Ever wondered what the biggest players in the crypto world are up to? We’re talking about the Ethereum whales – those massive holders who can make markets tremble with their moves. Well, recent data has dropped, and it reveals some fascinating shifts in their crypto portfolios. Guess what’s catching their eye? Meme crypto sensation Shiba Inu and a couple of red-hot metaverse tokens! Let’s dive into the details and see what these crypto titans are buying and why it matters to you.

Whale Watching: Decoding Ethereum’s Top Investors

Thanks to WhaleStats, a platform that keeps a close eye on the top 1,000 non-exchange Ethereum addresses, we’ve got a peek into the investment strategies of these crypto whales. Think of WhaleStats as your on-chain detective, tracking the movements of the biggest ETH holders. The latest 30-day snapshot reveals some intriguing trends in where these deep-pocketed investors are placing their bets.

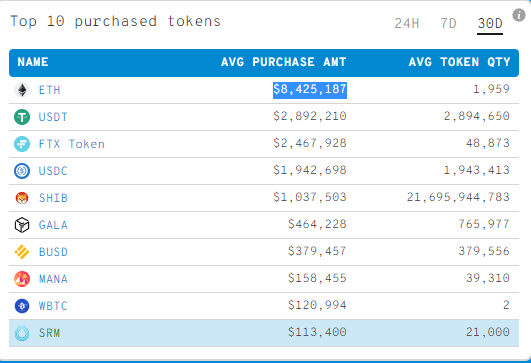

Here’s a quick rundown of the top crypto assets Ethereum whales have been accumulating, based on average purchase amounts:

- Ethereum (ETH): Unsurprisingly, ETH itself tops the list with an average purchase of a whopping $8.42 million. It’s their home turf, after all!

- Tether (USDT): Stablecoins like USDT are crucial for liquidity and hedging, with whales averaging $2.89 million in purchases.

- FTX Token (FTT): The utility token of the FTX exchange grabs the third spot at $2.46 million. This suggests whales are bullish on the FTX ecosystem.

Shiba Inu and Metaverse Tokens Enter the Whale Spotlight

Now, here’s where things get interesting! Beyond the crypto giants, Shiba Inu (SHIB) and metaverse tokens like Gala (GALA) and Decentraland (MANA) are making significant waves in whale portfolios.

Let’s break down the notable altcoin investments:

- USD Coin (USDC): Another stablecoin, USDC, sees an average whale purchase of $1.94 million, reinforcing the need for stable assets.

- Shiba Inu (SHIB): Meme coin turned potential ecosystem, Shiba Inu, grabs attention with an average purchase of $1.03 million. Yes, whales are betting on the Doge-killer!

- Gala (GALA): The blockchain gaming platform Gala is attracting whale interest with average buys of $464,228. Gaming in the metaverse is clearly on their radar.

- Binance USD (BUSD): Binance’s stablecoin BUSD holds the 7th spot, indicating continued stablecoin accumulation.

- Decentraland (MANA): Metaverse pioneer Decentraland secures the 8th position with $158,455 average purchases. Virtual real estate is still hot!

- Wrapped Bitcoin (WBTC): Representing Bitcoin on the Ethereum network, WBTC sits at ninth, showing whales’ diversification across blockchains.

- Serum (SRM): Decentralized derivatives exchange Serum rounds out the top 10, suggesting interest in DeFi trading platforms.

Why Shiba Inu and Metaverse Tokens? Decoding Whale Strategy

So, why are Ethereum whales dipping their toes (or should we say fins?) into Shiba Inu and metaverse tokens? Here are a few potential reasons:

- High Growth Potential: Altcoins, especially in the meme coin and metaverse space, can offer explosive growth potential compared to more established cryptocurrencies. Whales might be looking for higher returns.

- Diversification: Smart investors diversify their portfolios. Allocating a portion to altcoins, even meme coins with strong community backing like SHIB, can be a strategic move to spread risk and capture different market segments.

- Metaverse Hype: The metaverse narrative is booming, and tokens like MANA and GALA are direct plays on this trend. Whales likely see long-term value in virtual worlds and gaming ecosystems.

- Community Strength: Shiba Inu, despite its meme origins, boasts a massive and passionate community. This can be a powerful driver for price appreciation and ecosystem development.

- Strategic Positioning: Whales often make moves anticipating broader market trends. Their accumulation of these tokens could signal a belief in the continued growth of the metaverse and altcoin markets.

Whales are Holding Big: Shiba Inu Still a Major Holding

Looking at the overall holdings of these Ethereum whales, ETH remains king, averaging over $166.56 million per wallet. But guess who’s second in line? You guessed it – Shiba Inu! With an average holding value of $1.69 million, SHIB is not just a small bet; it’s a significant part of whale portfolios.

This reinforces the idea that while ETH is their primary holding, whales are seriously considering Shiba Inu as a valuable asset within their crypto strategy.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

Key Takeaways: What Does This Mean for You?

- Whales are diversifying into altcoins: Don’t underestimate the power of altcoins like Shiba Inu and metaverse tokens. Smart money is flowing into these sectors.

- Metaverse is a key trend: Whale investments confirm the metaverse is more than just hype; it’s a space where significant capital is being deployed.

- Keep an eye on WhaleStats: Tracking whale movements can provide valuable insights into potential market trends and investment opportunities.

- Do your own research: While whale activity is informative, always conduct thorough research before making any investment decisions.

In Conclusion: Riding the Crypto Waves with the Whales

The latest data from WhaleStats paints a clear picture: Ethereum whales are strategically positioning themselves in the evolving crypto landscape. Their increased interest in Shiba Inu and metaverse tokens signals a potential shift towards higher-growth altcoins and the burgeoning virtual world sector. While following whales blindly isn’t advisable, understanding their investment patterns can offer valuable clues for navigating the dynamic crypto market. Keep watching the whale movements, stay informed, and happy investing!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.