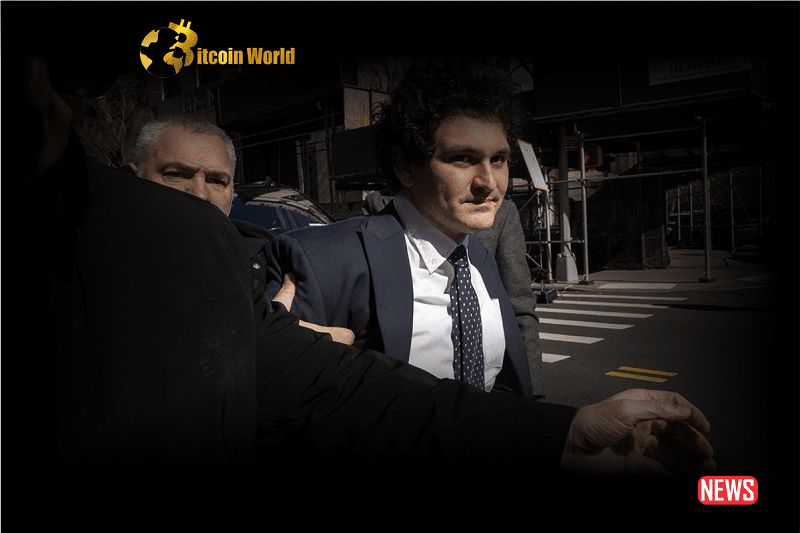

The clock is ticking down to October, and the financial world is holding its breath for the fraud trial of Sam Bankman-Fried, the co-founder of FTX. But a recent twist has everyone talking: SBF is reportedly bringing in a team of expert witnesses, potentially shelling out a cool $1,200 per hour for their insights. Let’s dive into what this means for his defense and the broader case.

The Expert Lineup: What Will They Bring to the Table?

Imagine trying to explain the intricacies of cryptocurrency and campaign finance law to a jury. That’s where these expert witnesses come in. Bankman-Fried’s defense seems to be focusing on demystifying the complex world he operated in. Here’s a glimpse at the expertise they’re bringing:

- Campaign Funding Laws: Bradley Smith, a former Federal Election Commission Chairperson, commanding a hefty $1,200 per hour, will likely shed light on the labyrinthine rules of political donations and the concept of straw donors.

- FTX and Alameda Valuations: Experts will delve into the financial health and worth of these entities, which are central to the fraud allegations.

- Software Architecture & Terms of Service: Understanding the nuts and bolts of the FTX exchange’s technology and user agreements is crucial. These experts will break down the complex systems involved.

- Banking Sector Procedures: Peter Vinella, a financial services consultant, will offer his perspective on standard practices within the banking world.

- Blockchain Technology & Crypto Market Crash: Professor Andrew Di Wu will provide expertise on the underlying technology and the volatile nature of the cryptocurrency market.

Why This Strategy? Decoding SBF’s Defense

Bringing in expert witnesses suggests a multi-pronged defense strategy. It hints at an attempt to argue that any alleged wrongdoing stemmed from a lack of understanding of complex regulations or the technical intricacies of the crypto world, rather than malicious intent. Think of it as trying to paint a picture of a well-intentioned, albeit perhaps overwhelmed, entrepreneur.

The Prosecution’s Counter-Argument: Is It Just a Smokescreen?

Federal prosecutors aren’t convinced. They’re trying to block the expert witnesses, arguing their testimony will simply focus on Bankman-Fried’s alleged lack of criminal intent based on conversations, rather than offering factual insights. They likely see this as a tactic to confuse the jury rather than illuminate the facts.

The Battle Behind the Scenes: Evidence and Access

The legal maneuvering extends beyond expert witnesses. There’s a tug-of-war over evidence disclosure and access. Bankman-Fried’s defense team sought to exclude evidence obtained after July 1st, but the judge denied this request, citing a lack of substantiation for claims of broken commitments and missed deadlines. Furthermore, his bail was revoked due to alleged witness tampering, placing him in a more restrictive environment as the trial approaches.

The “Advice of Counsel” Defense: A Risky Gambit?

Another potential element of Bankman-Fried’s defense is the “advice of counsel” strategy. This involves arguing that his actions were based on the guidance of FTX’s legal team. However, this is a tricky path to navigate, as it could potentially waive attorney-client privilege and open up more scrutiny.

The Stakes Are High: What’s Really on Trial?

At its core, this trial revolves around serious allegations, including:

- Mixing customer funds

- Diverting exchange funds for personal use (executive loans, real estate)

- Engaging in high-risk trading

These actions are alleged to have contributed to the dramatic collapse of FTX in November 2022, leaving many users with significant losses.

The Road Ahead: Key Factors to Watch

As the trial date looms, several factors will be critical in determining the outcome:

- The Effectiveness of Expert Witness Testimony: Will they successfully demystify complex issues for the jury, or will the prosecution’s arguments prevail?

- The Impact of Former Associates’ Testimony: Several of Bankman-Fried’s closest colleagues have pleaded guilty and are cooperating with the government. Their testimony could be damaging.

- The Jury’s Perception: Ultimately, the jury will need to weigh the evidence and decide whether Bankman-Fried acted with criminal intent.

Actionable Insights: What Can We Learn?

- Complexity Doesn’t Equal Innocence: While the crypto world is complex, understanding the rules and regulations is crucial for any operator.

- Transparency and Trust are Paramount: The FTX saga highlights the importance of transparency and trust in financial institutions, especially in emerging markets like cryptocurrency.

- Due Diligence Matters: For investors and users, understanding the risks and conducting thorough due diligence is essential before engaging with any financial platform.

Conclusion: A Trial That Will Shape the Future of Crypto Regulation

The upcoming trial of Sam Bankman-Fried is more than just a legal battle; it’s a landmark case that will likely have significant implications for the future of cryptocurrency regulation and the perception of the industry as a whole. The high-stakes clash between the prosecution and the defense, fueled by expert testimony and intense scrutiny, promises a gripping legal drama with far-reaching consequences. The world is watching to see how this unfolds and what lessons will be learned from the rise and fall of FTX.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.