Remember the buzz around Friend.tech? It felt like the next big thing in crypto, promising to revolutionize how influencers connect with their followers through Social Finance (SoFi). But recent data paints a less rosy picture. Let’s dive into what’s happening and whether this SoFi pioneer is losing steam.

Friend.tech’s On-Chain Metrics: A Deep Dive into the Downturn

Friend.tech burst onto the scene with a novel concept: allowing influencers to monetize their audience directly on-chain. This Social Finance (SoFi) model was touted as a potential game-changer, moving away from traditional ad-driven social platforms. However, the initial excitement seems to have faded, and the on-chain metrics are reflecting a significant drop in activity. Let’s break down the key indicators:

- Transaction Volume Plummets: Daily transactions on Friend.tech have sunk to alarmingly low levels.

- Protocol Fees Dwindle: Reflecting the transaction decline, protocol fees have also taken a nosedive.

- New User Acquisition Slows to a Trickle: The influx of new users has drastically reduced, indicating waning interest.

Friend.tech Metrics Falter: By the Numbers

The numbers tell a compelling story. According to Dune Analytics, the daily transaction count on Friend.tech hit a new low of just 5,160 on November 14th. To put this into perspective, consider this:

Peak vs. Trough: Daily Transactions

On September 13th, Friend.tech recorded a staggering 539,810 daily transactions. Fast forward to November 14th, and that number has plummeted to a mere 5,160. That’s a peak-to-trough drawdown of approximately 99%! This dramatic fall highlights the sharp decline in platform activity.

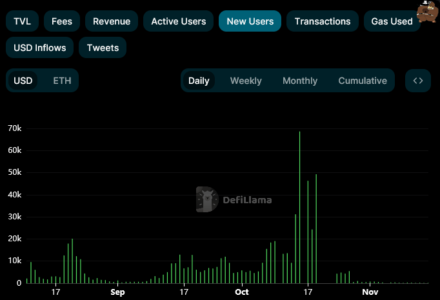

Let’s visualize this journey:

Initially launched in early August, Friend.tech experienced a rapid surge in daily transactions, leading many to believe it was poised for mainstream adoption. The initial excitement, however, proved short-lived, starting to wane around August 21st. A brief resurgence of interest followed, peaking again around September 13th. But since then, the platform hasn’t been able to recapture that initial spark, with the decline becoming even more pronounced as we moved into November.

Read Also: Microsoft, Tencent And Other Tech Giants Join Decentralized Infura Network

It’s not just transaction volume that’s down. Other key metrics paint a similar picture of reduced platform engagement:

Protocol Fees: From Peak to Valley

Daily protocol fees, a direct indicator of platform revenue and user activity, have mirrored the transaction decline. They’ve fallen to 17.7 ETH as of November 14th, a significant 97% drop from the September 13th peak of 578.8 ETH.

New Users: The Influx Slows

The number of new users joining Friend.tech daily has also dwindled. DeFiLlama data reveals that on November 14th, only 170 new users signed up. Compare this to the peak on October 15th, when the platform attracted an impressive 68,640 new users. The dramatic decrease in new user acquisition further underscores the platform’s struggle to maintain momentum.

Is it Game Over for Friend.tech? Protocol Improvements and Future Outlook

While the on-chain metrics present a concerning picture, it’s not necessarily the end of the road for Friend.tech. The team has been actively working behind the scenes to address platform weaknesses and enhance user experience. Let’s take a look at some of the improvements:

- Enhanced Security: Recognizing the growing threat of SIM-swap attacks, Friend.tech implemented two-factor authentication last month, adding a crucial layer of security for users.

- Profile Customization: To foster a more engaging and personalized user experience, customizable bios were introduced, allowing users to add more personality to their profiles.

- Bug Bounty Program: Friend.tech launched a bug bounty program, proactively seeking community input to identify and address vulnerabilities, demonstrating a commitment to platform security.

- Performance Optimization: Efforts have been made to fine-tune data loading speeds, aiming for a smoother and more responsive user interface.

gm frens 👋

small ftech update:

✅ 2FA

✅ bios

✅ bug bounty

✅ data loading speed improvements— friend.tech (@friendtech) October 13, 2023

The Future of Social Finance and Friend.tech’s Role

Friend.tech’s journey highlights the volatile nature of the crypto space and the challenges of sustaining initial hype. While the current metrics are down, the concept of Social Finance remains promising. The platform’s efforts to improve security and user experience are steps in the right direction. Whether these improvements will be enough to reignite user interest and reverse the current downtrend remains to be seen.

The broader Web3 social landscape is still evolving, and Friend.tech’s experience offers valuable lessons for future SoFi platforms. The demand for new models that empower creators and communities is undeniable. It’s possible that Friend.tech will adapt, innovate, and find a way to recapture its initial momentum, or perhaps its trajectory will pave the way for new, more robust Social Finance platforms to emerge.

Key Takeaways:

- Friend.tech’s on-chain metrics (daily transactions, protocol fees, new users) have significantly declined from their peak.

- The initial hype surrounding the platform has waned, leading to reduced user activity.

- Friend.tech is actively working on protocol improvements, including security enhancements and user experience optimizations.

- The future of Friend.tech and the broader Social Finance space remains uncertain but full of potential.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.