Is Binance feeling the heat? Recent reports of regulatory scrutiny and leadership changes have cast a shadow over the crypto giant. Adding fuel to the fire, data reveals a significant surge in Tether (USDT) withdrawals from Binance, hitting a staggering $100 million. This outflow, the largest in over three months, has understandably stirred up questions and concerns within the crypto community. But is this a sign of deeper trouble, or just routine market activity amidst the noise? Let’s dive into the details.

Why the $100 Million USDT Outflow from Binance?

The crypto world is no stranger to volatility and speculation, often fueled by events surrounding major exchanges like Binance [BNB]. In recent times, Binance has been navigating a wave of FUD (Fear, Uncertainty, and Doubt) due to:

- Reports of substantial fines and regulatory pressures.

- The high-profile stepping down of Changpeng Zhao (CZ) as CEO.

Against this backdrop, the reported $100 million USDT withdrawal understandably raises eyebrows. To put it in perspective:

- This $100 million outflow is the highest in over three months.

- Previous significant withdrawals were notably smaller, staying under $50 million.

While large withdrawals can sometimes be normal in the fast-paced crypto market, the scale and timing of this outflow, coupled with the existing FUD, make it a point of interest. Is it just market jitters, or is something more significant happening behind the scenes?

See Also: BNB Dips 15% As Binance CEO CZ Steps Down

BNB Price Check: How is Binance Coin Holding Up?

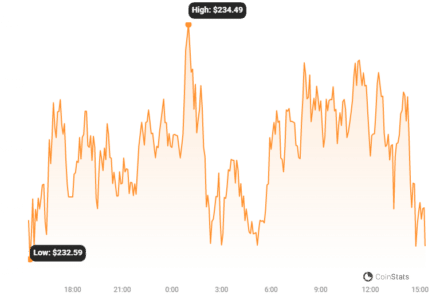

Binance Coin (BNB), the native token of the Binance ecosystem, has undoubtedly felt the impact of the recent turbulence. Following the news and uncertainty, BNB experienced a price dip of over 10%. The challenge now is its struggle to reclaim the $250 price level.

As of the latest update, BNB is trading around $233. While there’s a slight positive movement of less than 1%, the overall trend needs closer examination. Looking at the Relative Strength Index (RSI), a key momentum indicator, we see:

- The RSI line is positioned below the neutral line.

- This confirms a bearish trend for BNB, suggesting continued selling pressure.

However, there’s a silver lining. After the price drop, BNB’s trade volume saw a significant surge, exceeding $2 billion according to Santiment data. While the volume has since settled to around $644 million at the time of writing, the initial spike indicates strong trading activity and potential stabilization after the initial shock.

See Also: Fake Elon Musk YouTube Streams Lead To $165k Crypto Scam

Binance’s Trading Volume: Still the King of Exchanges?

Despite the USDT withdrawals and FUD, let’s look at the bigger picture: Binance’s overall trading volume. A review of trading activity across all crypto exchanges in the last 24 hours reveals a compelling story.

Binance continues to dominate the market in terms of daily trading volume. Data from CoinMarketCap shows:

- Binance recorded over $11.7 billion in trading volume in the last 24 hours.

- Coinbase, the exchange with the second-highest volume, registered just over $2 billion.

This massive difference highlights Binance’s sustained market leadership. Even with the headwinds, traders are still actively using the platform.

BSC TVL: A Sign of Underlying Ecosystem Health?

Another important metric to consider is the Total Value Locked (TVL) on the Binance Smart Chain (BSC). TVL represents the total value of assets locked within decentralized finance (DeFi) protocols on a blockchain. A stable TVL can indicate the health and resilience of the underlying ecosystem.

Analyzing BSC’s TVL, we observe:

- No significant changes to BSC’s TVL have been observed recently.

- As of now, the TVL remains around $3 billion.

- There’s even a slight upward trend in TVL.

This stability in TVL suggests that despite price fluctuations and exchange volume shifts, the core DeFi activity on BSC remains robust. Users continue to trust and utilize the BSC network.

Key Takeaways: Navigating the Binance Narrative

The recent $100 million USDT withdrawal from Binance is undoubtedly a noteworthy event, especially in the context of ongoing FUD and leadership transitions. It’s a reminder of the ever-present uncertainties in the crypto market. However, looking beyond this single data point, a more nuanced picture emerges.

While the USDT outflow and BNB’s price struggles are valid concerns, Binance’s continued dominance in trading volume and the stability of BSC’s TVL paint a picture of resilience. The exchange remains a central hub in the crypto world, and its ecosystem continues to function.

Key Points to Consider:

- USDT Outflow: A significant $100M withdrawal, highest in 3 months, warrants attention but needs to be seen in context.

- BNB Price Volatility: BNB has faced price pressure, but trading volume indicates market engagement.

- Market Dominance: Binance still leads by a wide margin in daily trading volume, showcasing its market position.

- BSC TVL Stability: BSC’s TVL remains stable, suggesting underlying ecosystem strength.

Ultimately, the situation surrounding Binance is complex and evolving. While the USDT outflow and FUD are factors to monitor, the exchange’s overall performance indicators suggest it’s navigating the challenges and maintaining its significant role in the crypto landscape. As always, staying informed and considering multiple data points is crucial for understanding the dynamics of the crypto market.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.