The decentralized finance (DeFi) landscape is constantly evolving, and a new contender has emerged to shake up the ranks! THORChain, the protocol designed for native asset settlement, has officially claimed the title of the second-largest decentralized exchange (DEX). This impressive feat is accompanied by a significant price surge in its native token, RUNE, creating a buzz in the crypto community. Let’s dive into what’s fueling this exciting growth.

THORChain’s Trading Volume: How Did It Surge So Dramatically?

Over the past week, THORChain has witnessed an explosive increase in trading activity, with volumes exceeding a staggering $1.325 billion. To put this into perspective, recent data from DeFi Llama shows THORChain’s daily trading volume hitting $334.3 million! This surge propelled it past PancakeSwap, firmly establishing it as the second-largest DEX, trailing only the giant, Uniswap.

While trading volume has skyrocketed, it’s interesting to note that THORChain’s total value locked (TVL) has remained relatively stable at $260.1 million. This suggests the surge is primarily driven by increased trading activity rather than a massive influx of new assets being locked into the protocol.

This rapid ascent wasn’t even anticipated to happen this quickly! Chad Barraford, a core developer at THORChain, initially predicted this milestone might be reached by the end of 2023. However, in a surprising X (formerly Twitter) post on November 13th, Barraford expressed his astonishment at the speed of this growth, stating it happened “much faster than they thought, ‘taking two days instead of 2 months’”.

Flipped Curve, much faster than we thought. 2 days instead of 2 months. $RUNE $THOR

— Chad Barraford (@CBarraford) November 13, 2023

What Makes THORChain Unique? The Multichain DEX Advantage

THORChain stands out as a multichain powerhouse, often described as the decentralized, multichain counterpart to Uniswap. Imagine being able to seamlessly swap your native Bitcoin for Ether without relying on centralized intermediaries – that’s the power of THORChain. This is made possible through THORSwap, the decentralized exchange built on the THORChain protocol.

One of the compelling aspects for users is the attractive yield opportunities. The platform boasts an average annual percentage rate (APR) of nearly 44%. Even more enticing are specific liquidity pools, such as Bitcoin and RUNE pairs, offering incredibly high APRs exceeding 353%!

Erik Voorhees, a prominent Bitcoin advocate, recently highlighted THORChain’s significant role in the Bitcoin ecosystem. He pointed out that THORChain processed nearly 2% of the total spot Bitcoin trading volume between November 11th and 12th, amounting to a substantial $224 million.

Read Also: Aave Resumes Standard Functions After Security Vulnerability

Voorhees emphasized the profound importance of THORChain for Bitcoin enthusiasts who value decentralization. He noted that it’s the only market enabling Bitcoin trading at scale without the need for intermediaries, perfectly aligning with the core principles of Bitcoin itself.

Incredible. @THORChain did $224m in spot $BTC volume yesterday. That's nearly 2% of all spot BTC volume globally.

For principled Bitcoiners, THORChain is the only market in the world to trade BTC at scale, without intermediaries.

It's profound. pic.twitter.com/7qO0o016Wj

— Erik Voorhees (@ErikVoorhees) November 12, 2023

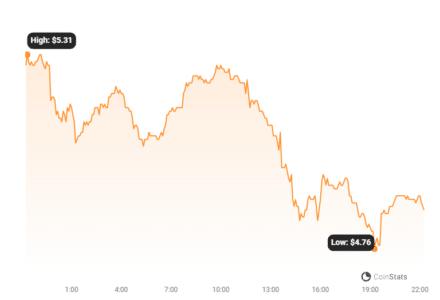

RUNE Price: Riding the Wave of THORChain’s Success

Unsurprisingly, the surge in THORChain’s trading volume has had a positive impact on its native token, RUNE. Over the past seven days, RUNE has experienced an impressive 40% price increase. Currently trading around $5, RUNE boasts a market capitalization of $1.5 billion, solidifying its position in the crypto market.

However, data from Santiment, a market intelligence platform, reveals a nuanced picture. While the price is up, RUNE’s social volume has decreased by 27% in the last day. Additionally, Santiment reports a slight decline in RUNE’s total open interest (OI), from $78.9 million to $72.4 million over the past 24 hours.

This slight dip in social volume and open interest coincides with Santiment’s data indicating a positive Binance funding rate for RUNE futures contracts, currently around 0.02%. A positive funding rate typically suggests that short positions are more prevalent than long positions in the futures market, at least until further price movements shift market sentiment. It will be interesting to see how these metrics evolve as THORChain continues its growth trajectory.

The Road Ahead for THORChain and RUNE

THORChain’s ascent to the second-largest DEX is a significant milestone, highlighting the growing demand for decentralized and cross-chain trading solutions. Its unique ability to facilitate native asset swaps, particularly for Bitcoin, positions it as a crucial infrastructure component in the expanding DeFi ecosystem. The surge in RUNE’s price reflects the market’s positive response to THORChain’s success and its potential for continued growth. As the DeFi space matures, protocols like THORChain, offering genuine utility and decentralization, are likely to play an increasingly vital role. Keep an eye on THORChain and RUNE – their journey in the DeFi landscape is just getting started!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.