Hold onto your hats, crypto enthusiasts! Dogecoin (DOGE), the meme-turned-crypto sensation, is showing signs of life. After a week of slight dips, DOGE’s price has unexpectedly pumped, climbing 4.45% in the last 24 hours to reach $0.08. Is this just a blip, or could we be seeing the start of a more significant uptrend for our favorite Shiba Inu coin?

DOGE Price Action: A Closer Look at the Recent Rise

Let’s dive into the numbers. While the past week saw Dogecoin experience a minor 1.0% decrease, slipping from $0.08 to its current level, the last day has painted a different picture entirely. This recent surge offers a glimmer of hope for DOGE holders and sparks the question: what’s behind this sudden positive movement?

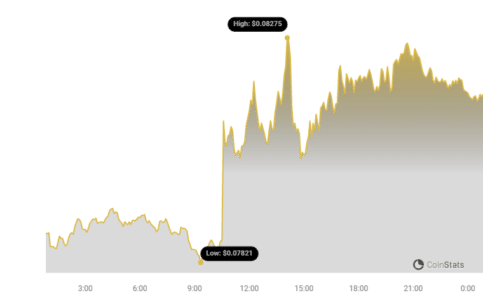

As the chart above illustrates, Dogecoin is currently navigating the volatile crypto seas. It’s important to remember that DOGE, like many cryptocurrencies, is known for its price swings. And while $0.08 might seem modest compared to its all-time high of $0.73, any upward movement is worth noting, especially in the fast-paced world of crypto.

Volatility Check: How Bumpy is the DOGE Ride Right Now?

To understand the bigger picture, we need to look at volatility. Volatility measures how much the price of an asset fluctuates over time. High volatility means prices can change dramatically in short periods, while low volatility suggests more stable price movement.

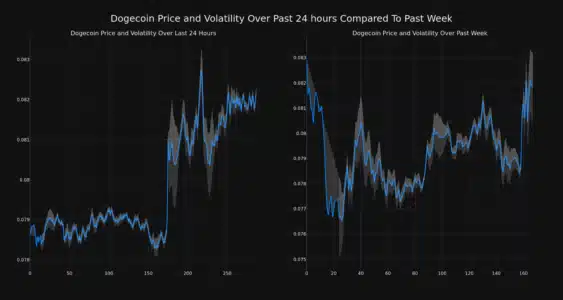

The chart below helps visualize Dogecoin’s volatility over the past 24 hours compared to the last week. Notice those gray bands? Those are Bollinger Bands, a handy tool to gauge volatility.

Understanding Bollinger Bands:

- Wider Bands = Higher Volatility: When the gray bands widen, it indicates increased price fluctuations. Expect more dramatic ups and downs.

- Narrower Bands = Lower Volatility: Narrow bands suggest price stability, with less dramatic price swings.

Currently, by observing the Bollinger Bands, you can assess whether DOGE is experiencing higher or lower than usual volatility in both the short-term (24 hours) and medium-term (weekly) timeframes.

Trading Volume and Circulating Supply: What Do They Tell Us?

Beyond price and volatility, two other key metrics provide valuable insights into Dogecoin’s market dynamics:

- Trading Volume: This is the total amount of DOGE that has been traded within a specific period. A decrease in trading volume, like the 19.0% drop over the past week for DOGE, can sometimes suggest waning interest or consolidation in the market.

- Circulating Supply: This refers to the total number of DOGE coins currently in circulation and available to be traded. An increase in circulating supply, such as the recent 0.36% increase to over 142.86 billion DOGE, can potentially dilute the value of each individual coin if demand doesn’t keep pace.

The chart above visually represents these two important factors. Analyzing the interplay between price, trading volume, and circulating supply can offer a more comprehensive understanding of Dogecoin’s market behavior.

DOGE’s Market Standing: Holding Strong in the Top Ranks

Despite the crypto market’s ups and downs, Dogecoin continues to maintain a significant position. Currently, DOGE holds the #11 spot in market capitalization ranking, boasting a market cap of $11.68 billion. Market capitalization, or market cap, is essentially the total value of a cryptocurrency. It’s calculated by multiplying the current price of the coin by its circulating supply.

Market Cap = Current Price x Circulating Supply

A high market cap generally indicates a more established and potentially less volatile cryptocurrency compared to those with lower market caps. Dogecoin’s consistent presence in the top ranks highlights its enduring popularity and the significant capital invested in it.

What’s Next for Dogecoin? Riding the Crypto Wave

Predicting the future of any cryptocurrency, especially one as meme-driven as Dogecoin, is no easy task. However, understanding the current price movements, volatility, trading volume, and market cap provides valuable context.

Key Takeaways for DOGE Watchers:

- Recent Price Surge: The 4.45% increase in the last 24 hours is a positive signal, but needs to be viewed in the context of the longer-term trend.

- Volatility Remains: Dogecoin is still subject to price swings, as indicated by the Bollinger Bands.

- Trading Volume Dip: The decrease in trading volume could be a point of concern or simply a period of consolidation before the next move.

- Strong Market Cap: DOGE’s top 11 market cap ranking demonstrates its established position in the crypto space.

Ultimately, the cryptocurrency market is dynamic and influenced by numerous factors, including broader market trends, technological developments, community sentiment, and even social media buzz. Keeping a close eye on these elements, alongside fundamental metrics, will be crucial for anyone interested in navigating the Dogecoin journey.

In Conclusion: Dogecoin’s recent price uptick offers an interesting development in its ongoing crypto saga. Whether this is the start of a sustained rally or a temporary bounce remains to be seen. Stay informed, do your own research, and remember to approach crypto investments with caution and awareness of the inherent risks.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.