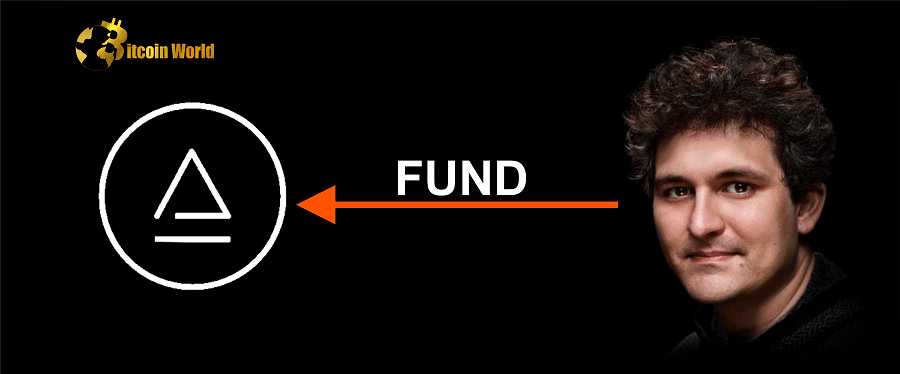

The FTX saga continues to unfold with another twist! Just days after his release on a staggering $250 million bond, Sam Bankman-Fried (SBF), the former head honcho of the collapsed crypto exchange FTX, is vehemently denying allegations of moving funds linked to Alameda Research wallets. But is the crypto community buying it? Let’s dive into the latest developments and see what’s brewing in the ever-turbulent world of crypto.

SBF’s Tweet: A Flat-Out Denial

In a bold move to address swirling rumors, SBF took to Twitter on December 30th to directly refute claims of fund transfers from Alameda wallets. To his 1.1 million followers, he declared, “None of these are me. I’m not and cannot move any of those funds because I no longer have access to them.” This tweet was a direct response to a Cointelegraph report highlighting suspicious on-chain activity linked to Alameda wallets.

But what exactly triggered this denial, and why is the crypto community raising eyebrows?

Decoding the On-Chain Data: What’s Got Crypto Twitter Buzzing?

The Cointelegraph report that sparked SBF’s denial pointed to a wallet address starting with ‘0x64e9’ that received over 600 ETH originating from Alameda-linked wallets. Here’s a breakdown of what on-chain data reveals:

- Fund Movement: A significant amount of ETH (over 600) was transferred from wallets associated with Alameda Research to a new address (0x64e9).

- Conversion to USDT: Transactional records indicate that a portion of this ETH was swiftly converted to USDT (Tether), a stablecoin pegged to the US dollar.

- Mixing Services: The remaining ETH was routed through a crypto mixing service.

Why are mixing services raising red flags? Crypto mixers are often used to obfuscate the origin and destination of cryptocurrency transactions, making it harder to trace the flow of funds. This naturally raises suspicion, especially in a high-profile case like FTX and Alameda.

Inside Job Suspicions: Is SBF Involved Despite His Denial?

The manner and timing of these fund movements have fueled speculation within the crypto community, with many suspecting an “inside job.” Given SBF’s former position and knowledge of Alameda’s operations, he became a prime suspect in the eyes of some. The community’s skepticism stems from several factors:

- Timing: The fund movement occurred shortly after SBF’s release on bail, raising questions about whether he might be attempting to access or move assets.

- Method of Transfer: The use of mixers and exchanges to convert and obscure the funds suggests an attempt to hide the transactions.

- Past Actions: The collapse of FTX and Alameda under SBF’s leadership has eroded trust, making the community more likely to suspect foul play.

BowTiedIguana’s Investigation: $684,000 Crypto Cashed Out Under House Arrest?

Adding fuel to the fire, DeFi educator BowTiedIguana conducted an on-chain investigation that alleges SBF might have cashed out a substantial $684,000 in cryptocurrency while already under house arrest. According to BowTiedIguana’s findings:

- Wallet Transactions: A series of wallet transactions were identified, allegedly linked to SBF.

- Exchange in Seychelles: These transactions reportedly involved an exchange based in Seychelles, a jurisdiction known for its less stringent regulations.

- Potential Release Condition Violation: BowTiedIguana suggests that these transactions may indicate SBF violated his release conditions, which might restrict spending beyond $1,000 without court approval.

It’s important to note that these are allegations and on-chain observations. Whether these transactions are definitively linked to SBF and constitute a violation of his bail conditions remains to be officially determined.

What Does This Mean for the FTX Saga and Crypto Trust?

This latest episode adds another layer of complexity and intrigue to the FTX saga. Here’s why it matters:

- Erosion of Trust: Continued allegations and suspicious activities further erode trust in the crypto industry, especially after the massive FTX collapse.

- Legal Ramifications for SBF: If investigations confirm SBF’s involvement in these fund movements or violations of his release conditions, it could have serious legal consequences for him.

- Increased Scrutiny: This situation will likely lead to increased scrutiny of crypto transactions, on-chain analysis, and the activities of key figures in the industry.

The Bottom Line: Denial vs. Data – Who Do You Believe?

Sam Bankman-Fried vehemently denies moving Alameda funds, but on-chain data and community skepticism paint a different picture. The allegations of fund movements, coupled with the use of mixers and reports of crypto cash-outs under house arrest, are certainly raising eyebrows and fueling suspicions.

As investigations continue and more information comes to light, the truth behind these transactions will hopefully be revealed. For now, the crypto world watches with bated breath, wondering if this is just another chapter in the ongoing FTX drama or a sign of more revelations to come. One thing is certain: the FTX saga is far from over, and its impact on the crypto landscape will be felt for a long time to come.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.