Excitement is building in the crypto world as the launch of spot Ethereum ETFs draws closer. Will Ethereum ride this wave to new heights, potentially even outperforming Bitcoin? A recent report by Kaiko suggests exactly that, painting a picture of Ethereum primed for a post-ETF surge. Even with recent price dips, digging deeper reveals strong underlying factors that could propel ETH forward. Let’s break down why Ethereum might just steal the spotlight from Bitcoin once those ETFs hit the market.

Why Ethereum Could Outperform Bitcoin After the ETF Launch

Despite a nearly 20% price correction for Ethereum in the past couple of months, the long-term outlook, especially post-ETF launch, appears bright. Kaiko’s analysis highlights several key indicators suggesting Ethereum’s potential to outshine Bitcoin. Let’s explore these factors:

- Strong Market Sentiment: Despite price fluctuations, the overall market sentiment around Ethereum remains positive, fueled by anticipation for the ETFs. Traders are generally optimistic about ETH’s prospects.

- Robust Liquidity: Ethereum’s market liquidity has shown remarkable resilience. This strength is expected to be further amplified by the influx of capital through the newly launched ETFs. Bitcoin, on the other hand, has seen more varied outcomes in terms of market depth.

- Solid ETH/BTC Ratio: The ETH to BTC ratio, a key indicator of Ethereum’s strength relative to Bitcoin, remains elevated around 0.05. This is a positive sign, suggesting that the market values Ethereum strongly even compared to the crypto king, Bitcoin. Notably, this ratio was around 0.045 before the ETF approval, indicating growing relative strength.

Decoding the Market Signals: ETH vs. BTC

Let’s dive deeper into the specific market indicators that support the prediction of Ethereum’s potential outperformance:

ETH/BTC Ratio: A Sign of Strength

The ETH/BTC ratio is a crucial metric for understanding the comparative strength of Ethereum against Bitcoin. A higher ratio suggests that Ethereum is performing well relative to Bitcoin. The fact that this ratio remains strong, even after recent price dips, signals underlying confidence in Ethereum’s potential.

Liquidity Remains Strong

Liquidity is the lifeblood of any market, and Ethereum’s spot market liquidity is holding up well.

- Steady Market Depth: Ethereum’s 1% market depth, which indicates the amount of capital required to move the price by 1%, has remained steady at approximately $230 million since the ETF approval. This is an increase from early May when it dipped below $200 million.

- Resilient Spot Markets: Despite the recent price correction, Ethereum’s spot markets have demonstrated resilience, indicating sustained buying and selling interest.

This robust liquidity suggests a healthy and active market, ready to absorb the increased trading volumes expected with the ETF launches.

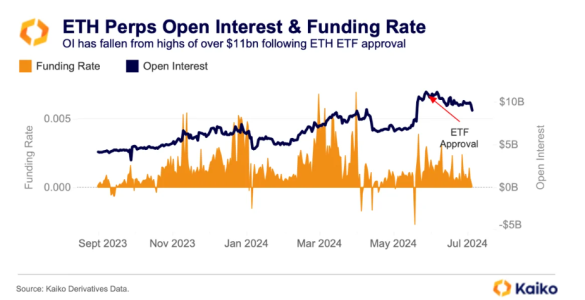

Perpetual Futures Show a Cooldown

While spot markets show strength, perpetual futures markets present a slightly different picture. Funding rates in perpetual futures have decreased by half since May. This indicates:

- Reduced Trader Confidence: Lower funding rates suggest that traders are less aggressively taking long positions and are less willing to pay premiums to maintain them.

- Decreased Open Interest: Open interest, which was around $11 billion post-ETF approval, has also declined.

This cooling in perpetual futures likely reflects uncertainty surrounding the exact launch date of the Ethereum ETFs. However, it’s important to note that this doesn’t negate the positive signals from the spot market and the overall optimistic outlook.

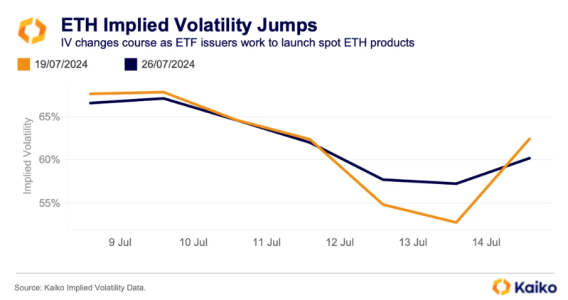

Implied Volatility Spikes: Short-Term Price Swings Anticipated

Interestingly, Kaiko observed a surge in implied volatility (IV) for near-term Ethereum options contracts. Specifically, Deribit ETH options expiring on July 19 and 26 showed the most significant increases.

Key takeaways from this volatility spike:

- Increased Hedging Activity: The jump in IV, reaching 62% on Monday from 53% on Saturday, indicates that traders are increasingly seeking to hedge their positions.

- Anticipation of Price Movements: Traders are willing to pay more for options that protect against potential sharp price fluctuations in the short term.

This volatility could be linked to the anticipation of the ETF launch and the potential for significant price movements around that event.

Beyond ETFs: Broader Market Trends and Crypto Narratives

While the ETF launch is a major catalyst, other factors are also influencing the crypto market landscape. For instance, the rise of “PolitiFi” tokens, linked to political speculation, particularly around the US presidential election, adds another layer of complexity. The surge in tokens like MAGA, following news related to Donald Trump, demonstrates the impact of political events on crypto markets.

VanEck’s Solana (SOL) ETF filing, as highlighted by Matthew Sigel, also reflects a broader strategic play, potentially linked to the upcoming presidential election cycle. The SEC’s timeline for responding to the SOL ETF extends into 2025, suggesting that regulatory decisions in the crypto space could be influenced by the changing political landscape.

Bitcoin’s Corporate Treasury Journey: Lessons Learned

In 2024, many companies followed the lead of MicroStrategy and Tesla by allocating portions of their balance sheets to Bitcoin. This trend was largely driven by Bitcoin’s growing recognition as a treasury asset, supported by evolving regulatory clarity. However, the outcomes have been varied.

- MicroStrategy’s Success: MicroStrategy has seen significant profits from its Bitcoin holdings.

- Mixed Results Elsewhere: Other companies have experienced less pronounced impacts, suggesting that the “announcement effect” of Bitcoin adoption might be wearing off.

Kaiko points out that the approval of spot Bitcoin ETFs and promotional efforts by major asset managers significantly boosted public awareness of Bitcoin, likely amplifying the initial “announcement effect.” As the market matures, the impact of corporate Bitcoin adoption may become more nuanced.

Conclusion: Ethereum Poised for a Post-ETF Rally?

The data suggests that Ethereum is well-positioned to potentially outperform Bitcoin in the wake of its ETF launch. Strong liquidity, positive market sentiment, and a robust ETH/BTC ratio paint an optimistic picture. While perpetual futures markets show some caution, and short-term volatility is expected, the underlying fundamentals for Ethereum appear strong.

Of course, the crypto market is inherently dynamic and influenced by numerous factors. The actual performance of Ethereum post-ETF launch will depend on a complex interplay of market forces, investor behavior, and broader economic conditions. However, based on current market signals and expert analysis, Ethereum is certainly shaping up to be a compelling contender in the crypto race. Keep an eye on the market as the ETH ETFs launch – it could be an exciting ride!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.