Remember the buzz around a potential FTX comeback? It seems those whispers are fading fast, and the crypto market is reacting. FTT, the token associated with the collapsed exchange, has taken a significant hit, plummeting over 30% last week. This sharp decline isn’t just a number on a chart; it’s a clear signal that the hope for an FTX 2.0 is dwindling, sending ripples through the crypto community. Let’s dive into what’s causing this downturn and what it means for everyone involved.

The FTX Relaunch Mirage: Why is the Hope Vanishing?

For months, speculation about a possible resurrection of the FTX exchange fueled a surge in FTT’s value. Investors, clinging to the hope of recovering lost assets or simply betting on a comeback story, pushed FTT prices upwards. However, recent developments have thrown cold water on these optimistic projections.

- Reality Check Bites: Reports are circulating that FTX, under its bankruptcy proceedings, is unlikely to resume operations. This news directly contradicts earlier hopes and insider whispers about a relaunch.

- Courtroom Clarity (of sorts): While there’s a silver lining – FTX representatives have stated they aim to fully repay users – the devil is in the details. Repayments will be calculated based on the value of assets at the time of FTX’s bankruptcy in late 2022.

Think back to late 2022. The crypto market was in a deep bear phase. Bitcoin was struggling below $20,000, and after the FTX implosion, it briefly dipped below $16,000. This means that users will be compensated based on those significantly lower prices, not the potentially higher values their assets might have reached today. This discrepancy is a major point of contention and frustration for many.

See Also: FTT Jumps 24% On Former FTX Customer Complaints

The FTT Freefall: A Look at the Numbers

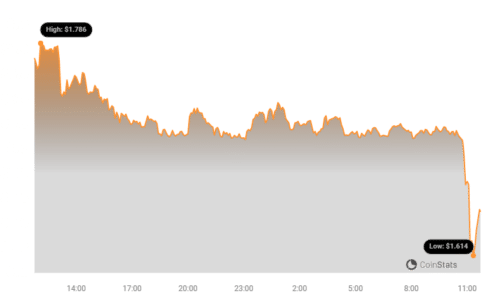

Kaiko, a leading crypto data provider, highlighted the stark reality. According to their data from February 5th, FTT experienced a dramatic 30% plunge last week alone. This nosedive effectively wiped out a significant portion of the gains FTT had accumulated based on the relaunch speculation.

📉 @FTX_Official's token $FTT plummeted over 30% last week as relaunch hopes fade, erasing much of its recent gains fueled by speculation of an FTX comeback.

Despite a glimmer of hope for FTX customers, the dream of a revived exchange evaporates, triggering a massive sell-off of its native token. pic.twitter.com/9T7qYjV9yK

— Kaiko (@KaikoData) February 5, 2024

The chart below visually represents the FTT price action, showcasing the recent downturn after a period of recovery.

Why the Repayment Plan Isn’t Enough to Save FTT (or Hopes)?

While full repayment sounds positive on the surface, the method and timing are causing concern and impacting FTT’s value. Here’s why:

- Valuation at Rock Bottom Prices: As mentioned, repayments are based on November 2022 prices. For users who held assets like Bitcoin or Ethereum, which have since rebounded significantly, this means receiving a fraction of their current value.

- No FTX 2.0, No Utility: FTT’s primary utility was within the FTX ecosystem. Without a relaunch, the token loses its core purpose. As Kaiko aptly described it, FTT is now a “utility-free currency of the defunct exchange.”

- Investor Disappointment: The deleted YouTube video featuring FTX lawyer Andrew Dietderich, confirming no relaunch plans due to lack of buyers, further cemented the negative sentiment. This official (albeit later retracted) statement dashed hopes and triggered sell-offs.

The Creditor Conundrum: Proving Your Claim

Adding another layer of complexity, FTX is requiring claimants to provide substantial proof of their holdings before the exchange’s collapse. This process raises several questions and potential hurdles:

- Burden of Proof: Gathering historical transaction data and account information from a defunct exchange can be challenging for many users.

- Fair Value Debate: Claimants are understandably arguing that the true value of their assets should be considered at pre-crash levels, reflecting the market recovery since then.

- Lengthy Process: Bankruptcy proceedings are notoriously slow. Creditors may face a prolonged wait before receiving any repayment, and even then, the amount may be less than anticipated.

See Also: Three Cryptocurrencies With Potential To Turn $100 Into $1,000

FTT Is Free Falling, Reverses November Gains

Let’s not forget, FTT had a significant price recovery throughout much of 2023. From November 2023, FTT prices surged by over 300%! This impressive rally was almost entirely fueled by the speculation surrounding “FTX 2.0” and a potential new management team taking over.

However, as the relaunch narrative crumbles, FTT is facing a brutal reality check. The fundamental question of its utility is now front and center. When FTX was operational, FTT played a vital role within its ecosystem, offering benefits to holders. But in its current state, that utility is gone.

As of February 5th, FTT was trading around $1.7. Price charts paint a clear picture: bears are dominating, effectively erasing all the gains from November 2023. The critical support level to watch now is around $0.95. If this level breaks, further downside could be expected.

The Road Ahead: What Does This Mean for FTT and FTX Creditors?

The fading hopes of an FTX relaunch and the subsequent FTT price crash serve as a stark reminder of the volatility and risks inherent in the crypto market. For FTT holders, the future looks uncertain. Unless a new use case or unexpected development emerges, the token’s value is likely to remain under pressure.

For FTX creditors, while the prospect of full repayment is positive, the valuation method and the potentially lengthy process are significant concerns. Navigating the claims process and understanding the terms of repayment will be crucial in the coming months.

Key Takeaways:

- FTT Price Plunge: FTT has fallen sharply due to diminished FTX relaunch hopes, wiping out recent gains.

- Repayment Reality: FTX aims to repay users fully, but based on 2022 bankruptcy-era asset values, not current market prices.

- Utility Void: Without an FTX exchange relaunch, FTT lacks clear utility, impacting its long-term value.

- Creditor Challenges: Proving claims and navigating the repayment process will be complex for FTX users.

Actionable Insights:

- For FTT Holders: Exercise caution and manage risk. Understand the token’s diminished utility and potential for further price volatility.

- For FTX Creditors: Gather all necessary documentation to support your claim. Stay informed about the bankruptcy proceedings and understand the repayment terms. Consult with legal or financial professionals if needed.

In Conclusion: The FTX saga continues to unfold, with the latest chapter marked by fading relaunch hopes and a significant FTT price correction. While the prospect of user repayment offers some solace, the details and implications are complex. The crypto community watches closely as FTX navigates this challenging path, and the future of FTT remains deeply intertwined with the exchange’s fate.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.