Heads up, crypto users! Binance, one of the world’s leading cryptocurrency exchanges, is making a significant move that’s sending ripples through the market. They’ve announced they will be delisting Tornado Cash’s native token, TORN. If you’re holding TORN or are interested in crypto privacy, you need to pay attention to this.

Binance to Remove Support for Tornado Cash (TORN) – What’s Happening?

In a recent blog announcement on November 27, 2023, Binance dropped the news: TORN, along with BitShares (BTS), PERL.eco (PERL), and Waltonchain (WTC), will be delisted. Here’s a quick rundown of the key dates:

- Delisting Date: December 7, 2023, at 03:00 (UTC).

- Deposit Closure: After December 7th, Binance will no longer accept deposits of TORN, BTS, PERL, and WTC.

- Withdrawal Suspension: Withdrawals for these tokens will be suspended on March 7, 2024, at 03:00 (UTC).

So, if you’re holding any of these tokens on Binance, especially TORN, it’s crucial to take note of these dates and plan accordingly.

See Also: Breaking: Binance To Delist 10 Trading Pairs

Why is Binance Delisting TORN? The Unclear Reasons & Market Reaction

Binance hasn’t explicitly stated the exact reason for delisting TORN and the other tokens, only mentioning that these tokens “no longer meet the high level of standard” they expect. This vagueness leaves room for speculation, but context clues point towards regulatory pressures and the nature of Tornado Cash itself.

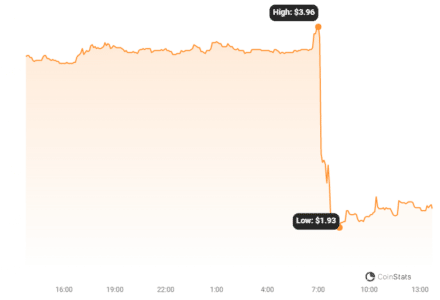

The market reaction to the delisting announcement was swift and decisive. Immediately after the news broke, the price of TORN took a significant hit, plummeting over 44% and dropping below the $2 mark, according to Coinstats data. This sharp decline underscores the impact of exchange delistings on token prices and market sentiment.

Tornado Cash: Privacy Tool or Regulatory Red Flag?

To understand why TORN’s delisting is significant, it’s important to understand what Tornado Cash is. In simple terms, Tornado Cash is a decentralized protocol built on the Ethereum blockchain designed to enhance transaction privacy. It acts as a crypto “mixer,” making it harder to trace the flow of cryptocurrencies.

Here’s how it works:

- Crypto Mixing Explained: Tornado Cash pools together cryptocurrencies from various users.

- Obscuring Origins: It then mixes and scrambles these funds, breaking the direct link between the sender and receiver addresses.

- Privacy Enhancement: This process makes it significantly more challenging to track the origin and destination of crypto transactions, offering users a higher degree of privacy.

While privacy is a valued aspect in the crypto world, tools like Tornado Cash have also attracted scrutiny from regulators, particularly concerning illicit activities.

Regulatory Storm Around Tornado Cash and Binance

Tornado Cash faced major headwinds when the U.S. government sanctioned the platform in August 2022, citing concerns about its use in laundering illicit funds. Adding to the pressure, in September 2023, Tornado Cash co-founder Roman Storm pleaded not guilty to charges of helping launder over $1 billion, allegedly linked to North Korean hackers and other illicit sources.

The timing of Binance’s delisting is also noteworthy. It comes shortly after Binance founder Changpeng Zhao (CZ) pleaded guilty to violating U.S. anti-money laundering (AML) laws and agreed to step down as CEO as part of a massive settlement.

See Also: North Korean Hackers Pose as South Korean Government Officials to Steal Crypto

According to the U.S. Treasury Department, Binance “willfully failed” to report over 100,000 transactions linked to illegal activities on its platform. As part of a staggering $4.3 billion settlement, Binance is required to identify and report “suspicious transactions” that it previously failed to flag to FinCEN, the financial crimes regulator.

Connecting the Dots: Delisting and Regulatory Compliance

While Binance hasn’t explicitly linked the TORN delisting to regulatory pressures, the context is hard to ignore. Given the sanctions against Tornado Cash, the charges against its co-founder, and Binance’s own recent run-in with regulators over AML compliance, the delisting of TORN appears to be a proactive move towards aligning with stricter regulatory standards.

Exchanges operate in a complex and increasingly regulated environment. Delisting tokens, especially those associated with privacy-enhancing technologies that can be misused for illicit activities, can be seen as a way for exchanges like Binance to mitigate risks and demonstrate a commitment to compliance.

What Does This Mean for TORN Holders and Crypto Privacy?

For TORN holders on Binance, the immediate action is clear: withdraw your TORN tokens before March 7, 2024. After this date, withdrawals will be suspended, and accessing your tokens through Binance will no longer be possible.

More broadly, this delisting raises important questions about crypto privacy and regulation:

- Privacy vs. Compliance: The case highlights the ongoing tension between the desire for privacy in crypto transactions and the increasing regulatory demands for transparency and AML compliance.

- Future of Privacy Coins: Will other exchanges follow suit and delist privacy-focused tokens? This event could set a precedent and impact the availability of privacy coins on major platforms.

- Decentralization and Regulation: The Tornado Cash situation underscores the challenges of regulating decentralized protocols and the implications for centralized exchanges that interact with them.

In Conclusion: Navigating the Evolving Crypto Landscape

Binance’s delisting of TORN is more than just the removal of a token; it’s a reflection of the evolving regulatory landscape in the crypto industry. As regulations tighten and exchanges face greater scrutiny, decisions like these are becoming increasingly common. For crypto users, staying informed about these changes and understanding the implications for privacy and market access is more important than ever. The delisting of TORN serves as a stark reminder of the ongoing balancing act between innovation, privacy, and regulatory compliance in the world of cryptocurrencies.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.