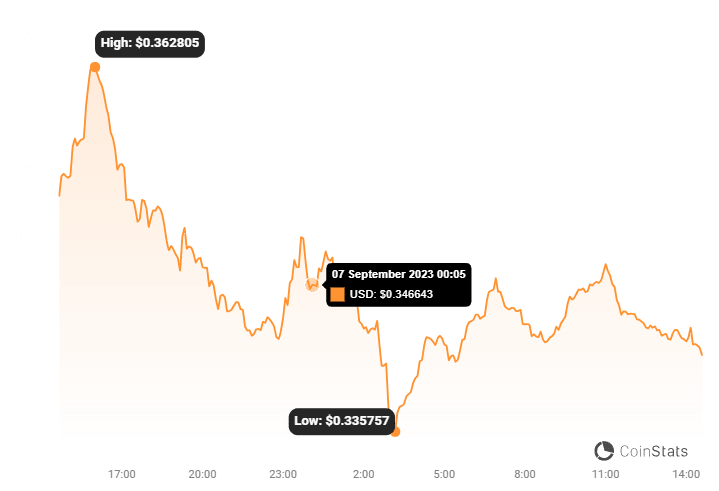

Buckle up, crypto enthusiasts! The volatile world of digital assets has delivered another jolt. This time, it’s Synapse (SYN) token taking a nosedive. Early on September 5th, the price of SYN experienced a dramatic 25% plunge, hitting just over $0.30. While it has since recovered slightly to around $0.34, the crypto community is buzzing with questions. What triggered this sudden price drop? Was it a market manipulation tactic? Or is there something more fundamental at play? Let’s dive into the details of this developing situation and understand what’s behind the Synapse (SYN) token’s wild ride.

The Flash Crash: What Exactly Happened to SYN Token?

The crypto markets are no stranger to volatility, but a 25% drop in a short period is significant. The culprit behind this sudden downturn appears to be a massive sell-off by an unidentified liquidity provider (LP). For those new to the DeFi space, liquidity providers play a crucial role in decentralized exchanges and cross-chain bridges like Synapse. They deposit their crypto assets into pools, enabling trading and other operations. In return, they earn rewards.

However, when a large LP decides to withdraw their liquidity and sell their tokens, it can create significant market turbulence, especially for tokens with lower liquidity. In the case of SYN, it seems a whale-sized LP decided to offload a substantial amount of their holdings, triggering the price plunge.

Synapse Labs Responds: Investigating the ‘Strange Behavior’

Hours after the price shockwave, Synapse Labs, the core team behind the Synapse cross-chain bridge, addressed the situation via a post on X (formerly Twitter). They confirmed that a liquidity provider had indeed sold their SYN tokens and removed their liquidity. Crucially, Synapse Labs stated they are investigating “strange behavior” associated with the LP’s wallets and are attempting to contact them for clarification.

Here’s the key takeaway from Synapse Labs’ initial response:

- Liquidity Provider Sell-Off Confirmed: Synapse Labs acknowledged that a large SYN token sale by an LP was the cause of the price drop.

- No Security Breach: Reassuringly, they explicitly stated that there was no evidence of a security breach on the Synapse protocol or bridge itself. This is vital information, as security concerns can trigger even more significant market panic.

- Investigating ‘Strange Behavior’: The mention of “strange behavior” adds an element of mystery. What could this mean? Could it be unusual wallet activity prior to the sell-off? Is there a possibility of a compromised account, despite no breach of the Synapse protocol? These are questions the community is asking.

- Seeking Contact: Synapse Labs’ attempt to contact the LP suggests they are genuinely trying to understand the motivation behind the massive sale and the context surrounding it.

- Further Updates Promised: The promise of future updates is crucial for transparency and maintaining community trust. The market will be watching closely for more information from Synapse Labs.

Enter the Whale Watchers: Lookonchain’s Analysis

Blockchain analytics firms like Lookonchain are invaluable in these situations. They provide on-chain data and insights that can help unravel the mysteries of crypto market movements. Lookonchain quickly jumped into action and reported that a “prominent whale” was indeed behind the SYN sell-off.

According to Lookonchain’s tweet, this whale dumped a massive 9 million SYN tokens for 2.35 million USDC stablecoins at an average price of $0.26 per SYN. Furthermore, Lookonchain stated that this entity no longer holds any SYN tokens, indicating a complete exit from their position.

Let’s break down what this means:

- Whale Identified: Lookonchain’s analysis points to a single, large holder (a whale) as the seller, rather than a coordinated action by multiple smaller players.

- Massive Sell Volume: 9 million SYN tokens is a substantial amount, enough to exert significant downward pressure on the price, especially in potentially thinner liquidity trading conditions.

- USDC Conversion: The whale converted their SYN to USDC, a stablecoin pegged to the US dollar. This suggests a move to de-risk or secure profits in a stable asset, rather than reinvesting in another volatile crypto.

- Complete Exit: Selling all SYN holdings implies a decisive move away from the token, at least for the time being. The reasons behind this complete exit remain unclear.

Synapse Bridge: A Key Player in the Cross-Chain World

To understand the significance of this event, it’s important to appreciate the role of Synapse in the broader crypto ecosystem. Synapse is a cross-chain bridge protocol. But what exactly is a cross-chain bridge and why are they important?

Imagine the crypto world as a collection of different islands (blockchains), each with its own unique ecosystem and rules. Cross-chain bridges act as, well, bridges, allowing users to transfer assets and data between these different blockchains. This is crucial for interoperability and breaking down the silos between different blockchain networks.

Synapse specifically focuses on bridging various Layer-1 and Layer-2 blockchains, enabling users to move assets like ETH, stablecoins, and other tokens across networks like Ethereum, Polygon, Avalanche, Arbitrum, and more. This functionality is vital for DeFi applications, as it allows users to access opportunities and manage assets across multiple chains seamlessly.

Key facts about the Synapse bridge, as per Synapse Labs’ website:

- Total Value Locked (TVL): Currently holds $123.5 million in value locked within its bridge contracts. TVL is a key metric for DeFi protocols, indicating the total value of assets deposited and utilized within the platform.

- Total Volume: Has facilitated a staggering $42 billion in cross-chain transaction volume. This highlights the significant usage and importance of Synapse in the cross-chain space.

However, it’s also worth noting that according to research by The Block Research, Synapse experienced a negative volume growth of -$395 million in the second quarter. This could indicate a broader trend or specific challenges faced by Synapse in recent months, although further context is needed to fully interpret this data point.

Why Would a Liquidity Provider Dump Millions of SYN Tokens?

This is the million-dollar question (or rather, the $2.35 million USDC question!). The exact motivations of the LP remain unknown, and we can only speculate at this point. Here are some potential reasons why a liquidity provider might execute such a large sell-off:

- Profit Taking: The simplest explanation is profit-taking. The LP may have accumulated SYN tokens at a lower price and decided to cash in their gains, especially if they anticipated market volatility or had other investment opportunities.

- Risk Management: LPs are exposed to risks, including impermanent loss and smart contract risks. The LP might have perceived increased risk associated with SYN or the Synapse bridge and decided to reduce their exposure. This could be due to market conditions, regulatory concerns, or internal risk assessments.

- Capital Reallocation: The LP might have decided to reallocate their capital to other investment opportunities that they deemed more promising or less risky. This is a common practice in portfolio management.

- Concerns about Synapse (Speculation): While Synapse Labs stated no security breach, the “strange behavior” mentioned could be related to some underlying concern that prompted the LP to exit their position. This is purely speculative, and we need more information from Synapse Labs and the LP to understand if this is the case.

- Malicious Intent (Less Likely but Possible): While less likely, there’s always a remote possibility of malicious intent, such as an attempt to manipulate the market or harm the Synapse project. However, without further evidence, this remains highly speculative.

What Does This Mean for SYN Token Holders and the Synapse Ecosystem?

The immediate impact is clear: a significant price drop for SYN token holders. For those who bought SYN at higher prices, this event will undoubtedly be concerning. However, it’s crucial to maintain perspective and consider the broader context:

- Market Volatility is Normal: Crypto markets are inherently volatile. Price swings, both upwards and downwards, are part of the game. Events like this serve as a reminder of the risks involved in crypto investments.

- Synapse Bridge Remains Operational: Importantly, Synapse Labs has confirmed that the bridge itself is operating normally and has not been compromised. This is a positive sign, as it indicates the core functionality of the project remains intact.

- Decentralization and Market Dynamics: This event highlights the decentralized nature of crypto markets. Large holders can make independent decisions that impact the market, and price corrections can occur rapidly.

- Opportunity for Some?: For traders and investors who believe in the long-term potential of Synapse, price dips can present buying opportunities. However, this is highly dependent on individual risk tolerance and investment strategies.

- Importance of Due Diligence: Events like this underscore the importance of thorough research (DYOR – Do Your Own Research) before investing in any crypto project. Understanding the tokenomics, the project’s fundamentals, and the potential risks is crucial.

- Monitor Synapse Labs’ Updates: Keep a close eye on official updates from Synapse Labs. Their investigation and further communication will be key to understanding the full picture and the future direction of the project.

Looking Ahead: Will SYN Recover?

The future trajectory of SYN token price is uncertain. Recovery will depend on several factors, including:

- Market Sentiment: Overall market sentiment towards crypto and DeFi will play a role. A broader market uptrend could help SYN recover.

- Synapse Labs’ Response and Transparency: How Synapse Labs handles the investigation and communicates with the community will be critical. Transparency and proactive communication can help restore confidence.

- LP’s Motivation and Future Actions: Understanding the LP’s motivation and whether they intend to return to the Synapse ecosystem could influence market perception.

- Synapse Bridge Usage and Growth: The continued usage and growth of the Synapse bridge will ultimately determine the long-term value of the SYN token. If the bridge remains a vital piece of cross-chain infrastructure, the token could see renewed demand.

In Conclusion: Navigating the Waves of Crypto Volatility

The Synapse (SYN) token price plunge serves as a stark reminder of the inherent volatility and dynamic nature of the cryptocurrency market. A large liquidity provider’s decision to sell off millions of tokens triggered a significant price correction, highlighting the influence of whales and the importance of liquidity in DeFi markets. While the immediate impact is a price drop, the Synapse bridge itself remains operational, and Synapse Labs is actively investigating the situation. As always in the crypto space, staying informed, doing your own research, and understanding the risks are paramount. Keep an eye on updates from Synapse Labs and monitor market developments to navigate these turbulent waters effectively. The crypto journey is rarely a smooth ride, but understanding these events helps us become more informed and resilient participants in this exciting and ever-evolving landscape.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.