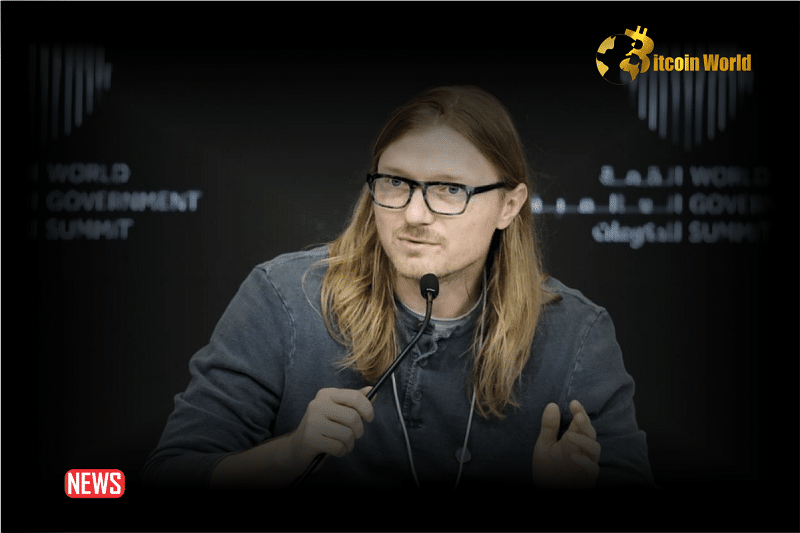

The cryptocurrency world is constantly evolving, often amidst a whirlwind of regulatory scrutiny and market fluctuations. Recently, the landscape shifted dramatically with the US Department of Justice’s landmark settlement with Binance. This event has sparked conversations across the industry, and one prominent voice offering his perspective is Jesse Powell, co-founder of the well-known crypto exchange, Kraken. Let’s dive into Powell’s thoughts on the current crypto environment and what the Binance deal might signify for the future of digital assets.

Kraken’s Jesse Powell: A Silver Lining in Regulatory Clouds?

While the crypto industry often feels like it’s navigating a complex maze of regulations, Jesse Powell suggests there might be a glimmer of hope. Following the hefty $4.3 billion settlement Binance reached with the US Department of Justice, Powell voiced his opinion that the crypto environment might actually be becoming fairer. This might sound surprising given the ongoing regulatory pressures, including Kraken’s own recent run-in with the U.S. Securities and Exchange Commission (SEC).

But what exactly makes Powell see a fairer landscape amidst these challenges? Let’s unpack his perspective.

Navigating the Regulatory Maze: Kraken’s Experience

It’s no secret that crypto platforms like Kraken have been under the regulatory microscope. In fact, Kraken itself faced a lawsuit from the SEC, adding to the industry’s perception of a tough regulatory climate. Powell is acutely aware of these hurdles and acknowledges the difficulties faced by platforms operating in the crypto space. He points out that platforms like Kraken, Coinbase, and Ripple often find themselves in the crosshairs of regulators like the SEC, especially within US jurisdiction. He even describes these platforms as “easy targets,” highlighting the perceived imbalance of power in these regulatory engagements.

See Also: City Of Lugano Integrates Polygon Into Its Crypto Payment System

Optimism Amidst the Storm: Why “Fairer” Now?

Despite the challenges and Kraken’s own regulatory battles, Powell expresses optimism about the fairness of the crypto space, particularly in light of the Binance settlement. This optimism likely stems from the idea that the Binance settlement, while significant, sets a precedent and potentially clarifies some regulatory boundaries. Perhaps Powell sees this as a sign that regulators are beginning to define their expectations more clearly, even if those expectations come with steep penalties.

Could the Binance settlement be a turning point, signaling a shift towards a more defined regulatory framework, even if it’s a costly one? Powell’s comments suggest he believes so. The massive fine against Binance might be seen as a strong enforcement action, but also as a form of closure, allowing the industry to potentially move forward with a clearer understanding of regulatory red lines.

Self-Regulation: A Key to Industry Maturity?

Powell also emphasizes the critical need for self-regulation within the crypto community. He highlights the persistent threats to the industry’s reputation and suggests that proactive self-regulation can play a crucial role in mitigating these threats. This could involve crypto platforms adopting stricter compliance measures, enhancing transparency, and working together to establish industry best practices. By taking responsibility for its own conduct, the crypto industry can potentially build trust with regulators and the public, fostering a more sustainable and positive environment for growth.

Here are some potential areas where self-regulation could be impactful:

- Enhanced KYC/AML Procedures: Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent illicit activities.

- Transparency and Reporting: Improving transparency in operations and providing clear, regular reports to users and stakeholders.

- Code of Conduct: Developing and adhering to a shared code of conduct that promotes ethical behavior and responsible innovation.

- User Education: Investing in user education to empower individuals to make informed decisions and protect themselves from scams and risks.

The Price of Regulatory Battles: A Stark Warning

Powell’s commentary isn’t just about optimism; it also carries a stark warning. Referring to the recent SEC lawsuit against Kraken and the $30 million settlement Kraken’s parent companies previously reached with the SEC, Powell expresses significant skepticism about the regulatory environment. His statement, “The message is clear: $30 million will buy you about 10 months before the SEC comes back to extort you,” is a blunt assessment of the ongoing pressure and potential for repeated regulatory actions.

He further elaborates on the immense financial burden of fighting the SEC in court. Powell cautions that a real legal battle with the SEC could easily escalate to costs exceeding $100 million. This is a staggering figure that puts into perspective the resources required to challenge regulatory actions. For many crypto companies, especially smaller startups, such costs are simply prohibitive.

“Get Out of the US Battlefield”: Powell’s Pragmatic Advice

Powell’s advice to crypto companies who cannot afford these expensive legal battles is direct and unequivocal: “If you can’t afford it, get your crypto company out of the US battlefield.” This is a pragmatic, albeit potentially controversial, piece of advice. It highlights the challenging regulatory landscape in the US and suggests that for some companies, focusing on jurisdictions with more favorable or clearer regulatory frameworks might be a more viable path forward.

This advice raises important questions for the crypto industry:

- Is the US becoming too hostile for crypto innovation? Powell’s statement suggests that the regulatory environment in the US might be stifling innovation and pushing companies to seek more welcoming jurisdictions.

- What are the implications of crypto companies leaving the US? If a significant number of crypto companies choose to relocate, it could impact the US’s position as a leader in technological innovation and the digital economy.

- Can the US regulatory approach evolve to be more supportive of responsible crypto innovation? Finding a balance between regulation and fostering innovation is crucial for the long-term health of the crypto industry and the broader economy.

Key Takeaways from Powell’s Perspective

Jesse Powell’s insights offer a valuable perspective on the evolving crypto regulatory landscape. Here are some key takeaways:

- Binance Settlement as a Potential Turning Point: The Binance settlement, despite its magnitude, could signal a move towards clearer regulatory boundaries and a potentially “fairer” environment.

- Ongoing Regulatory Scrutiny: Crypto platforms, particularly in the US, continue to face significant regulatory scrutiny and challenges from agencies like the SEC.

- Self-Regulation is Crucial: The crypto industry needs to prioritize self-regulation to build trust, enhance reputation, and foster a sustainable ecosystem.

- High Cost of Regulatory Battles: Legal battles with regulators like the SEC are incredibly expensive, potentially costing companies tens or even hundreds of millions of dollars.

- Pragmatic Approach to Jurisdiction: Crypto companies need to strategically consider their jurisdictional choices, especially if they cannot afford costly legal battles in challenging regulatory environments like the US.

Conclusion: Navigating the Future of Crypto Regulation

Jesse Powell’s comments provide a nuanced view of the current crypto regulatory landscape. While acknowledging the ongoing challenges and the significant hurdles faced by crypto platforms, he also suggests that the Binance settlement might represent a step towards a more defined and potentially fairer regulatory environment. However, his stark warnings about the costs of regulatory battles and the need for jurisdictional pragmatism cannot be ignored. As the crypto industry matures, navigating the complexities of regulation will remain a critical factor in its continued growth and evolution. The path forward will likely require a combination of proactive self-regulation, constructive dialogue with regulators, and strategic decision-making by crypto companies to ensure a sustainable and innovative future for digital assets.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.