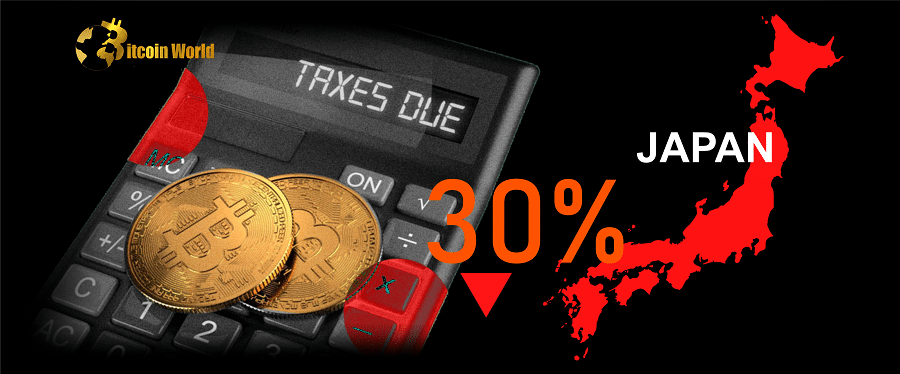

Big news for crypto in Japan! For years, companies issuing cryptocurrencies in Japan have faced a hefty 30% corporate tax on their crypto holdings, even if they hadn’t actually sold them for profit. Imagine paying taxes on something that hasn’t even made you money yet! This has been a major pain point, pushing many promising crypto and blockchain ventures to set up shop outside of Japan. But hold on, things are about to change!

Is Japan Becoming a Crypto Haven? Tax Relief on the Horizon

In a move that’s sending ripples of excitement through the crypto world, the Japanese government is planning to significantly ease tax regulations for domestic crypto firms. This isn’t just a minor tweak; it’s a strategic shift aimed at injecting活力 (katsuryoku – vitality) into Japan’s finance and technology sectors. Think of it as rolling out the welcome mat for crypto innovation!

Currently, the tax system has been a significant hurdle. Let’s break down the problem:

- The 30% Tax Burden: Japanese crypto issuers are currently slapped with a 30% corporate tax on their cryptocurrency holdings. This applies even if they haven’t sold the tokens and realized a profit.

- Discouraging Innovation: This tax structure has been criticized for stifling growth and pushing talented crypto companies and individuals to relocate to more crypto-friendly jurisdictions.

- Brain Drain in Blockchain: Reports indicate that numerous Japanese crypto and blockchain startups, along with skilled professionals, have chosen to establish themselves overseas to escape these stringent tax rules.

The Turning Point: LDP Tax Committee Greenlights Change

Finally, there’s light at the end of the tunnel! On December 15th, the tax committee of Japan’s ruling Liberal Democratic Party (LDP) gave the thumbs up to a proposal that could revolutionize the crypto landscape in Japan. This proposal, initially discussed in August, is all about removing the tax burden on unrealized gains for crypto companies. Essentially, crypto companies will no longer be taxed on “paper profits” from tokens they issue and hold.

This is a crucial shift because it addresses the core issue that has been hindering the growth of the crypto industry in Japan. Reports suggest this change is a direct response to industry feedback and a recognition of the potential of blockchain technology.

When Will These New Rules Take Effect?

The good news keeps coming! These relaxed crypto tax rules are expected to be formally presented to the Japanese parliament in January. If all goes as planned, they are slated to become effective on April 1st, coinciding with the start of Japan’s next fiscal year. Mark your calendars – April could be a pivotal month for crypto in Japan!

Industry Leaders Cheer the Tax Reform

Akihisa Shiozaki, a prominent LDP lawmaker and a key figure in the party’s Web3 policy office, expressed his enthusiasm about this development. Speaking to Bloomberg on December 15th, Shiozaki stated, “this is a very big step forward.” He further emphasized that these changes will make it significantly “easier for various companies to do business that involves issuing tokens.” This sentiment echoes the broader industry’s positive reaction to the proposed tax reforms.

Japan’s Broader Embrace of Web3 and Digital Assets

Interestingly, this tax reform isn’t happening in isolation. It’s part of a larger trend of Japan embracing digital innovation. Despite the recent turbulence in the crypto market, exemplified by the FTX collapse, Japan remains optimistic about the future of blockchain and Web3 technologies.

Consider these points:

- Prime Minister Kishida’s Vision: Back in October, Prime Minister Fumio Kishida himself highlighted the significant roles that NFTs, blockchain, and the Metaverse will play in Japan’s digital transformation. He even cited the digitization of national identity cards as a prime example of this digital push.

- Easing Token Listing: The Japan Virtual and Crypto Assets Exchange Association is also taking steps to make the crypto market more accessible. In October, they announced plans to relax the often-stringent screening process for listing new tokens on exchanges. This move came at the request of PM Kishida, who had urged the self-regulatory organization to streamline token listings back in June.

What Does This Mean for the Future of Crypto in Japan?

The relaxation of crypto tax rules in Japan is more than just a tax break; it’s a signal. It signals that Japan is serious about becoming a hub for crypto innovation and attracting blockchain businesses. By removing a major obstacle – the tax on unrealized gains – Japan is creating a more favorable environment for crypto companies to thrive.

Key Takeaways:

- Increased Competitiveness: Lower taxes can make Japan a more attractive location for crypto businesses compared to other countries with stricter tax regimes.

- Stimulating Growth: The tax relief is expected to encourage the growth of domestic crypto firms and attract foreign investment in the sector.

- Innovation Hub Potential: Combined with other pro-crypto initiatives, Japan is positioning itself as a potential leader in the Web3 space.

Looking Ahead: Japan’s Crypto Renaissance?

While the global crypto landscape remains dynamic and sometimes volatile, Japan’s proactive approach to regulation and taxation is noteworthy. By addressing the tax burden on crypto issuers, Japan is taking a significant step towards fostering a more vibrant and innovative digital economy. Will this lead to a crypto renaissance in Japan? Only time will tell, but the signs are certainly promising. Keep watching this space!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.