Hold onto your hats, SHIB Army! The Shiba Inu (SHIB) price chart delivered another dose of crypto rollercoaster action today. If you blinked, you might have missed it – a rapid 5% surge to $0.0000147, marking an eight-day high for the meme-inspired token. But just as quickly as it pumped, it dumped, leaving investors scratching their heads (and maybe checking their portfolios with a little less enthusiasm).

SHIB Price Rockets… Briefly

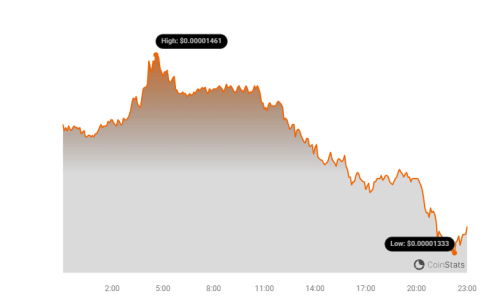

Let’s dive into what happened. Early in the trading day, SHIB bulls seemed to take charge. Fueled by what appeared to be strong buying pressure, the price of Shiba Inu jumped nearly 5%. This bullish move propelled SHIB to $0.0000147, injecting a shot of optimism into the market. Take a look at the chart:

Notice that impressive green candle shooting upwards? That represents the sudden price spike, backed by a noticeable increase in trading volume. This suggests genuine buying interest at play.

…Then Reality Bites: The Crash and the Wick

However, the party was short-lived. Almost as soon as SHIB hit that peak, the selling pressure intensified. The price swiftly reversed, erasing all the gains and even dipping below the day’s opening price. This rapid reversal created what traders call a “wick” on the daily candlestick chart – a long vertical line showing the high and low prices reached during that trading period.

This wick is more than just a chart pattern; it tells a story of market dynamics at play. It begs the question:

Will This Wick Be Filled? Decoding SHIB’s Price Action

This is the million-dollar (or should we say, million-SHIB?) question. The appearance of the wick suggests a few potential scenarios:

- Whale Activity: The initial pump could have been triggered by a large investor or a group of investors making significant SHIB purchases. This shows there’s still appetite to buy SHIB at these levels.

- Pump and Dump Dynamics: The subsequent crash raises concerns about a potential “pump and dump” scenario. This happens when traders artificially inflate the price to lure in other buyers, then quickly sell off their holdings for profit, leaving latecomers with losses.

- Thin Order Books: The dramatic price swing, both up and down, could indicate that SHIB’s order books are relatively thin. This means that even moderately sized buy or sell orders can cause significant price fluctuations, leading to increased volatility.

In simpler terms, imagine a market like a shallow pool. A small splash (a large buy order) can create a big wave (price spike), but the water level can quickly return to normal (price correction) because there isn’t a large volume of water (liquidity) to sustain the wave.

What Does This Mean for SHIB Investors?

SHIB’s recent price action highlights the inherent volatility of meme coins and the broader cryptocurrency market. Here’s what investors should consider:

- Increased Volatility: Expect continued price swings. SHIB, like many meme coins, is prone to rapid pumps and dumps.

- Trading Risks: The thin order book and potential for pump-and-dump schemes make SHIB trading riskier, especially for short-term traders. Stop-loss orders and careful risk management are crucial.

- Market Sentiment: Meme coin prices are heavily influenced by social media sentiment and online trends. Keeping an eye on these factors can provide clues, but predicting these trends is inherently difficult.

- Long-Term Perspective: If you’re a long-term believer in the Shiba Inu ecosystem and its development (like Shibarium, TREAT, etc.), short-term price fluctuations might be less concerning. However, always remember to invest responsibly.

Navigating the SHIB Waters

The SHIB price chart is a reminder that the crypto market, especially the meme coin sector, can be a wild ride. While the 5% pump offered a glimpse of bullish potential, the subsequent crash underscores the risks associated with volatility.

For traders and investors, understanding these dynamics is key. Whether the “wick” will be filled remains to be seen, but one thing is clear: SHIB continues to be an asset that demands attention, caution, and a healthy dose of risk awareness.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.