Cryptocurrency markets are known for their rollercoaster rides, and Ethereum Classic (ETC) is no exception. After enjoying a significant surge over the past week, ETC is currently experiencing a slight pullback. Let’s dive into the latest price movements and market indicators to understand what’s happening with Ethereum Classic.

Ethereum Classic (ETC) Price Today: A Snapshot

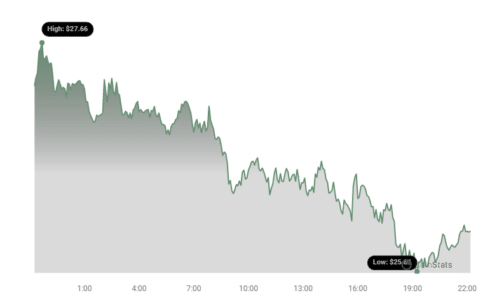

As of today, Ethereum Classic (ETC) is trading at $25.89. Over the last 24 hours, the price has seen a decrease of 3.08%. While this might sound concerning at first glance, it’s crucial to zoom out and look at the bigger picture.

Weekly Gains vs. Daily Dip: What’s the Trend?

Interestingly, this daily dip comes after a robust week for Ethereum Classic. Over the past seven days, ETC has actually gained 21.0%, climbing from $21.47 to its current price. This significant weekly increase puts the current daily decrease into perspective. It appears to be a minor correction within a larger upward trend.

To visualize this, consider the following:

- Last 24 Hours: ETC price decreased by 3.08%.

- Past Week: ETC price increased by 21.0%.

Volatility Check: Are Things Getting Shaky?

Volatility is a key characteristic of the crypto market. To understand ETC’s price fluctuations better, let’s look at volatility indicators. The chart below utilizes Bollinger Bands, a popular tool to measure price volatility over time. Wider bands indicate higher volatility, while narrower bands suggest lower volatility.

The chart compares the 24-hour (left) and 7-day (right) price movement and volatility of Ethereum Classic. By observing the gray Bollinger Bands, we can gauge the degree of price fluctuation in both timeframes.

See Also: Price Analysis: Stacks (STX) Decreases More Than 3% Within 24 Hours

Trading Volume and Circulating Supply: What Do They Tell Us?

Beyond price and volatility, trading volume and circulating supply are important indicators of a cryptocurrency’s market health. Let’s examine ETC’s recent data:

- Trading Volume: Decreased by 35.0% over the past week. A decrease in trading volume could suggest reduced market interest or consolidation after the recent price surge.

- Circulating Supply: Increased by 0.26% over the past week. This minor increase in circulating supply brings the total to 143.20 million ETC.

Currently, the circulating supply of 143.20 million ETC represents approximately 67.96% of its maximum supply of 210.70 million ETC.

Ethereum Classic Market Cap and Ranking

According to the latest data, Ethereum Classic holds the #25 position in market cap ranking, with a market capitalization of $3.70 billion. Market cap is a crucial metric as it reflects the total value of a cryptocurrency and its relative size in the market.

Key Takeaways and Considerations

In summary, while Ethereum Classic has experienced a slight price decrease in the last 24 hours, it’s important to remember the significant gains it has made over the past week. Here’s a quick recap:

- Short-Term Correction: The 3.08% daily drop appears to be a short-term correction after a strong weekly uptrend.

- Positive Weekly Performance: A 21% gain in the past week indicates underlying positive momentum.

- Decreased Trading Volume: The 35% decrease in trading volume could signal a period of consolidation.

- Circulating Supply Increase: A minor 0.26% increase in circulating supply is unlikely to be a major market mover.

- Market Position: ETC remains a significant cryptocurrency, ranked #25 by market cap.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial or trading advice. Cryptocurrency investments are inherently risky. Bitcoinworld.co.in is not responsible for any investment decisions made based on this information. We strongly advise conducting thorough independent research and seeking advice from a qualified financial advisor before investing in cryptocurrencies.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.