Is Ethereum’s growing validator count becoming a double-edged sword? While a massive network of validators strengthens decentralization – a core tenet of crypto – it also introduces significant technical complexities. Ethereum’s co-founder, Vitalik Buterin, has stepped in with a fresh blog post outlining potential solutions to address this very challenge. Let’s dive into Buterin’s proposals and understand how they could reshape the future of Ethereum staking and network efficiency.

The Validator Conundrum: Decentralization vs. Network Strain

Currently, the Ethereum network boasts an impressive number of validators – around 895,000 to be precise! This high validator count is fantastic for decentralization, empowering individuals to participate in securing the network through staking. However, this massive scale comes at a cost. Processing signatures from nearly a million validators in each slot (a 12-second time unit in Ethereum) places a considerable strain on the network.

Buterin himself acknowledges that the current system is pushing the boundaries of technical feasibility. The complexity is becoming too high, and adjustments are needed to ensure the long-term health and accessibility of Ethereum. This isn’t just theoretical; it’s a practical concern that could impact network performance and future scalability.

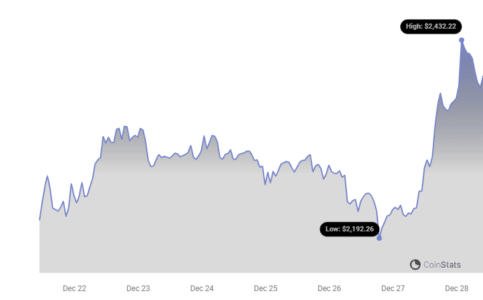

Interestingly, despite these network discussions, Ether (ETH) is showing positive market movement. As per Coinstats, ETH has experienced a 6.1% surge in the last 24 hours, reaching $2,389. This suggests continued market confidence in Ethereum, even amidst ongoing development and adjustments.

Buterin points out that the current signature aggregation system, handling approximately 28,000 signatures per slot, is complex and doesn’t truly achieve the goal of universal staking accessibility. He argues that aiming for a system where everyone signs in every slot becomes unsustainable as Ethereum’s user base grows. Imagine 10% of 500 million users staking – that’s a staggering 100 million signatures per slot!

Understanding Ethereum Slots

For those new to Ethereum’s mechanics, a ‘slot’ is a fundamental time unit. Think of it as a 12-second window where the network selects a validator to propose the next block of transactions. Currently, with a high validator count, each slot requires processing a large volume of signatures.

Buterin proposes a shift towards sticking to 8,192 signatures per slot, a significant reduction from the current 28,000. This adjustment, he believes, would drastically simplify the technical challenges the network currently faces.

See Also: Tether Minted $1B USDT For ‘Inventory Replenish’ On Christmas Day

Vitalik’s 3-Pronged Approach: How to Reduce Validator Load?

To tackle this validator load challenge, Buterin lays out three distinct approaches. Let’s explore each of them:

-

Going All-In on Decentralized Staking Pools

This first approach emphasizes the role of decentralized staking pools. To incentivize smaller stakers to join these pools, Buterin suggests a significant increase in the minimum deposit size – potentially to 4,096 ETH.

- Benefit: Consolidates staking efforts, reducing the number of individual signatures the network needs to process.

- Challenge: Raises the barrier to entry for solo stakers, potentially impacting decentralization at the individual level.

-

Creating Two Layers of Stakers: Heavy and Light

Buterin’s second proposal introduces a layered staking system:

- “Heavy” Layer: Validators with a large stake (e.g., 4,096 ETH minimum) responsible for finality – ensuring transaction confirmation and immutability.

- “Light” Layer: Stakers with no minimum deposit, providing an extra layer of security to the network.

- Benefit: Enhanced security as attacks would need to compromise both layers.

- Challenge: Could create a divide within the staking community, potentially making staking less egalitarian by establishing distinct tiers.

-

Rotating Validator Communities

The final approach suggests rotating communities of validators, selected from the active pool. These communities would be adjusted every slot to enhance security.

- Benefit: Preserves solo staking in a recognizable form, maintains a single-class system, and could even allow for a reduced minimum deposit (e.g., 1 ETH).

- Challenge: Increases the complexity of the Ethereum protocol itself.

The Goal: Easing the Load and Simplifying Ethereum

Buterin emphasizes that aiming for 8,192 signatures per slot is about simplifying the technical complexities currently burdening the Ethereum network. He believes this reduction would have several positive impacts:

- Easier Client Operation: Running a consensus client would become significantly less resource-intensive.

- Increased Accessibility: Users and staking enthusiasts could more readily participate and build upon this simplified assumption.

- Predictable Future Load: The future computational demands of the Ethereum protocol would become more predictable and manageable.

“It becomes much easier for anyone to run a consensus client, and users, staking enthusiasts and others would be able to immediately work off of that assumption,” Buterin stated, concluding that “The future load of the Ethereum protocol becomes no longer unknown.”

What’s Next? Community Discussion and Implementation

Vitalik Buterin has presented the problem and potential paths forward. Now, the Ethereum community faces the crucial task of evaluating these proposals and deciding which approach, or combination of approaches, to implement. This discussion will likely involve developers, stakers, and the broader Ethereum ecosystem, shaping the next chapter in Ethereum’s evolution towards greater scalability and efficiency. The choices made now will have a significant impact on the future of Ethereum staking and its ability to handle increasing network demands.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.