Hey crypto enthusiasts! The market is always buzzing with activity, and today, all eyes are on Toncoin (TON). If you’ve been tracking TON, you’ll know it’s been making waves, and the last 24 hours have been particularly exciting. Let’s dive into the latest price movements and understand what’s fueling this surge.

Toncoin (TON) Price Rockets: A Quick Look at the Numbers

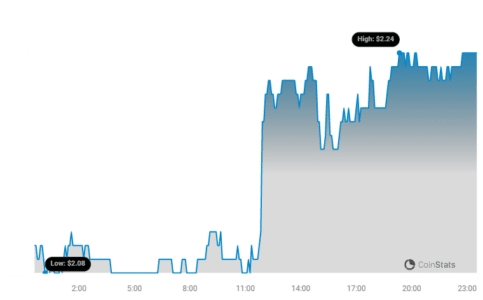

Hold on to your hats, because Toncoin (TON) has just experienced a significant upward swing! In the past 24 hours alone, the Toncoin price has jumped by a solid 5.34%, pushing its value to $2.23. That’s a notable increase, and it’s definitely got the crypto community talking.

But the good news doesn’t stop there. Zooming out a bit, we can see that this isn’t just a one-day wonder. Over the last week, Toncoin has been on a steady climb, racking up gains of over 8.0%. It’s moved from around $2.06 to its current price, indicating a strong positive trend.

See Also: Bitcoin Hits $50,000 For The First Time Since 2021

While TON is currently trading at these exciting levels, it’s worth remembering its all-time high of $5.29. This gives us a perspective on its potential and how far it has come, and perhaps how much further it could go.

Decoding the Charts: Price Movement and Volatility

Charts are our best friends when it comes to understanding crypto price action. Let’s break down what the charts tell us about Toncoin’s recent performance.

The following chart provides a visual comparison of Toncoin’s price movement and volatility over two key periods:

- Past 24 Hours (Left Chart): This shows the immediate price fluctuations and volatility within the day.

- Past Week (Right Chart): This gives a broader perspective on the weekly price trend and overall volatility.

Understanding Bollinger Bands: Your Volatility Indicator

Notice those gray bands on the charts? Those are Bollinger Bands, a popular tool for measuring volatility. Here’s what you need to know:

- Width = Volatility: The wider the bands, the higher the volatility. A large gray area indicates significant price swings during that period.

- Narrow Bands = Lower Volatility: Conversely, narrower bands suggest less price fluctuation.

By looking at the Bollinger Bands, you can quickly gauge how stable or volatile Toncoin’s price has been recently, both in the short term (daily) and over the past week.

Trading Volume and Circulating Supply: What’s the Buzz?

Price movement is only part of the story. Let’s look at other crucial indicators:

- Trading Volume Surge: Here’s a big number – Toncoin’s trading volume has skyrocketed by a massive 299.0% over the past week! This huge jump indicates a significant increase in buying and selling activity, suggesting growing interest in TON.

- Circulating Supply Increase: Alongside the trading volume, the circulating supply of TON has also slightly increased by 0.04%. While seemingly small, any change in circulating supply can influence price dynamics.

Currently, the circulating supply of Toncoin stands at 3.46 billion. And in terms of market capitalization, Toncoin is holding strong at #17, with a market cap of $7.72 billion. This ranking reflects its significant position in the overall cryptocurrency market.

Key Takeaways and What Could Be Driving the Price?

So, what can we conclude from all this data?

- Positive Price Momentum: Toncoin is clearly experiencing positive price momentum in both the short and medium term.

- Increased Interest: The massive surge in trading volume points to growing interest and activity around Toncoin.

- Volatility in Check: While there’s price movement, the Bollinger Bands can help assess the degree of volatility, allowing traders to make informed decisions.

Potential Factors Fueling the Rise:

While we can’t pinpoint exact reasons without further fundamental analysis, here are some potential factors that could be contributing to Toncoin’s recent price increase:

- Broader Market Sentiment: Positive sentiment in the overall crypto market, perhaps driven by Bitcoin’s recent milestones, often lifts other altcoins as well.

- Project Developments: Any positive news or developments within the Toncoin ecosystem, such as partnerships, technology upgrades, or increased adoption, could boost investor confidence.

- Increased Utility: Growing use cases for Toncoin and its underlying technology can drive demand and price appreciation.

- Whale Activity: Large investors (whales) making significant purchases can sometimes trigger price rallies.

Final Thoughts: Is Toncoin a Crypto to Watch?

Toncoin’s recent price surge and increased trading volume are definitely noteworthy. The cryptocurrency is showing strong positive momentum, and its market cap ranking reflects its solid standing in the crypto space. Whether this upward trend will continue remains to be seen, and like all cryptocurrencies, TON is subject to market volatility.

For investors and traders, keeping a close eye on Toncoin, monitoring market trends, and conducting thorough research is always recommended. The crypto market is dynamic, and staying informed is key to making smart decisions.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.