Hold onto your hats, crypto enthusiasts! It’s been a rollercoaster 24 hours in the digital currency world, and unfortunately, many of our beloved meme coins are feeling the brunt of it. Just when you thought things were looking up, the market took a nosedive, and meme coins, known for their wild swings, are experiencing significant turbulence. Leading meme tokens like Shiba Inu (SHIB), Dogecoin (DOGE), and PEPE have all taken a tumble as a broader crypto market downturn intensifies. Let’s dive into what’s happening and see if there’s any light at the end of this crypto tunnel.

Meme Coins in a Bloodbath: How Deep is the Dip?

It’s no secret that meme coins are often more volatile than established cryptocurrencies. When the market sneezes, meme coins sometimes catch a cold – or in this case, maybe the flu! Over the past day, the entire meme coin category has collectively dropped by around 7%. While that might seem like a small percentage in the grand scheme of things, in the fast-paced world of crypto, it translates to significant losses for many investors. And as you might expect, some meme coins are feeling the pain more acutely than others.

Let’s take a closer look at how some of the big names in the meme coin universe are performing:

- Dogecoin (DOGE): Down 4.7%

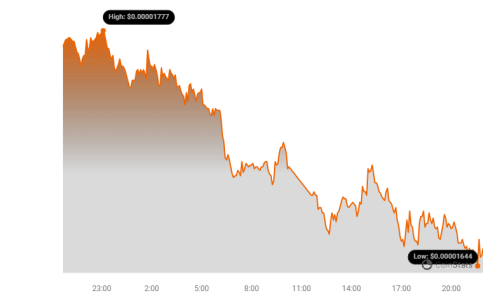

- Shiba Inu (SHIB): Down 6.4%

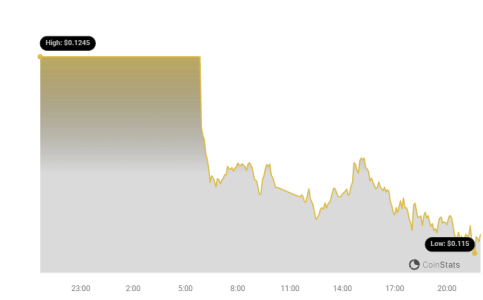

- Pepe (PEPE): Down 5.8%

- FLOKI: Down 4.2%

- BRETT: Down a hefty 9.1%

- BONK: Holding up relatively well, down 2.8%

- BOME: Down 6.1%

As you can see, it’s a sea of red across the board for the major meme coin players. And it gets even more dramatic when we look at smaller, more obscure meme coins. Hold your breath – RYU has plummeted by a staggering 79% in the last 24 hours! MUMU and ANDY aren’t far behind, each losing around 25% of their value. This highlights the incredibly high-risk nature of investing in less established meme coins. The potential for massive gains is there, but so is the potential for equally massive losses.

Is There a Meme Coin Miracle? BODEN Bucking the Trend

Amidst all the doom and gloom, there’s a glimmer of hope, a tiny green shoot in this red market landscape. Enter BODEN, a meme coin that’s been trending and, surprisingly, has defied the overall market downturn. While most meme coins were sinking, BODEN actually increased by about 10.6% in the past 24 hours. Is this a sign of resilience? Or just a temporary anomaly? It’s hard to say for sure, but it certainly stands out as an outlier in the current market.

Why the Crypto Bloodbath? Blame it on Mt. Gox?

So, what’s behind this widespread crypto market decline that’s dragging meme coins down with it? One major factor seems to be related to Mt. Gox, a name that sends shivers down the spines of long-term crypto veterans. For those unfamiliar, Mt. Gox was a major cryptocurrency exchange that collapsed years ago. Now, the trustee managing the exchange’s bankruptcy has announced that they are preparing to start repaying creditors as early as July.

Why is this causing a market crash? Well, Mt. Gox holds a significant amount of Bitcoin. The fear is that when these repayments begin, creditors, many of whom have been waiting for years, might sell their newly received Bitcoin, flooding the market with supply and driving prices down. This potential influx of Bitcoin hitting the market has understandably spooked investors, leading to a widespread sell-off across the crypto spectrum, including our beloved meme coins.

Bitcoin itself has dipped below $61,000 for the first time since May 13th, a significant psychological level. And when Bitcoin sneezes, the whole market catches a cold, remember? The market heatmaps are awash in red, indicating a broad-based decline.

Liquidation Cascade: $315 Million Wiped Out

This market downturn isn’t just about price drops; it’s also causing significant pain for leveraged traders. In the past 24 hours, a staggering $315 million worth of leveraged positions have been liquidated. Bitcoin positions account for the lion’s share of this, with around $130 million liquidated, followed by Ethereum at $72 million. Liquidation events like these can exacerbate market downturns, creating a negative feedback loop as forced selling puts further downward pressure on prices.

Ethereum (ETH) is currently trading below $3,300, and analysts are watching the $3,000 level as the next key support. For Bitcoin, the crucial support level to watch is $60,000. This is not only a technical support level but also a significant psychological barrier. If bears manage to push Bitcoin below $60,000, the next level of support to watch is around $58,000. Breaking these levels could signal further downside in the short term.

What Does This Mean for Meme Coin Investors?

For meme coin holders, this market downturn is a stark reminder of the inherent risks involved in these highly speculative assets. Meme coins can offer explosive gains, but they are also prone to dramatic crashes. The current situation underscores the importance of:

- Diversification: Don’t put all your eggs in one basket, especially not a basket of meme coins! Diversify your crypto portfolio and your overall investment portfolio.

- Risk Management: Understand your risk tolerance and invest accordingly. Meme coins should generally be a small portion of your portfolio, if at all, given their volatility.

- Staying Informed: Keep up-to-date with market news and developments. Understanding the factors driving market movements, like the Mt. Gox situation, can help you make more informed decisions.

- Long-Term Perspective: If you believe in the long-term potential of crypto, try to avoid panic selling during short-term downturns. However, always re-evaluate your investment thesis if market conditions fundamentally change.

The Bottom Line: Crypto Winters Can Be Chilly

The current meme coin crash and broader crypto market downturn serve as a valuable lesson in the volatile nature of digital assets. While meme coins can be fun and potentially profitable, they are not for the faint of heart. Market corrections are a normal part of the crypto cycle, and while they can be painful in the short term, they can also present opportunities for those with a long-term view and a strong stomach. Whether this is just a temporary dip or the start of a deeper bear market remains to be seen. One thing is certain: the crypto market continues to keep us on our toes!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.