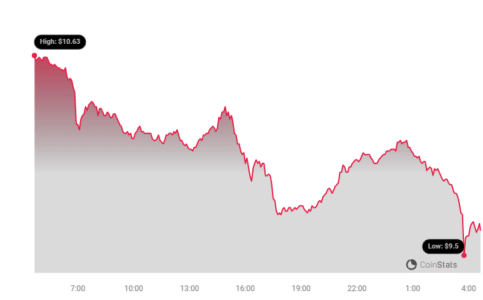

Render (RNDR), a prominent player in the decentralized GPU rendering space, is currently facing a critical juncture. After reaching an all-time high in March, the token’s price has been on a downward trend, and now it’s teetering on the edge of losing its $10 support level. Is this just a temporary setback, or are there deeper issues at play? Let’s dive into the indicators suggesting a potential further decline.

Is RNDR’s $10 Support About to Break?

- Price Pressure: Render’s price is nearing a critical support level of $10, a breach of which could trigger a fall to $8.

- Investor Apathy: Participation has plummeted, with a staggering 55% decrease in investor activity within a mere five days.

- Profit-Taking Signals: Approximately 25% of active investors are currently in profit, hinting at potential sell-offs that could exacerbate the downward pressure.

The combination of these factors paints a concerning picture for RNDR’s short-term prospects. Let’s examine each of these indicators in more detail.

Render Investors Are Retreating

Render’s bearish outlook isn’t solely due to broader market trends; internal factors are also contributing significantly. A key indicator is the dramatic decline in active addresses – a measure of investors actively participating in the network through transactions.

See Also: What! Bitcoin (BTC) Price Dumped To $66K As Bears Gained Strength, $64K Next?

Over the past week, active addresses have plummeted from 3,530 to just 1,580. This 55% drop signifies a significant loss of confidence among investors, who appear to be withdrawing in anticipation of further price declines. This mass exodus could intensify the selling pressure, pushing RNDR closer to the $10 support level.

Further analysis of active addresses reveals another potential headwind: profit-taking. A breakdown of these addresses by profitability shows that while 77% are at breakeven, a substantial 21% are currently in profit. These profitable investors may be tempted to cash out their gains before prices fall further, adding to the downward pressure on RNDR.

The presence of these potentially profit-taking investors suggests that further bearishness is on the horizon. Should they decide to liquidate their holdings, Render’s price could experience a significant drop.

RNDR Price Prediction: How Low Could It Go?

Based on the aforementioned bearish indicators, Render’s price is at risk of breaching the $10 support level. A break below this critical point could pave the way for a decline to $8.7. If this support also fails to hold, the altcoin could plummet to $8.05, representing a 20% correction from its current levels.

Key Support Levels to Watch:

- $10: Immediate support; a break below signals further downside.

- $8.7: Next support level; a potential target after losing $10.

- $8.05: Major support level; a 20% correction target.

While these predictions are based on current market indicators, it’s crucial to remember that the cryptocurrency market is inherently volatile. Unexpected events or shifts in market sentiment could invalidate these projections.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.