Hold onto your hats, crypto enthusiasts! The market is buzzing with action, and we’ve witnessed a major shake-up in the top cryptocurrency rankings. Did you catch the news? Solana (SOL), the blazing-fast blockchain, briefly surged past Binance Coin (BNB) in market capitalization, claiming the coveted 4th spot! Let’s dive into this exciting development and unpack what’s driving these market dynamics.

Solana vs. Binance Coin: A Market Cap Showdown

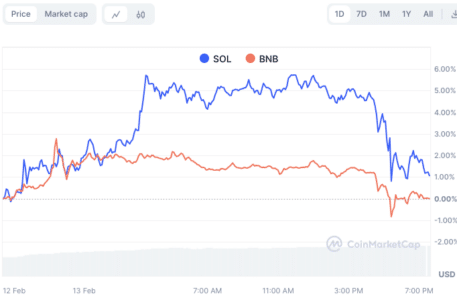

For a fleeting moment, the crypto leaderboard looked a little different. On February 13th, Solana (SOL) achieved a significant milestone, its market cap soaring to a whopping $49.7 billion. This surge propelled SOL past Binance Coin (BNB), making it the 4th largest cryptocurrency by market capitalization. Imagine the crypto world’s reaction! It’s like a rising star momentarily eclipsing a long-established giant.

- Solana (SOL) briefly hit a $49.7 billion market cap.

- This surge positioned SOL as the 4th largest crypto, overtaking BNB.

- The shift sparked discussions about Solana’s rapid growth and market impact.

SOL vs BNB[/caption>

SOL vs BNB[/caption>Currently, the top crypto rankings are typically dominated by Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). Solana briefly breaking into this elite group highlights its growing prominence and investor interest. But what fueled this impressive climb for Solana?

What’s Driving Solana’s Meteoric Rise?

The broader cryptocurrency market has been experiencing a wave of positive momentum, and Solana has certainly ridden this wave. Market optimism plays a significant role in boosting crypto valuations, and SOL has been a prime beneficiary. Let’s break down some key factors contributing to Solana’s surge:

- Overall Market Optimism: A generally bullish sentiment in the crypto market lifts most boats, and Solana has capitalized on this positive trend.

- Strong Price Performance: SOL’s price has been on a tear! Currently trading around $113.66 with an 8.1% daily increase, it’s clear investors are excited.

- Explosive 24-Hour Growth: Solana witnessed an astounding 54% growth in just 24 hours! That’s the kind of jump that grabs headlines.

- Surging DEX Trading Volume: Decentralized exchanges (DEXs) are seeing massive Solana activity, with 24-hour trading volume hitting $795 million. This indicates strong on-chain activity and user engagement.

You can see the excitement reflected in the trading volumes and price action. Check out this tweet highlighting Solana’s DEX volume surge:

https://twitter.com/SolanaFloor/status/1757404574384628060

See Also: Bitcoin (BTC) Fell Back Below $50K After Inflation Data Spooks Investors

Are There Clouds on Solana’s Horizon?

While Solana’s recent performance is undeniably impressive, it’s important to acknowledge the challenges it faces. Solana’s journey hasn’t been without bumps in the road. The network has faced criticism regarding:

- Network Outages: Solana has experienced occasional network outages, raising concerns about its reliability and stability.

- Centralization Concerns: Its delegated Proof-of-Stake (dPoS) consensus mechanism has led to debates about centralization, a key tenet of decentralization in the crypto space.

These issues are crucial to consider for long-term sustainability. Investor trust relies on network stability and decentralization. Solana needs to address these concerns to solidify its position as a leading blockchain platform. You can see some discussions about past network issues here:

https://twitter.com/SolanaStatus/status/1754813351945789491

Despite these hurdles, Solana’s resilience and innovation are undeniable. Overcoming these challenges will be vital for its continued growth and market leadership.

See Also: Earn Crypto By Playing Solana Game ‘Aurory’ On Epic Games Store

BNB’s Rebound: The Comeback Kid?

Don’t count Binance Coin (BNB) out just yet! While briefly overtaken, BNB quickly demonstrated its resilience and reclaimed its 4th position. BNB is showing signs of a strong comeback. Let’s look at BNB’s recent performance:

- BNB Recovers: BNB has bounced back and is currently holding onto the 4th spot in market cap rankings.

- Price Increase: BNB’s price is up by 0.79%, reflecting positive market sentiment.

- Robust Market Cap: BNB boasts a significant market cap of $48,267,558,480, demonstrating its strong market presence.

- Trading Volume Surge: BNB’s 24-hour trading volume jumped by an impressive 45% to $1,077,791,340. This surge signals renewed investor confidence and activity.

The Big Picture: What Does This Mean for the Crypto Market?

The Solana-BNB market cap flip is more than just a ranking change; it signifies the dynamic and ever-evolving nature of the cryptocurrency market. It highlights:

- Altcoin Season is in Full Swing?: Solana’s surge could be indicative of a broader altcoin season, where alternative cryptocurrencies gain momentum against established players.

- Increased Competition: The competition among top cryptocurrencies is intensifying, pushing innovation and growth within the ecosystem.

- Market Volatility: The crypto market remains volatile, and rankings can shift rapidly. This event serves as a reminder of the importance of staying informed and adaptable.

In Conclusion: A Dynamic Crypto Landscape

The brief overtaking of Binance Coin by Solana in market capitalization is a fascinating event in the crypto world. It underscores Solana’s impressive growth and the overall bullish momentum in the market. While Solana faces challenges, its innovation and community support are undeniable. BNB’s quick recovery also highlights its strength and established position. As the crypto market continues to evolve, expect more exciting shifts and developments in the rankings and beyond. Stay tuned!

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.