Hold onto your chopsticks, crypto enthusiasts! SushiSwap [SUSHI] has been cooking up a storm in the market, delivering mouthwatering gains for investors. In a market brimming with green candles, SUSHI has truly stood out, surging by over 80% recently. But is this rally just a flash in the pan, or is there more flavor to this Sushi surge? Let’s dive into the key ingredients driving this price explosion and see what the charts are telling us.

Sushi’s Price Surge: Riding the Crypto Bull Wave

SushiSwap is definitely savoring the current cryptocurrency bull market. Like many altcoins, SUSHI is benefiting immensely from the rising tide of Bitcoin [BTC]. As Bitcoin confidently climbed above $34,000, profits started flowing into the altcoin market, and SushiSwap has been a prime recipient.

According to a recent analysis by Santiment, the value of SUSHI has jumped an astounding 82% in just the last week! That’s a spicy move! You can check out the Santiment tweet here:

🍣 @SushiSwap is up a whopping +82% in the past week as crypto has continued its steady climb! This is the top performing asset in the top 500 market cap assets, and @santimentfeed data is showing the crowd is quite mixed on whether this is a pump or the real deal. pic.twitter.com/1n17X4o4QO

— Santiment (@santimentfeed) November 4, 2023

Decoding the SUSHI Price Chart: What’s Behind the 80% Rally?

Let’s break down this impressive price action. A significant chunk of SushiSwap’s 80% surge happened in a single day on November 1st. In fact, one trading session accounted for nearly half (47.80%) of the entire increase. That’s a powerful move!

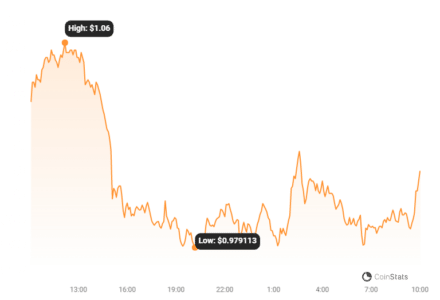

However, the very next day, SUSHI experienced a bit of a pullback, dropping by over 8%. Despite this dip, the price remained within the newly established higher range. As of writing, SushiSwap is trading around $1.0, still reflecting a healthy 2% gain on the day.

Price Correction Imminent? RSI and Volume Signals

Now, for a bit of caution. The Relative Strength Index (RSI) is flashing a potential warning sign. Currently, the RSI has climbed above 80. In technical analysis, an RSI above 70 is generally considered to indicate an overbought condition. This suggests that SUSHI might be due for a price correction in the short term.

Adding to this potential correction signal, we’re seeing a decrease in trading volume. Lower trading volume alongside an overbought RSI can often precede a price pullback. It’s important to keep an eye on these indicators as they develop.

Read Also: ADA Price Rose 36.5% in Two Weeks as Cardano Sees Increased Whale Transactions and Address Activity

Derivative Traders Betting on Continued Upswing?

Let’s peek into the derivatives market to gauge trader sentiment. An examination of the funding rate on Coinglass reveals that derivative traders are also leaning towards a bullish outlook for SUSHI. SushiSwap’s funding rate recently hit its highest point in months, reaching around 0.2%. This positive funding rate indicates that traders are paying to hold long positions, reflecting a belief in further price increases.

While the funding rate has slightly decreased from its peak, it remains positive, currently hovering around 0.01%. This suggests that the bullish sentiment, although tempered, is still present in the derivatives market.

Furthermore, the liquidation data provides additional insights. The price surge did trigger a wave of liquidations. Interestingly, the difference between short and long liquidations was quite small at the time of reporting. Short liquidations amounted to approximately $213,000, while long liquidations were around $218,000. This relatively balanced liquidation figure might suggest that both bulls and bears were caught off guard by the sudden price movement.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.