Did you expect Bitcoin miners to buckle under pressure after the fourth halving slashed their block rewards in half? Think again! Despite the significant reduction in revenue, Bitcoin’s hashrate, a key indicator of miner activity and network security, has just smashed through previous records, reaching a new all-time high (ATH). Let’s dive into what this surprising development means and why Bitcoin miners are showing such resilience.

Bitcoin Hashrate Rockets to New Heights Post-Halving

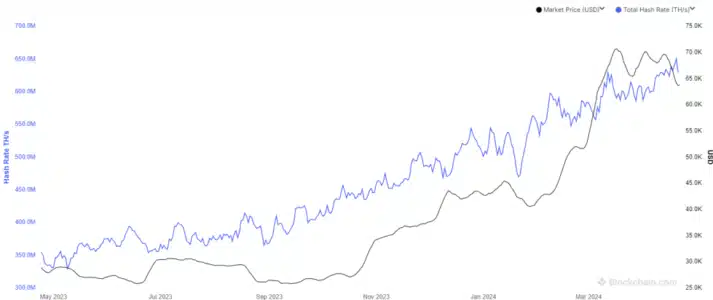

In a fascinating turn of events, the 7-day average Bitcoin hashrate recently achieved a groundbreaking milestone, hitting a new ATH. This comes hot on the heels of the fourth Bitcoin halving, an event designed to reduce the rate at which new bitcoins are created. For those new to the crypto space, let’s quickly break down what this halving business is all about.

Bitcoin Halving Explained: A Periodic Squeeze on Miner Rewards

Imagine Bitcoin as digital gold. Miners are the digital prospectors, using powerful computers to solve complex puzzles and validate transactions, securing the Bitcoin network. As a reward for their efforts, they receive newly minted Bitcoins – these are called block rewards.

Now, to maintain Bitcoin’s scarcity and control inflation, the Bitcoin protocol incorporates a clever mechanism called “halving.” Roughly every four years, or every 210,000 blocks mined, the block reward is cut in half. This predetermined event ensures that Bitcoin’s total supply is capped at 21 million coins.

The most recent halving, the fourth in Bitcoin’s history, just occurred, reducing the block reward from 6.25 BTC to 3.125 BTC. Historically, these events are pivotal moments for miners, directly impacting their earnings. So, with revenue slashed, why are miners not just surviving, but thriving, pushing the hashrate to record levels?

Hashrate: The Pulse of the Bitcoin Mining Network

To understand miner sentiment and activity, we look at the hashrate. Think of hashrate as the collective computing power dedicated to mining Bitcoin. It’s measured in hashes per second (H/s), and in today’s Bitcoin network, we’re talking about exahashes per second (EH/s) – a truly colossal figure!

Why is hashrate important?

- Network Security: A higher hashrate makes the Bitcoin network more secure and resistant to attacks. More computing power makes it exponentially harder for malicious actors to tamper with the blockchain.

- Miner Confidence: Hashrate trends often reflect miner profitability and confidence in Bitcoin’s future. An increasing hashrate generally suggests miners are optimistic and investing in more mining equipment.

- Network Activity: While not a direct measure, hashrate can indirectly indicate the overall health and activity within the Bitcoin ecosystem.

Historically, post-halving periods have often seen a dip in hashrate as some less efficient miners become unprofitable and disconnect from the network. However, this time is different.

See Also: Bitcoin (BTC) Transaction Fees Surge Post-Halving, Sparking Alternative Search Trends

As highlighted by analyst James Van Straten, previous halvings were often followed by hashrate declines. But this time, the chart tells a different story.

Bitcoin Mining Hashrate has historically always gone down following Halving events. pic.twitter.com/623j8l9f8a

— James Van Straten (@jvs_btc) April 21, 2024

Instead of a drop, the 7-day average Bitcoin hashrate surged to an unprecedented 650 EH/s on the very day of the halving!

While there has been a slight pullback since then, with the hashrate hovering around 629 EH/s, it’s clear that the overall level remains exceptionally high, near ATH territory. This suggests a robust and confident mining sector.

Why Are Miners Still Going Strong? The Runes Protocol Effect

So, what’s fueling this unexpected resilience? While the halving undeniably reduces block rewards, miners have another significant income stream: transaction fees. And recently, transaction fees have been anything but “relatively low.”

Bitcoin transaction fees are currently still driving miner revenue share, even post rune hype.

Fee revenue is still accounting for 30% of total miner revenue.

Historically this is still very high and a reflection of strong demand to use blockspace.

Chart via https://t.co/iQ6i7GlwzQ pic.twitter.com/vS8r6r6jPE

— James Van Straten (@jvs_btc) April 22, 2024

The surge in transaction fees can be attributed to the arrival of the Runes protocol. Runes is a new protocol on Bitcoin that simplifies the creation of fungible tokens. This has sparked significant activity on the Bitcoin network, driving up demand for block space and consequently, transaction fees.

Initially, fees contributed to over 75% of miner revenue at the peak of the Runes hype. While this has cooled down somewhat, fees still account for a substantial 30% of total miner revenue. This significantly higher-than-usual fee revenue is likely a key factor in keeping miners engaged and hashrate elevated despite the halved block rewards.

Bitcoin Price Holds Steady

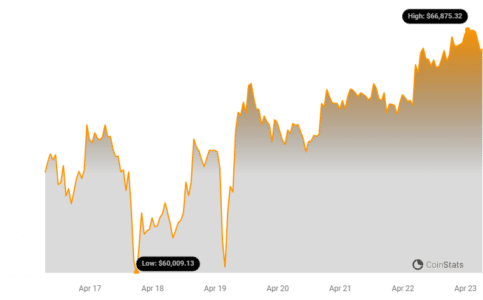

Adding to the positive sentiment, Bitcoin’s price has shown resilience amidst the halving and hashrate surge.

As of writing, Bitcoin is trading around $66,100, marking a more than 3% increase over the past week. This price stability, or even slight upward trend, further supports miner profitability and overall market confidence.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

In Conclusion: Bitcoin Miners – Resilient and Ready for the Future

The Bitcoin halving, while a significant event that halves block rewards, hasn’t dampened the spirits of Bitcoin miners. The hashrate’s impressive surge to a new ATH is a testament to the miners’ adaptability and the Bitcoin network’s underlying strength. The unexpected boost from transaction fees, driven by innovations like the Runes protocol, has provided a crucial buffer against reduced block rewards.

This post-halving period is shaping up to be quite different from previous cycles. It highlights the evolving dynamics of Bitcoin mining revenue streams and the continued innovation within the Bitcoin ecosystem. As the Runes hype settles and the Bitcoin landscape continues to mature, it will be fascinating to watch how miners navigate the ever-changing crypto terrain and contribute to the ongoing security and growth of the Bitcoin network.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.