Buckle up, crypto enthusiasts! Polygon (MATIC) is flashing green, and it’s not just a flicker. Like a rocket fueled by bullish sentiment, MATIC’s price has been soaring, leaving many wondering: is this the start of a sustained rally? Let’s dive into the data and see what’s powering this impressive surge.

MATIC on a Tear: By the Numbers

The numbers don’t lie. MATIC is making waves in the crypto market, mirroring the positive trends seen across various altcoins. Here’s a quick snapshot of what’s been happening:

- Whale Alert: Addresses holding a substantial 100,000 to 10 million MATIC tokens are on an accumulation spree. This significant buying activity from large holders signals strong confidence in MATIC’s future potential.

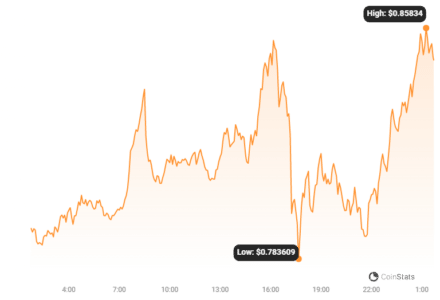

- Price Surge: As of now, MATIC is trading around $0.80, showcasing an impressive 21.15% jump in value over the past week alone, according to CoinMarketCap.

- Market Cap Boost: It’s not just price; MATIC’s market capitalization has swelled by a whopping 54% in the last three weeks. Data from Santiment, a leading on-chain analytics platform, confirms this explosive growth.

- Open Interest Surges: Adding fuel to the fire, Open Interest in MATIC futures contracts has climbed alongside the price. This indicates a growing number of traders betting on further upward price movement, reinforcing the bullish narrative.

Santiment highlighted this whale accumulation in a recent X post (formerly Twitter) on November 9th, emphasizing the increased buying pressure. When deep-pocketed investors start accumulating, it often precedes significant price appreciation, especially when combined with overall positive market sentiment.

Technical Indicators Paint a Bullish Picture

Looking at the technical charts, MATIC’s 4-hour chart reveals a robust bullish structure taking shape. Let’s break down what key indicators are suggesting:

- Bollinger Bands (BB): The Bollinger Bands are widening, signaling increased volatility around MATIC. This heightened volatility often accompanies strong price movements, and in this case, it’s to the upside.

- Potential Retracement? The upper Bollinger Band touched $0.858, hinting at a possible short-term pullback. If this happens, a retracement towards $0.78 could occur. However, strong support around $0.75 suggests any dip might be limited.

Read Also: MATIC Propels Over $0.75, Is $1 Possible?

The $0.70 support level, established on November 7th and seemingly defended by buyers, provides a safety net against deeper declines.

Awesome Oscillator (AO): Momentum is Your Friend?

The Awesome Oscillator (AO) further strengthens the bullish case. Currently at 0.083, the AO displays lengthening green bars. What does this mean?

- Accelerating Uptrend: Lengthening green bars on the AO indicate that bullish momentum is not just present, but gaining strength. This suggests the upward trend could accelerate further.

- Potential for Further Gains: With the $0.70 support level holding firm, continued buying pressure could propel MATIC another 10% higher in the short term.

Open Interest: Are More Traders Joining the Bull Run?

Another crucial piece of the puzzle is Open Interest. This metric reflects the total number of outstanding futures contracts – essentially, how much new money is flowing into the market betting on MATIC’s price.

- Rising Open Interest is Bullish: A rising Open Interest alongside a rising price is generally considered a strong bullish signal. It indicates that new positions are being opened to the long side, confirming and potentially amplifying the uptrend.

- MATIC Open Interest Soars: MATIC’s Open Interest has jumped to a significant $214.95 million. This substantial increase reinforces the idea that traders are increasingly confident in MATIC’s upward trajectory.

Will MATIC Break $0.90?

The confluence of whale accumulation, positive technical indicators, and surging Open Interest paints a compelling picture for MATIC. The data strongly suggests that a move above $0.90 is not just possible, but increasingly likely if current trends persist.

Key Takeaways and What to Watch For:

- Whale Accumulation is a Major Catalyst: Keep an eye on whale activity. Continued accumulation suggests sustained bullish pressure.

- Monitor Open Interest: A rising Open Interest confirms bullish momentum. Watch for any significant drops, which could signal weakening conviction.

- $0.78 Retracement Level: Be prepared for a potential pullback to $0.78. This could present a buying opportunity if the overall bullish trend remains intact.

- $0.70 Support is Crucial: The $0.70 support level is critical for maintaining the bullish structure. A break below this level could signal a trend reversal.

In Conclusion: Is MATIC’s Bull Run Just Getting Started?

MATIC’s recent price surge is backed by solid fundamentals and technical indicators. Whale accumulation, rising open interest, and positive momentum suggest this bullish phase could have further legs. While short-term retracements are always possible in the volatile crypto market, the overall outlook for MATIC appears bright. Keep a close watch on the key levels mentioned, and remember to do your own research before making any investment decisions. The crypto market is always dynamic, but for now, the wind seems to be firmly at MATIC’s back!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.