Remember the FTX collapse? It sent shockwaves through the crypto world, leaving countless users in the lurch. Now, as the dust (sort of) settles, FTX has unveiled its repayment plan. But hold on, because it’s not the relief many were hoping for. In fact, it’s stirring up a fresh wave of controversy, and at the heart of it all is how FTX is valuing your digital assets – particularly Bitcoin, pegged at a mere $16,000.

Why is FTX’s Repayment Plan Causing Such a Stir?

Imagine you entrusted your hard-earned crypto to FTX, only to see the exchange crumble. Now, imagine being told that when you get some of it back, it will be based on prices from back when things went south, not today’s market value. That’s precisely what FTX’s repayment plan proposes, and it’s understandably infuriating many customers.

Here’s the crux of the issue:

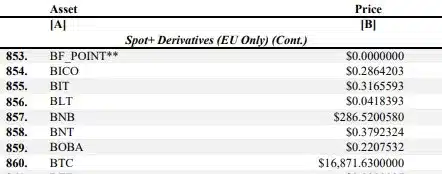

- Bitcoin’s Throwback Price Tag: FTX is valuing Bitcoin at roughly $16,871.63 for repayment purposes. Yes, you read that right. Considering Bitcoin is currently trading around $42,800 (and has been for a while), this is a massive gap.

- It’s Not Just Bitcoin: This isn’t just a Bitcoin issue. Other cryptocurrencies are also being valued at significantly lower prices than their current market value. Ethereum at $1,258, Solana at $16.247, and Lido at $1,176 – these figures are a far cry from where these assets are trading today.

- Valuation at the Time of Collapse: The core problem is that FTX is using the value of digital assets at the time of its bankruptcy. While this might seem like a standard bankruptcy procedure in some ways, the volatile and appreciating nature of crypto assets throws a wrench into the works.

In their official filing on December 27th, FTX stated the plan is aimed at “returning the value of the assets” to customers and creditors. But “value” is proving to be a highly contentious word in this situation.

See Also: FTX Files To Exit Bankruptcy And Repay Billions To Affected Customers

Decoding FTX’s Valuation Methodology

So, how did FTX arrive at these seemingly low valuations? According to the filing, they used data from Coin Metrics, a reputable source for crypto price information. They then made “adjustments” for factors like:

- Orderly Liquidation of Assets: This likely accounts for the potential impact of selling off large amounts of crypto in a distressed situation.

- Non-Marketable Assets: Some assets might be harder to sell quickly or at good prices.

- Equity-like Assets: This is a bit vague, but could refer to tokens with governance or revenue-sharing features, which might be valued differently in bankruptcy.

However, despite these justifications, the bottom line for customers is starkly clear: the proposed valuation means they will recover significantly less than the current market value of their crypto holdings. This discrepancy is what’s fueling the outrage.

Customer Uprising: Will FTX Reconsider?

Unsurprisingly, FTX customers are not taking this lying down. Social media and online forums are buzzing with disgruntled users expressing their frustration and seeking advice on how to fight back. Many feel cheated, arguing that they should be repaid the equivalent value of their assets at today’s prices, not prices from a distressed period.

The key question now is: What can FTX customers do?

- Object to the Plan: FTX has set a deadline of January 11th for objections. If you disagree with the valuation, this is your window to formally voice your concerns.

- Seek Legal Guidance: Navigating bankruptcy proceedings can be complex. Many customers are exploring legal options and seeking advice from lawyers specializing in bankruptcy and crypto assets.

- Organize and Unite: Collective action can be more effective. Customers are organizing online to share information, strategies, and potentially amplify their voices in the legal process.

See Also: FTX And FTX Digital Markets (FDM) Strike Deal To Align Customer Reimbursement Efforts

The situation remains fluid, and the future of FTX’s repayment plan is uncertain. Will customer pressure force FTX to reconsider its valuation? Will legal challenges reshape the repayment process? The coming weeks will be critical in determining how this unfolds and what level of recovery FTX customers can realistically expect.

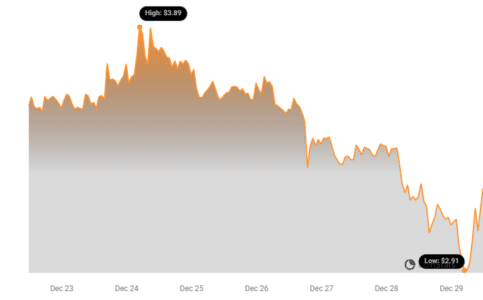

Meanwhile, the FTT token, once central to the FTX ecosystem, continues to reflect the exchange’s woes. Currently trading at around $3.24, FTT has plummeted over the past month, underscoring the deep loss of confidence in the FTX brand.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.