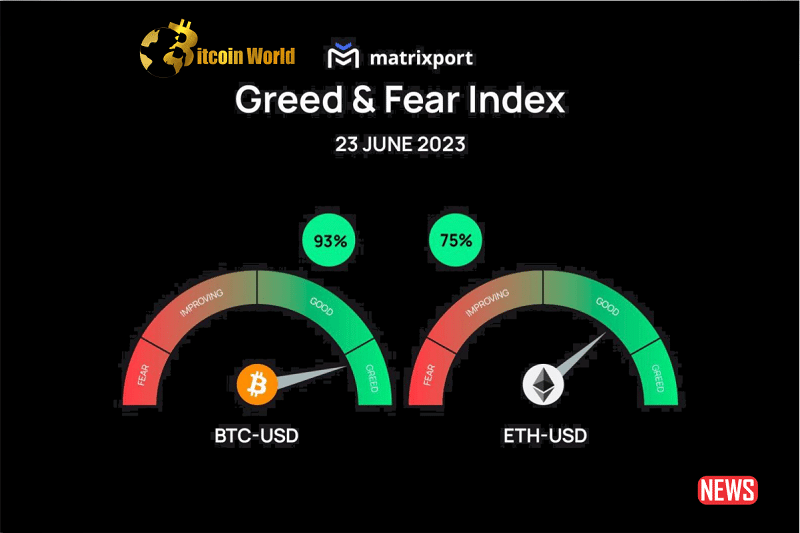

Ever feel like the cryptocurrency market is driven by emotions? You’re not wrong! Savvy crypto traders know that understanding market sentiment is key to spotting potential price swings. Enter Matrixport’s Bitcoin Greed and Fear Index – a tool with a knack for calling those crucial turning points. And guess what? It’s hinting at some exciting news for Bitcoin ($BTC) enthusiasts!

Decoding the Crypto Mood Ring: What’s the Greed and Fear Index?

Think of Matrixport’s Greed and Fear Index as a thermometer for the crypto market’s emotional state. It crunches the numbers and spits out a score that tells us whether investors are feeling greedy or fearful. Here’s the lowdown:

- High Score (Above 90%): Party time! This usually means everyone’s super optimistic, bordering on overconfident. Historically, this can signal a market top.

- Low Score (Below 10%): Panic stations! Extreme fear grips the market, and investors might be selling off. This often indicates a market bottom.

- The Sweet Spot (In Between): A more balanced market sentiment.

Why is this important? Because these emotional swings often precede price changes. Knowing where the market stands emotionally can give you a valuable edge.

The Latest Buzz: Sentiment Shift Suggests a Bitcoin Bounce

Here’s where it gets interesting. The Greed and Fear Index recently took us on a bit of a rollercoaster. It zoomed past 90%, indicating peak greed, then cooled down to a fearful 30%. But hold on – the latest update shows a rebound to 60%! This significant shift suggests that the downward trend we saw in July might be losing steam. Could this be the start of something new?

Markus Thielen, the sharp mind leading research and strategy at Matrixport, certainly thinks so. He pointed out that the index seems to have found its footing, with the daily signal flashing a bullish sign. After a period of consolidation, this indicator is suggesting that Bitcoin might just be gearing up for another run.

History Repeats? The Index’s Track Record

What makes this index so reliable? It has a pretty good track record of aligning with Bitcoin’s price reversals. Think of it like this:

- Index Peaks: Often coincide with Bitcoin price peaks.

- Index Bottoms: Often precede Bitcoin price surges.

Adding another layer to this analysis, the 21-day Simple Moving Average (SMA) of the index is also showing signs of bottoming out. This historical correlation further strengthens the argument for a potential Bitcoin price increase.

Bitcoin’s Holding Pattern: Calm Before the Storm?

Bitcoin has been playing it cool lately, mostly hovering between $28,000 and $30,000 for a couple of weeks. This period of stability comes amidst broader market uncertainty and anticipation of potential Federal Reserve rate cuts down the line.

The SEC’s Decision: A Potential Catalyst

One major factor that could shake things up is the Securities and Exchange Commission’s (SEC) decision on Ark Invest’s spot Bitcoin ETF application. The official date is August 13th, a Sunday, leading many to believe the announcement could drop on the preceding Friday. This decision is a closely watched event and could inject significant volatility into the market.

Key Takeaways: What Does This Mean for You?

- Sentiment Matters: The Greed and Fear Index is a valuable tool for understanding the emotional currents driving Bitcoin’s price.

- Potential Bullish Signal: The recent rebound in the index suggests a possible end to the recent downtrend and the potential for upward movement.

- Historical Accuracy: The index has a history of correctly identifying trend reversals.

- Watch the SEC: The upcoming decision on the Bitcoin ETF could be a significant market mover.

What’s Next? Staying Informed and Ready

The cryptocurrency market is never dull, and understanding indicators like Matrixport’s Greed and Fear Index can help you navigate its twists and turns. While no indicator is foolproof, this index provides valuable insights into market psychology and potential future price action. Keep an eye on the market, stay informed about regulatory developments, and be prepared for potential shifts as Bitcoin’s story continues to unfold.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.