Buckle up, crypto enthusiasts! It’s been a rollercoaster ride in the digital asset world, and Bitcoin (BTC) is feeling the brunt. The recent collapse of the cryptocurrency exchange FTX has sent shockwaves through the market, resulting in significant selling pressure on Bitcoin and other cryptocurrencies. In fact, this November is shaping up to be Bitcoin’s worst November yet, with the price plummeting by over 21%. But who’s feeling the heat the most? You guessed it – Bitcoin miners.

Why Are Bitcoin Miners Feeling the Squeeze?

When the price of Bitcoin takes a nosedive, it directly impacts the profitability of mining. Think of it this way: miners invest in expensive equipment and electricity to solve complex mathematical problems and validate transactions on the blockchain, earning Bitcoin as a reward. When the price of Bitcoin drops below their operational costs, it becomes unsustainable. This leads to what’s known as miner capitulation.

Miner Capitulation: What Does It Mean?

Miner capitulation essentially means that some miners are forced to throw in the towel. It’s a tough situation where they can no longer profitably mine Bitcoin at the current price. As a result, they’re compelled to sell their existing Bitcoin holdings to cover costs and, in some cases, even shut down their operations. On-chain data confirms that Bitcoin miner capitulation has officially begun, signaling potential further downward pressure on the price of BTC.

The Hashrate Connection: What’s Happening There?

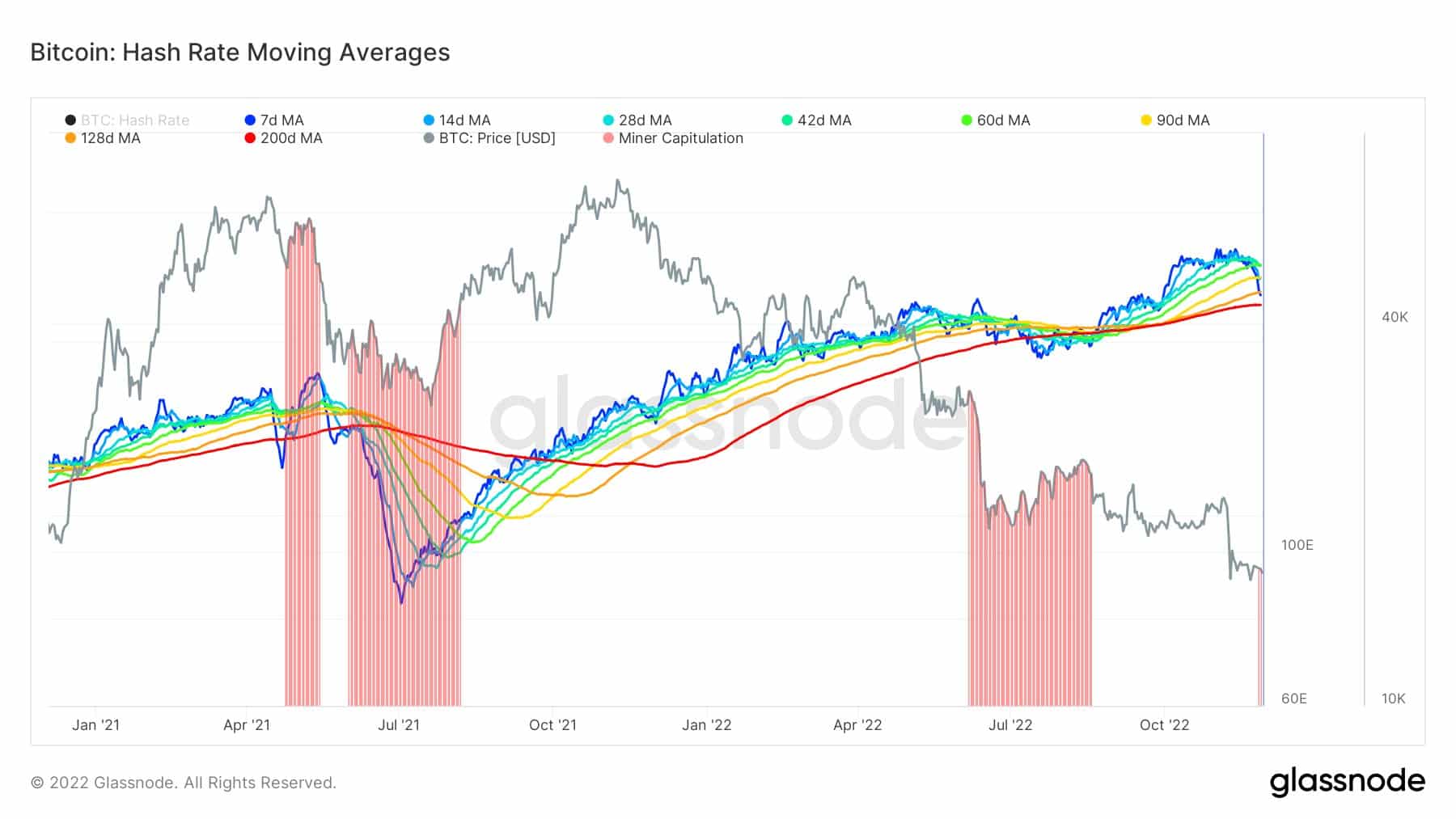

The Bitcoin hashrate, which measures the total computational power being used to mine new Bitcoins, provides another crucial insight into the miners’ situation. While it hit all-time highs recently, the hashrate has started to show signs of fluctuation. Currently, it’s about 13.7% below its all-time high on a 7-day moving average.

Why is a Fluctuating Hashrate Important?

A declining hashrate can indicate that miners are turning off their machines because they’re no longer profitable. This leads to the next point: mining difficulty adjustment.

Difficulty Adjustment: A Sign of the Times

In approximately a week, the Bitcoin mining difficulty is projected to decrease by around 9%. This automatic adjustment is a built-in mechanism of the Bitcoin protocol to maintain a consistent block generation time. When miners leave the network, the difficulty automatically decreases to make it easier for the remaining miners to find new blocks. This significant upcoming adjustment is a clear indication of the ongoing miner capitulation.

Courtesy: Glassnode[/caption>

Courtesy: Glassnode[/caption>

The chart above visually represents the recent trend in Bitcoin’s hashrate. You can see the slight dip, reinforcing the narrative of miners facing challenges.

Selling Pressure Intensifies: Miners Offloading Holdings

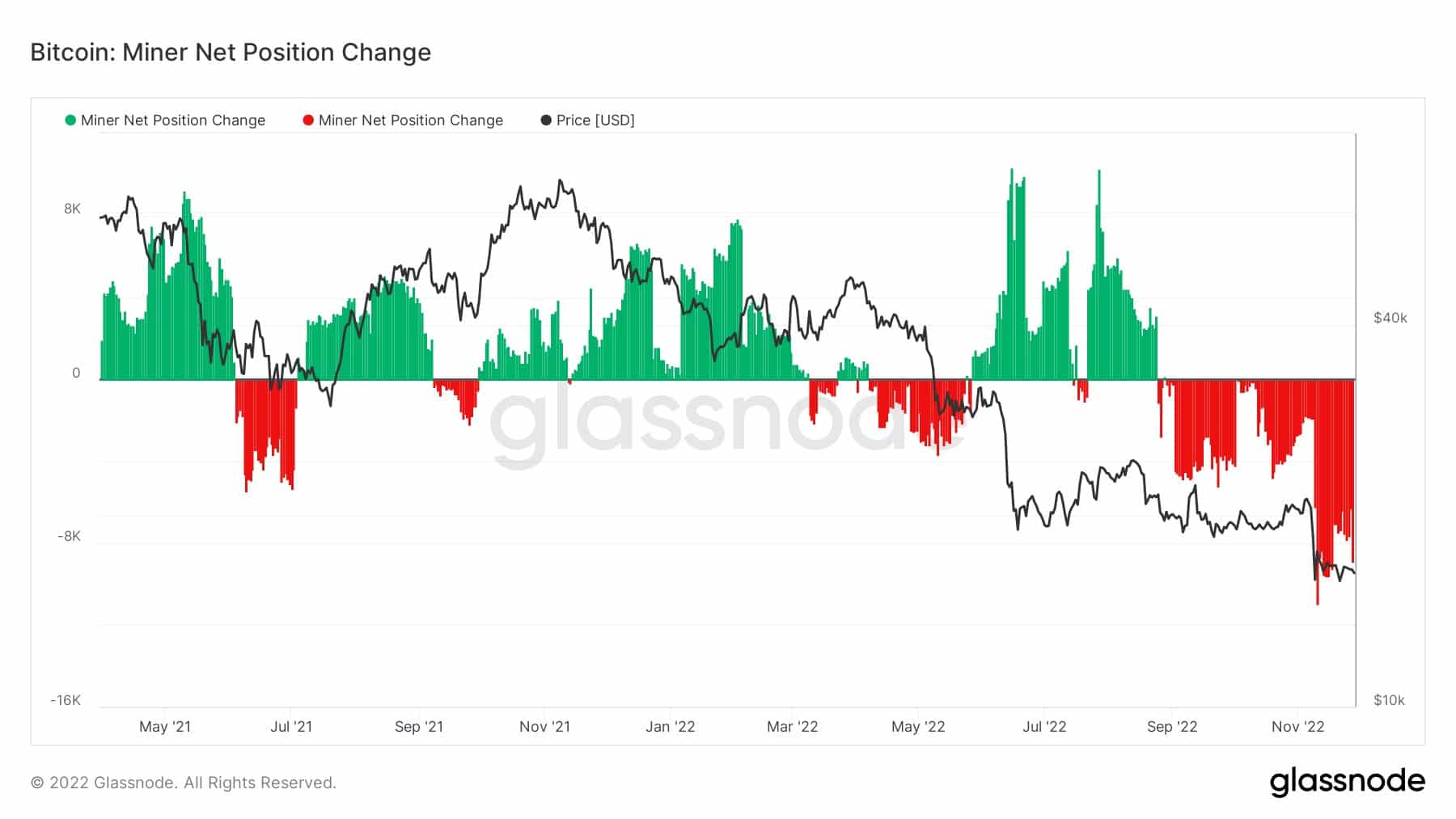

Adding to the market woes, Bitcoin miners have been actively selling their Bitcoin holdings over the past month. This selling pressure, combined with the broader market panic following the FTX collapse, is further contributing to the downward spiral of the BTC price.

Courtesy: Glassnode[/caption>

Courtesy: Glassnode[/caption>

The graphic above clearly illustrates the net position change of Bitcoin miners, highlighting the significant selling activity in recent weeks.

When Will the Dust Settle? Insights from Crypto Analysts

Predicting the bottom of a market downturn is notoriously difficult, but seasoned analysts are offering their perspectives. IncomeSharks, a respected voice in the crypto space, suggests that it could take another three to six months for Bitcoin to reach its bottom.

$BTC Bottoms usually come 3-6 months after miner capitulation starts. pic.twitter.com/yG1Di8x8k9

— IncomeSharks 🦈 (@IncomeSharks) November 29, 2022

This timeline aligns with historical patterns observed during previous bear markets, where miner capitulation often precedes the final price bottom.

Key Takeaways and What to Watch For

- FTX Collapse Impact: The failure of FTX has triggered significant selling pressure across the crypto market, impacting Bitcoin severely.

- Miner Capitulation is Here: On-chain data confirms that Bitcoin miners are capitulating, selling their holdings due to reduced profitability.

- Hashrate Fluctuation: The Bitcoin hashrate is showing signs of decline, indicating miners are turning off their machines.

- Difficulty Adjustment: The upcoming significant decrease in mining difficulty further confirms the ongoing miner capitulation.

- Potential for Further Downside: Miner selling pressure contributes to the overall bearish sentiment and could lead to further price drops.

- Patience Required: Historical data and analyst insights suggest the bottom might still be months away.

In Conclusion: Navigating the Bitcoin Storm

The current situation in the Bitcoin market is undoubtedly challenging, particularly for miners. The confluence of the FTX collapse and the resulting price drop has created a perfect storm, forcing miners into a state of capitulation. While this situation signals potential further downside in the short term, it’s crucial to remember the cyclical nature of the crypto market. Keep a close eye on the hashrate and difficulty adjustments as potential indicators of market stabilization. While the road ahead may be bumpy, understanding the dynamics of miner capitulation provides valuable insight into the current market conditions and potential future movements. Stay informed, stay vigilant, and navigate these turbulent waters with caution.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.