In the bustling world of cryptocurrency and virtual investments, the promise of quick riches can be incredibly tempting. But as the saying goes, if it sounds too good to be true, it probably is. Hong Kong residents recently learned this lesson the hard way, falling victim to a sophisticated scam involving fake virtual investment talk show tickets. Let’s dive into how this elaborate scheme unfolded and what it means for the fight against crypto fraud in Hong Kong.

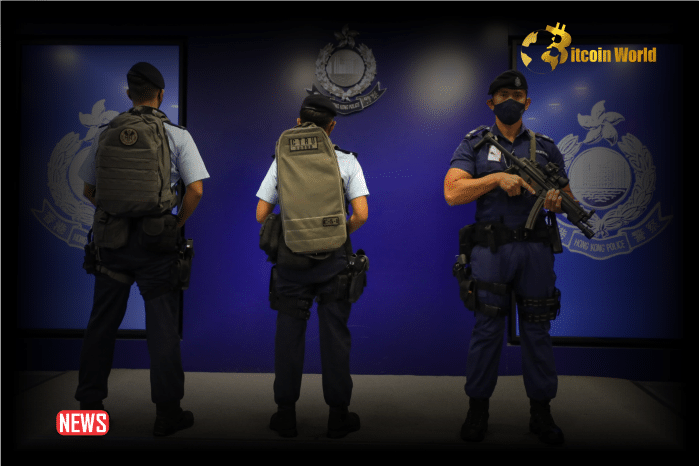

Hong Kong Police Nab Three Suspects in HK$5.1 Million Virtual Investment Scam

Hong Kong law enforcement has taken decisive action against a fraud syndicate accused of swindling at least ten individuals out of a staggering HK$5.1 million (US$653,900). On Tuesday, police arrested three individuals believed to be key players in this elaborate scheme. The victims were lured into bidding for nonexistent tickets to a virtual investment seminar, all with the false hope of reselling them for a hefty profit.

The Anatomy of the Scam: How Did it Work?

Imagine being invited to an exclusive investment seminar held in a swanky grade-A office in Kowloon Bay. Sounds legitimate, right? That’s exactly how this syndicate operated. They created an illusion of credibility to reel in unsuspecting individuals. Here’s a breakdown of their deceptive tactics:

- The Bait: Victims were invited to an investment seminar promising high returns with minimal to no risk. This initial seminar served as the entry point to the larger scam.

- Fake Ticket Bidding: Attendees were then enticed to participate in a sham trading platform controlled by the syndicate. The platform facilitated bidding for tickets to a virtual investment talk show.

- The Illusion of Profit: Scammers persuaded victims to deposit funds into this bogus platform, promising an enticing monthly return of 7% interest.

- Ponzi Scheme Mechanics: The bidding for each ticket started at 100 Tether coins (approximately HK$780). Victims were led to believe they could resell these tickets the very next day at a significantly inflated price of 300 Tether coins. However, high handling fees were strategically placed to complicate the process.

- Fake Payouts, Real Losses: As bidding prices escalated, the fraudsters claimed they would eventually repurchase all tickets at an exorbitant price of 15,000 Tether coins. Crucially, Inspector Tam Ho-yin of the Sau Mau Ping district crime squad revealed the core of the Ponzi scheme: “The money supposedly won by the victims during this process belonged to other victims,” meaning early participants were paid with money from new recruits, a classic red flag.

- Platform Collapse: The syndicate’s operation, which began in November 2022, ultimately crumbled when they could no longer attract new victims to sustain the payouts. The trading platform abruptly ceased operations, leaving many with substantial losses and no way to recover their funds.

- Withdrawal Denials and Extortion: When victims attempted to withdraw their supposed profits, the scammers became evasive, offering excuses and ultimately refusing withdrawals. Adding insult to injury, they even demanded exorbitant “administrative fees” before even considering any withdrawal requests.

Some victims, initially seeing “profits” (which were simply recycled funds from other victims), unknowingly became recruiters themselves, introducing family and friends to the scheme, further amplifying the damage.

Legal Repercussions and Seized Assets

The arrested individuals now face serious charges of conspiracy to defraud, a crime that carries a potential prison sentence of up to 14 years in Hong Kong. During the arrests, police seized crucial evidence, including five mobile phones and a sum of cash amounting to HK$15,000 and 30,000 yuan (US$4,145). Authorities are urging anyone else who may have fallen victim to this scam to come forward and assist with the ongoing investigation.

See Also: Russian Court Jails Finiko Crypto Scam Executive For Three Years

Hong Kong Grapples with Surge in Crypto Fraud

This case is unfortunately part of a larger, concerning trend in Hong Kong. The city has witnessed a significant surge in fraud cases, particularly in the digital asset space. Consider these alarming statistics:

- Dramatic Increase in Cases: Reports of fraud in Hong Kong jumped by a staggering 42.6 percent last year, totaling 39,824 cases compared to 27,923 in 2022.

- Explosive Growth in Financial Losses: The financial devastation caused by these scams is even more striking. Losses surged by a massive 89 percent, reaching HK$9.1 billion in 2023, up from HK$4.8 billion the previous year.

SFC and Police Join Forces to Combat Crypto Crime

Recognizing the escalating threat posed by cryptocurrency-related scams, the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Police Force have forged a strong partnership to combat this growing menace. This collaboration, formalized in a meeting on September 28, aims to proactively monitor and tackle illegal activities linked to virtual asset trading platforms (VATPs) operating within Hong Kong.

A major catalyst for this intensified collaboration is the ongoing JPEX exchange scandal, arguably the most significant fraud case in Hong Kong’s crypto history. JPEX faces serious accusations of illegally advertising its services without proper SFC licensing. This alleged oversight, coupled with other illicit activities, has resulted in estimated losses of around $166 million, impacting over 2,086 investors.

To empower individuals to protect themselves, the SFC has taken a proactive step by publishing a public list of licensed, unlicensed, and suspicious VATPs. This list includes platforms nearing closure and those currently awaiting SFC approval, providing a crucial resource for investors to verify the legitimacy of crypto platforms before engaging with them.

Protect Yourself: Red Flags of Crypto Scams

How can you avoid becoming the next victim of a crypto scam? Vigilance and informed decision-making are key. Be wary of these common red flags:

- Unrealistic Promises: Guaranteed high returns with “no risk” are hallmarks of scams. Legitimate investments always carry risk.

- Pressure to Invest Quickly: Scammers often create a sense of urgency to prevent you from doing thorough research.

- Unsolicited Investment Offers: Be cautious of investment opportunities that come out of the blue, especially through social media or messaging apps.

- Lack of Transparency: Be wary if you can’t find clear information about the company, its team, or its regulatory compliance.

- Complex or Opaque Systems: Scams often involve convoluted investment schemes that are difficult to understand.

- Withdrawal Problems: Difficulty or inability to withdraw your funds is a major warning sign.

- Unlicensed Platforms: Always verify if a crypto platform is licensed by the SFC in Hong Kong before investing. Check the SFC’s public list.

Conclusion: Stay Informed, Stay Safe

The Hong Kong virtual investment ticket scam serves as a stark reminder of the ever-present dangers in the crypto world. While the allure of high returns is strong, it’s crucial to exercise caution, conduct thorough due diligence, and be skeptical of opportunities that seem too good to be true. The collaborative efforts of the Hong Kong Police Force and the SFC are a positive step towards combating crypto fraud, but ultimately, investor awareness and vigilance are the strongest defenses. If you believe you may have been a victim of a similar scam, don’t hesitate to contact the Hong Kong police and report it. Your action can help prevent others from falling into the same trap. Stay informed, stay safe, and remember, in the world of crypto, skepticism is your best friend.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.