Ever imagined a traditional company making waves by diving headfirst into Bitcoin? That’s exactly what Metaplanet, a Japanese public firm, is doing! And guess what? The market is loving it.

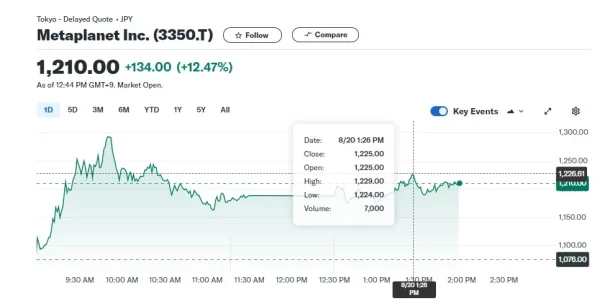

Metaplanet Shares Soar After Bitcoin Acquisition

Shares of Metaplanet jumped 14% after announcing the completion of its ¥1 billion Bitcoin (BTC) acquisition. This move solidifies Metaplanet’s position as a forward-thinking company embracing digital assets.

According to a statement shared by CEO Simon Gerovich, the firm purchased 57.273 BTC, valued at ¥500 million (approximately $3.4 million) on August 20. This latest purchase brings Metaplanet’s total holdings to an impressive 360.368 BTC.

According to Simon Gerovich’s X account:

https://twitter.com/gerovich/status/1825688778414891228

Why is Metaplanet Betting Big on Bitcoin?

This acquisition is part of Metaplanet’s broader strategy to build its BTC reserves, leveraging a ¥1 billion loan from MMXX Ventures. But why Bitcoin? Here’s the lowdown:

- Economic Challenges in Japan: High government debt and prolonged negative real interest rates have pushed Metaplanet to seek alternative treasury reserve assets.

- Bitcoin as a Solution: Metaplanet views Bitcoin as a hedge against these economic challenges, recognizing its potential for long-term value appreciation.

- Strategic Diversification: Originally focused on hotel development, Metaplanet is diversifying into Bitcoin adoption consulting, real estate, and investments.

The company explicitly stated, “As disclosed in our announcement dated August 8, 2024, regarding the loan and purchase of Bitcoins worth 1 billion yen, we hereby announce that we have purchased additional 500 million yen worth of Bitcoins as below. With this purchase, we have completed the purchase of 1 billion yen worth of Bitcoins.”

From Zombie Company to Bitcoin Believer

Metaplanet’s pivot to Bitcoin seems to be paying dividends. CEO Simon Gerovich mentioned at the Bitcoin Conference in Nashville that the company was showing signs of becoming a zombie company before embracing Bitcoin. Now, the outlook is completely transformed.

Gerovich emphasized that they “realized that Bitcoin is the apex monetary asset” and would be a “great” addition to Metaplanet’s treasury.

Key Takeaways for Investors

- Embrace Innovation: Metaplanet’s story highlights the importance of exploring innovative financial strategies in response to changing economic landscapes.

- Consider Bitcoin: For companies facing economic headwinds, Bitcoin could offer a viable alternative for treasury reserves.

- Diversification is Key: Metaplanet’s diversification into Bitcoin-related consulting and investments showcases a holistic approach to embracing digital assets.

In Conclusion: A Bold Move with Promising Results

Metaplanet’s bold move to adopt Bitcoin as a primary treasury reserve asset is turning heads and delivering impressive results. With shares surging and a clear vision for the future, Metaplanet is proving that sometimes, the most unconventional strategies can lead to the greatest success. Keep an eye on this Japanese firm as it continues to navigate the world of digital assets and redefine corporate finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.