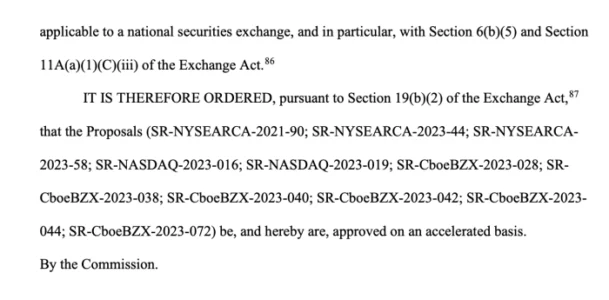

Get ready for a potential game-changer in the crypto world! After years of anticipation, the US Securities and Exchange Commission (SEC) has officially given the green light for listing and trading spot Bitcoin Exchange-Traded Funds (ETFs). This landmark decision marks a monumental step, bridging the gap between traditional finance and the burgeoning world of cryptocurrency.

“Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares,” stated SEC Chair Gary Gensler.

While celebrating this milestone, it’s crucial to understand the nuances. Gensler himself emphasized, “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

See Also: BREAKING: US SEC Finally Approves 11 Bitcoin Spot ETFs, Trading Starts Tomorrow

What Exactly are Spot Bitcoin ETFs and Why is This a Big Deal?

For those new to the crypto space, let’s break down what spot Bitcoin ETFs are and why their approval is making waves:

- Direct Bitcoin Exposure: Unlike Bitcoin futures ETFs that track Bitcoin futures contracts, spot Bitcoin ETFs directly hold actual Bitcoin. This means investors gain exposure to the real-time price movements of Bitcoin itself.

- Simplified Investment: Investing in Bitcoin directly can be complex, involving crypto exchanges, wallets, and security considerations. Spot ETFs simplify this process. You can now invest in Bitcoin through traditional brokerage accounts, just like buying stocks.

- Increased Accessibility: This approval opens the door for a broader range of investors, especially institutional players and retail investors who were previously hesitant to navigate the complexities of direct Bitcoin ownership.

- Regulatory Green Light: The SEC’s approval signals a significant shift in regulatory perception. It indicates a growing acceptance of Bitcoin as a legitimate asset class within the established financial framework.

Benefits of Spot Bitcoin ETFs: Unlocking Opportunities

The introduction of spot Bitcoin ETFs is anticipated to bring a multitude of benefits to the crypto ecosystem and the broader investment landscape:

- Institutional Investment Surge: Industry experts predict a significant influx of institutional capital into Bitcoin. ETFs provide a regulated and familiar investment vehicle for institutions previously restricted from direct crypto exposure.

- Retail Investor Participation: Retail investors can now easily diversify their portfolios with Bitcoin through ETFs, potentially driving wider adoption and market growth.

- Market Legitimacy: The SEC’s approval lends further legitimacy to Bitcoin and the crypto market as a whole, fostering trust and potentially attracting more conservative investors.

- Price Discovery and Liquidity: Increased trading volume through ETFs can contribute to more efficient price discovery and enhanced liquidity in the Bitcoin market.

Potential Challenges and Considerations

While the approval is overwhelmingly positive, it’s important to acknowledge potential challenges and heed the SEC Chair’s warning:

- Bitcoin Volatility: Bitcoin remains a volatile asset. Investors should be prepared for price swings and understand the inherent risks associated with crypto investments.

- Regulatory Scrutiny: The crypto space is still evolving, and regulatory landscapes are subject to change. Ongoing regulatory developments could impact the market.

- Custodial Risks: While ETFs simplify access, investors still rely on the ETF providers for the custody of the underlying Bitcoin. It’s crucial to choose reputable ETF providers.

- Market Manipulation: Concerns about market manipulation in the crypto space persist. Investors should be aware of these risks and conduct thorough research.

What’s Next? Launch and Market Impact

The excitement is building as the launch of these spot Bitcoin ETFs is expected imminently, with some anticipating trading to begin as early as tomorrow, Thursday, January 11th. All eyes are now on major stock exchanges as investors and Bitcoin enthusiasts eagerly await their debut.

The immediate impact on market dynamics and investor sentiment remains to be seen. However, many believe this approval could be a catalyst for a significant bull run, potentially pushing Bitcoin to new all-time highs and further solidifying its place as a mainstream asset class.

See Also: Bitcoin Spot ETFs To Start Trading Tomorrow – CBOE

A Turning Point for Bitcoin and Crypto?

The SEC’s decision to approve spot Bitcoin ETFs is undoubtedly a landmark event. It signifies a notable shift in regulatory attitude towards Bitcoin and cryptocurrencies, moving from caution to a more embracing stance within traditional finance.

This approval is expected to pave the way for further innovation and development in Bitcoin-related investment products. We might see a wider array of Bitcoin-based financial instruments emerge, offering investors more diversified options to engage with this revolutionary asset class.

Final Thoughts: Entering a New Era of Bitcoin Investment

As the SEC finalizes the details for the listing of the first spot Bitcoin ETFs, the financial world stands on the cusp of a new era. The integration of Bitcoin into mainstream investment portfolios is no longer a distant dream but a tangible reality.

While due diligence and caution remain paramount in the volatile crypto market, the approval of spot Bitcoin ETFs marks a pivotal moment. It’s a testament to Bitcoin’s growing maturity and acceptance, potentially ushering in a wave of adoption and innovation that could reshape the future of finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.