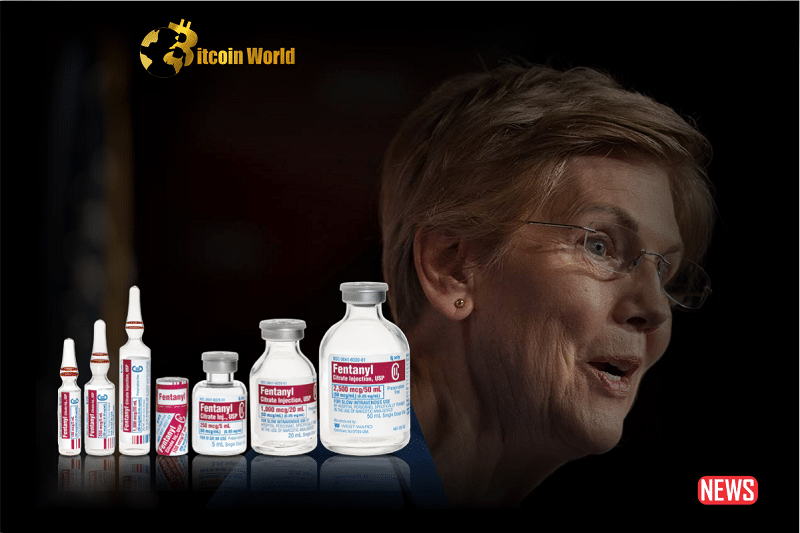

Is your crypto wallet unknowingly connected to something sinister? US Senator Elizabeth Warren is raising serious concerns about the role of cryptocurrency in facilitating the deadly fentanyl trade. Let’s dive into her recent statements and the potential implications for the future of digital assets.

The Senator’s Stance: Crypto as a Conduit for Crime

Senator Warren, a vocal critic of cryptocurrencies, recently brought the issue to the forefront during a congressional hearing. Her message was clear and direct: cryptocurrency is being used to fund the illegal fentanyl trade, and it’s time to act. She passionately advocated for her bill, the Digital Asset Anti-Money Laundering Act, arguing it’s crucial to close loopholes that allow criminals to exploit digital currencies.

“Crypto is helping fund the fentanyl trade,” Warren declared during the Senate Banking Committee hearing. “And we have the authority to stop it. It’s finally time.” This isn’t just about abstract financial regulations; it’s about a crisis with devastating real-world consequences.

The Devastating Reality of Fentanyl

The numbers paint a grim picture. Fentanyl and other synthetic opioids are responsible for a staggering number of overdose deaths in the US. Consider this:

- The CDC estimates over 150 overdose deaths per day are linked to synthetic opioids like fentanyl.

- The DEA identifies China and Mexico as the primary sources for fentanyl and related drugs.

Senator Warren’s argument hinges on the idea that cryptocurrency provides a relatively anonymous and efficient way for these illicit operations to move money.

Spotlight on the Flow of Funds

During the hearing, Senator Warren pressed Elizabeth Rosenberg, the Treasury Department’s assistant secretary for Terrorist Financing and Financial Crimes, on the specifics. The key question: Are Chinese entities involved in the fentanyl trade using cryptocurrency?

Rosenberg confirmed that, indeed, certain precursor manufacturers and illegal drug organizations are leveraging cryptocurrency. This acknowledgment lends weight to Warren’s concerns and underscores the potential scale of the problem.

The Shocking Numbers: Billions in Bitcoin

Senator Warren cited research from Elliptic, a blockchain analytics firm, highlighting a jaw-dropping statistic:

- 90 Chinese sources reportedly exchanged precursor chemicals for cryptocurrency.

- The total value of these transactions? A staggering $54 billion in fentanyl tablets.

- This amount of fentanyl has the potential to kill approximately 9 billion people.

- And it was all facilitated through Bitcoin transactions.

These figures are alarming and highlight the immense scale of the issue. It raises a critical question: Can current regulations effectively combat this type of financial activity?

Warren’s Proposed Solution: The Digital Asset Anti-Money Laundering Act

Senator Warren’s proposed legislation aims to tackle this problem head-on. Here’s what the Digital Asset Anti-Money Laundering Act intends to do:

- Strengthen anti-money laundering (AML) regulations within the cryptocurrency industry.

- Combat terrorist financing by increasing scrutiny of digital asset transactions.

- Ensure compliance with existing financial regulations within the crypto space.

Essentially, the bill seeks to bring the cryptocurrency world under similar regulatory frameworks as traditional financial institutions, making it harder for criminals to operate undetected.

Beyond Fentanyl: A Broader Skepticism of Crypto

Senator Warren’s concerns about cryptocurrency aren’t limited to the fentanyl trade. She has consistently voiced skepticism about the market, often characterizing it as a haven for illicit activities. Her view is that the inherent features of some cryptocurrencies, such as pseudonymity, make them attractive to those seeking to evade law enforcement.

A Global Perspective on Crypto Crime

Warren also highlighted the potential for cryptocurrency to be used for other illicit purposes on a global scale. She specifically raised concerns about North Korean actors potentially using digital assets to circumvent international sanctions. This underscores the broader implications of cryptocurrency regulation and its impact on global security.

The Ongoing Debate: Regulation vs. Innovation

Senator Warren’s strong stance has reignited the debate surrounding cryptocurrency regulation. There are valid arguments on both sides:

| Arguments for Stronger Regulation | Arguments Against Overly Strict Regulation |

|---|---|

| Combats money laundering and terrorist financing. | Could stifle innovation and growth in the crypto space. |

| Protects consumers from fraud and scams. | May drive legitimate crypto activity underground or overseas. |

| Ensures a level playing field with traditional finance. | Could hinder the development of new and beneficial technologies. |

Actionable Insights: What Does This Mean for You?

- Stay informed: Keep up-to-date on the evolving regulatory landscape for cryptocurrencies.

- Understand the risks: Be aware of the potential for illicit activity within the crypto space.

- Support responsible regulation: Engage in discussions about how to balance innovation with security.

- Due diligence is key: When investing in or using cryptocurrencies, understand the underlying technology and the entities involved.

Conclusion: A Crossroads for Crypto

Senator Elizabeth Warren’s persistent warnings about the link between cryptocurrency and the fentanyl trade have brought a critical issue into sharp focus. As the debate over digital asset regulation intensifies, the industry finds itself at a crossroads. The challenge lies in finding a balance that allows for innovation while effectively addressing the legitimate concerns about money laundering and criminal activity. The future of cryptocurrency may well depend on how this balance is struck.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.