Ever wondered who holds the reins in the crypto world? Recent reports are shedding light on the significant holdings of one of crypto’s most influential figures, Changpeng Zhao, also known as CZ, the former CEO of Binance. A new Forbes report, backed by forensic analysis, suggests that CZ isn’t just a stakeholder in Binance – he’s a major holder of Binance Coin (BNB), the exchange’s native token. Let’s dive into the details of CZ’s reported BNB stash and what it means for the crypto ecosystem.

CZ’s BNB Bonanza: How Much Does He Really Own?

According to the Forbes report, leveraging data from Gray Wolf Analytics, CZ reportedly commands a whopping 64% of BNB’s circulating supply. That translates to approximately 94 million BNB tokens! To put this in perspective, consider these key findings:

- Founding Team’s Initial Allocation: 80 million BNB tokens were originally earmarked for the Binance founding team.

- Binance Still Holds a Chunk: Of those initial 80 million, Binance reportedly still controls 46 million tokens.

- CZ’s Lion’s Share: CZ’s personal holdings make up the bulk of the founding team’s allocation, cementing his position as a major BNB holder.

- Combined Power: Together, Binance and CZ are estimated to control a staggering 71% of the total 147 million BNB currently circulating.

These numbers paint a picture of concentrated ownership, highlighting CZ’s profound influence within the BNB ecosystem. His significant equity stake in Binance, coupled with his crypto assets, has propelled him into the ranks of the world’s wealthiest individuals, reportedly holding the 24th spot with an estimated net worth of $61 billion.

This revelation comes at a time when Binance and CZ are navigating complex regulatory landscapes, adding another layer of intrigue to the narrative.

Understanding BNB Tokenomics: What Makes BNB Tick?

BNB is more than just a cryptocurrency; it’s the utility token fueling the Binance ecosystem. Think of it as the engine oil that keeps the Binance machine running smoothly. Here’s a quick rundown of its key features:

- Native Token of Binance: BNB is integral to the Binance exchange, powering various functionalities.

- Utility King: It’s primarily used for paying trading fees on the Binance platform, often at a discounted rate, incentivizing users to hold and use BNB.

- Rewards and More: BNB also plays a role in various Binance features, including staking, participating in token sales (Launchpad), and accessing exclusive features.

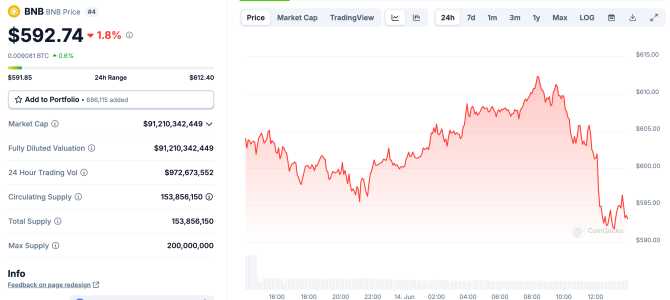

Let’s look at some key metrics:

- Maximum Supply: BNB has a capped maximum supply of 200 million tokens, designed to create scarcity over time.

- Circulating Supply: Currently, over 153 million BNB tokens are actively circulating in the market, contributing to its market dynamics.

- Market Cap Powerhouse: With a price hovering around $593 per token, BNB boasts a robust market capitalization exceeding $91 billion.

- Recent Price Surge: BNB has experienced a significant bull run, more than doubling in value from approximately $290 in January 2024 to highs of $724 in June 2024. This surge reflects positive market sentiment and growing utility.

CZ’s Legal Battles: Navigating the DOJ Storm

While CZ’s BNB holdings highlight his success, it’s crucial to acknowledge the legal challenges he and Binance have faced. In 2023, the U.S. Department of Justice (DOJ) brought serious allegations against Zhao and Binance, citing violations of sanctions and money laundering regulations.

Here’s a quick recap of the situation:

- DOJ Indictments: The DOJ accused Binance and CZ of violating the Bank Secrecy Act and other regulations.

- Plea Deal and Resignation: CZ entered into a plea agreement, admitting guilt to violating the Bank Secrecy Act. As part of the settlement, he stepped down as CEO of Binance, with Richard Teng taking the helm.

- Heavy Fines: The settlement included substantial financial penalties: $50 million for CZ personally and a massive $4.3 billion fine for Binance.

- Independent Monitor: To ensure compliance, the DOJ appointed the Forensic Risk Alliance to monitor Binance’s operations for three years.

- Prison Sentence: In April 2024, CZ was sentenced to four months in prison by a U.S. federal judge. This was a lighter sentence than the three years initially sought by prosecutors.

Despite these legal headwinds, BNB has shown remarkable resilience, as evidenced by its price surge. This could indicate strong underlying confidence in the BNB ecosystem and its long-term prospects, even amidst regulatory scrutiny.

Key Takeaways: CZ, BNB, and the Crypto Landscape

Changpeng Zhao’s significant BNB holdings underscore his deep connection to Binance and the BNB ecosystem. His journey, from building a crypto empire to navigating legal challenges, is a compelling narrative within the rapidly evolving crypto world.

Here are some key takeaways to consider:

- Centralized Influence: CZ’s large BNB stake highlights the centralized nature of some aspects of the crypto market, even within decentralized ecosystems.

- Tokenomics Matter: Understanding BNB’s tokenomics – its supply, utility, and distribution – is crucial for investors and participants in the Binance ecosystem.

- Resilience of BNB: Despite regulatory pressures and CZ’s legal issues, BNB’s price performance suggests a robust community and underlying value proposition.

- Regulatory Scrutiny: The DOJ case serves as a reminder of the increasing regulatory scrutiny facing the crypto industry and the importance of compliance.

As the crypto landscape continues to mature, the story of CZ and BNB offers valuable insights into the dynamics of power, influence, and regulation within this exciting and often unpredictable space. Keep an eye on BNB as it continues to evolve and shape the future of finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.