Exciting news for Ethereum enthusiasts and crypto investors! Imagine a world where investing in Ethereum is as simple as buying stocks. Well, that world might be closer than you think. Asset management giant BlackRock, known for its massive influence in traditional finance, has just signaled its intent to launch a spot Ethereum Exchange Traded Fund (ETF). This is a monumental step that could potentially unlock billions in investment and send ripples across the entire cryptocurrency market. Let’s dive into what this means for you, for Ethereum, and for the future of crypto investing.

What’s the Buzz About BlackRock’s Ethereum ETF?

BlackRock, a name synonymous with financial power and innovation, recently made waves by filing paperwork for an “iShares Ethereum Trust” with the Nasdaq stock exchange. This isn’t just another filing; it’s a clear indication of BlackRock’s serious move into the Ethereum space. Think of an ETF as a bridge connecting traditional stock market investors to the world of crypto. Instead of directly buying and managing Ethereum, investors can purchase shares of this ETF, which represents ownership of ETH held by the trust. This makes investing in Ethereum accessible and straightforward, just like trading any other stock.

According to the official filing, the proposed ETF aims to track the price of Ethereum closely. BlackRock’s subsidiary, iShares, a well-respected name in the ETF world, will be the sponsoring entity, adding further credibility to this venture. The ticker symbol? Simply “ETH”.

Why is This a Big Deal for Ethereum?

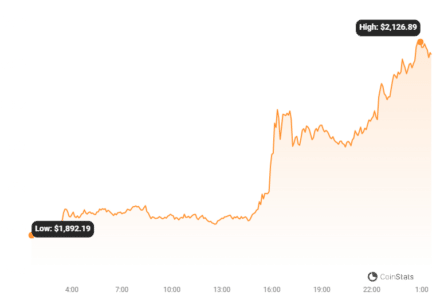

The market reaction speaks volumes. Following the announcement, Ethereum’s price jumped by a significant 10%, breaking past the $2,100 mark – levels not seen since April! This surge highlights the immense anticipation and positive sentiment surrounding BlackRock’s move. But why is an Ethereum ETF such a game-changer?

- Mainstream Adoption: ETFs make investing in assets like Ethereum far easier for the average investor. No more navigating crypto exchanges, wallets, or private keys. It’s as simple as buying shares through your brokerage account.

- Influx of Capital: BlackRock’s involvement and the ETF structure are expected to attract substantial institutional and retail investment into Ethereum. Billions of dollars could flow into the ETH market, potentially driving prices higher.

- Validation for Crypto: A major player like BlackRock launching an Ethereum ETF sends a powerful message: cryptocurrencies are maturing as an asset class and are gaining mainstream acceptance.

- Price Appreciation Potential: Increased demand due to ETF investment, coupled with Ethereum’s ongoing development and utility, could lead to significant price appreciation for ETH.

As Coinstats reports, Ethereum has already seen impressive growth, up over 30% this month and a remarkable 85% year-to-date. The potential ETF approval could further fuel this upward trend.

What are the Hurdles? SEC Approval and the Road Ahead

While the news is exciting, the journey to an approved Ethereum ETF isn’t without its challenges. The biggest hurdle is regulatory approval from the Securities and Exchange Commission (SEC). The SEC has been cautious about spot crypto ETFs, primarily due to concerns about market manipulation. They’ve previously rejected numerous spot Bitcoin ETF proposals.

However, there are reasons for optimism:

- Bitcoin Futures ETF Approval: The SEC has already approved Bitcoin futures ETFs, signaling a gradual warming up to crypto-related investment products.

- Ethereum Futures ETFs: Just last month, the SEC allowed Ethereum futures ETFs to trade, another positive step in the right direction.

- BlackRock’s Track Record: BlackRock has a strong reputation and significant influence. Their involvement could lend more credibility to the ETF application and potentially sway the SEC.

It’s important to remember that BlackRock has also filed an Ethereum trust in Delaware, often seen as a preliminary step before formally seeking ETF approval. While the exact timeline for SEC application and potential approval remains unclear, the pieces are falling into place.

Ethereum ETF vs. Holding ETH Directly: What’s the Difference?

For seasoned crypto users, the question might be: why invest in an ETF when you can simply buy and hold ETH directly? Both options have their merits. Let’s compare:

| Feature | Ethereum ETF | Holding ETH Directly |

|---|---|---|

| Ease of Investment | Simple, accessible through traditional brokerage accounts. | Requires crypto exchange accounts, wallets, and understanding of crypto security. |

| Security | Managed by a reputable institution (BlackRock), regulated environment. | User responsible for securing private keys, risk of loss or theft. |

| Custody | Custody handled by the ETF provider. | User is responsible for self-custody. |

| Fees | Management fees associated with the ETF. | Exchange fees when buying/selling, gas fees for transactions (if applicable). |

| Direct Ownership | Indirect exposure to ETH price movements. | Direct ownership of ETH, can participate in staking, DeFi, etc. |

| Tax Implications | Tax treatment as a traditional stock investment (in many jurisdictions). | Potentially more complex tax implications depending on crypto regulations. |

In essence: An Ethereum ETF is ideal for traditional investors seeking exposure to ETH without the complexities of direct crypto ownership. Holding ETH directly offers more control and access to the full crypto ecosystem but requires greater technical understanding and responsibility.

Read Also: Bitcoin and Ethereum Outperform Gold Significantly This Year

The Bottom Line: A Potential Game Changer for Ethereum and Crypto

BlackRock’s move towards an Ethereum ETF is a landmark moment for the cryptocurrency industry. It signifies growing institutional interest, potential for massive capital inflow, and further legitimization of Ethereum as a significant asset. While SEC approval is not guaranteed, the recent positive steps in the crypto ETF space and BlackRock’s credibility provide a strong sense of optimism.

Whether you’re a seasoned crypto investor or someone curious about dipping your toes into the digital asset world, the potential Ethereum ETF is something to watch closely. It could very well be the catalyst that propels Ethereum and the broader crypto market to new heights, bringing digital assets further into the mainstream financial landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.