell

Enter Elon Musk, the CEO of Tesla and Twitter, who amplified the speculation to a whole new level. Responding to Manidis’s tweet, Musk didn’t just agree; he dramatically escalated the figures. He suggested the publicly disclosed $40 million was just the tip of the iceberg.

Musk tweeted:

That’s just the publicly disclosed number. His actual support of Dem elections is probably over $1B. The money went somewhere, so where did it go?

— Elon Musk (@elonmusk) December 3, 2022

Musk’s assertion that SBF’s actual political donations could be over $1 billion sent shockwaves. Where did this massive amount of money go? This is the question now echoing throughout the crypto community and beyond.

Key Takeaways from Musk’s Claim:

- Public vs. Private Donations: Musk highlights the difference between publicly disclosed figures and potentially much larger, undisclosed political contributions.

- Vast Sums Involved: The jump from $40 million to potentially over $1 billion is staggering, indicating a far deeper level of political entanglement.

- Unanswered Questions: Musk’s rhetorical question – “where did it go?” – underscores the lack of transparency and raises serious concerns about the flow of funds.

Why Does This Matter? The Potential Implications

If Musk’s claims are even partially true, the implications are enormous. SBF, who was indeed a significant donor to President Biden’s 2020 campaign and the recent midterm elections, could be facing scrutiny far beyond just financial mismanagement. The suggestion that political donations might be influencing his current freedom is a serious accusation that demands investigation.

Consider this:

| Potential Scenario | Implications |

|---|---|

| Significant Political Donations | Could create a perception of preferential treatment or leniency in legal proceedings. |

| Undisclosed or Illicit Funding | Raises questions about the source and legitimacy of these donations. |

| Erosion of Public Trust | Damages faith in both the crypto industry and the political system if influence is perceived to be bought. |

Media Portrayal: Whitewashing or Fair Reporting?

Adding another layer to this complex narrative is the criticism surrounding mainstream media’s coverage of the FTX saga and SBF’s role. Accusations of misrepresentation and even a subtle ‘whitewashing’ of SBF’s actions have been circulating.

During his ‘Apology Tour’, including the New York Times Dealbook Summit, SBF’s demeanor and statements have been closely analyzed. Some observers found his performance unsettling. As Naomi, a Twitter developer, noted, “SBF’s interview is like Casey Anthony’s documentary. They sound robotic and inauthentic… The way it’s expressed is subjective.”

The summit appearance reportedly ended with applause for SBF, a detail that further fueled the narrative of a potentially sympathetic media portrayal. Coinspeaker, among others, has previously highlighted concerns about mainstream media outlets potentially downplaying the severity of the situation and portraying SBF in a more favorable light – perhaps as a well-intentioned visionary whose ambitious project simply went wrong.

The Stakes Are High

The FTX collapse is more than just a crypto industry crisis; it’s a story that intersects with politics, media influence, and questions of accountability. Whether SBF’s political donations, potentially reaching billions as suggested by Elon Musk, will offer him any form of protection remains to be seen. However, the questions are out there, and they aren’t going away.

The world is watching to see if justice will be served for the FTX creditors and if the full truth behind SBF’s actions – and his connections – will ultimately be revealed. This is a developing story with far-reaching implications for the future of crypto regulation, political finance, and public trust in both systems.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.