Hold onto your hats, crypto enthusiasts! The FTX saga continues to unfold, and the latest chapter involves a significant move of Solana (SOL) tokens. On Monday, the FTX estate, managing the remnants of the collapsed crypto exchange, initiated a transfer of 750,000 SOL tokens, valued at a cool $30 million, to crypto giants Binance and Kraken. This news sent ripples through the market, causing SOL’s price to dip by 5% in just 24 hours. But what does this transfer really mean, and is this just the tip of the iceberg?

Why is FTX Moving Millions in SOL?

This $30 million transfer is reportedly the first step towards a potential sale of SOL holdings by the FTX estate. It’s no secret that FTX’s collapse left a massive financial hole, and liquidating assets is crucial to repay creditors. Solana, being a significant holding within the FTX estate, is naturally on the list for potential liquidation. In fact, this recent move brings the total SOL transferred to exchanges to a whopping $102 million!

🚨 FTX Estate transferred 750,000 $SOL ($30M) to #Binance and #Kraken in the past 2 hours.

And transferred 750,000 $SOL ($30M) to #Binance and #Kraken 8 hours ago.

Currently, FTX Estate has transferred a total of 2,573,421 $SOL ($102M) to exchanges in the past 3 weeks. pic.twitter.com/PZz9bAcjZu

— Lookonchain (@lookonchain) November 3, 2023

According to blockchain analytics firm Lookonchain, as highlighted in the tweet above, the FTX estate has been gradually moving SOL to exchanges over the past few weeks. This latest transfer is a significant chunk, raising eyebrows and sparking concerns about potential selling pressure on SOL.

SOL’s Price Under Pressure: A Temporary Dip or a Trend?

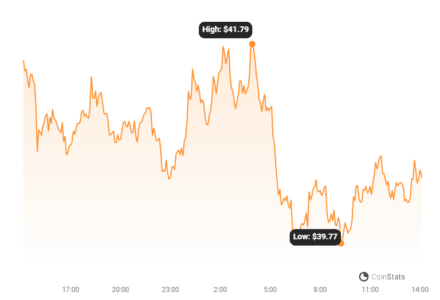

The immediate impact of the transfer was a noticeable 5% drop in SOL’s price within 24 hours. While the crypto market is known for its volatility, this event serves as a stark reminder of how large token movements can influence prices. Adding to the pressure, reports indicate that SOL constitutes the largest liquid asset on the FTX estate’s balance sheet, valued at over $1.16 billion! This substantial holding means any significant sell-off could have a considerable impact on SOL’s market value.

It’s worth noting that SOL has had a remarkable run recently, increasing by about 70% in the past month and 10% year-on-year. However, the price has also retreated 15% from a 14-month high, signaling that the recent rally might be losing steam. The FTX estate’s token transfer is likely contributing to this pullback, as the market anticipates potential large-scale selling.

What’s Next for Solana and the FTX Estate?

The current transfer to Binance and Kraken is likely just the first step in a broader liquidation process. Typically, estates unstake and move tokens to exchanges before selling them off. While the FTX estate hasn’t officially sold any SOL yet, the market is bracing for potential sales in the near future. The scale and pace of these sales will be crucial in determining the ultimate impact on SOL’s price.

It’s also important to remember the regulatory landscape surrounding Solana. Earlier this year, the Securities and Exchange Commission (SEC) classified Solana as a security in a lawsuit. This allegation initially caused market jitters. However, the Solana Foundation publicly refuted the SEC’s claim, and Ripple’s partial legal victory against the SEC provided some relief to the crypto market, including Solana. The legal uncertainty, however, still lingers in the background.

Read Also: SIEMENS And Microsoft Collaborate To Advance AI Adoption In Manufacturing

Key Takeaways and Market Outlook

Let’s break down the key points:

- FTX Estate’s SOL Transfer: The FTX estate has moved $30 million worth of SOL to Binance and Kraken, totaling $102 million transferred to exchanges recently.

- Potential Selling Pressure: This transfer is widely seen as a precursor to potential SOL sales by the FTX estate to repay creditors.

- Price Impact: SOL’s price dipped 5% following the news, and the market anticipates further volatility.

- Large Holdings: Solana is a significant asset for the FTX estate, meaning sales could be substantial.

- Market Sentiment: While SOL has been rallying, the FTX situation adds selling pressure and could dampen further price increases in the short term.

For Solana holders and potential investors, it’s crucial to monitor the FTX estate’s actions closely. The market’s reaction will depend on the scale and pace of any potential SOL sales. While the long-term prospects for Solana remain linked to its technology and adoption, the FTX factor introduces a near-term headwind that cannot be ignored.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.