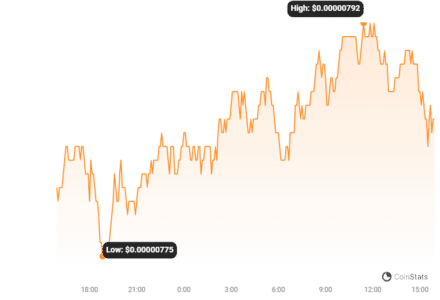

Shiba Inu (SHIB), the popular memecoin, has seen its price momentum stall recently. After a promising surge in late October, SHIB bulls couldn’t conquer the $0.000009 resistance, leading to a period of consolidation. Now, on-chain data is painting a picture that suggests potential downward pressure. Is SHIB bracing for a price correction? Let’s dive into the crucial data factors that could dictate SHIB’s price action in the coming days.

After a period of positive movement, Shiba Inu’s price has entered a phase of uncertainty. Will the second-largest memecoin by market cap experience a downturn, or is this just a temporary pause before another rally? Let’s explore what the on-chain metrics are telling us.

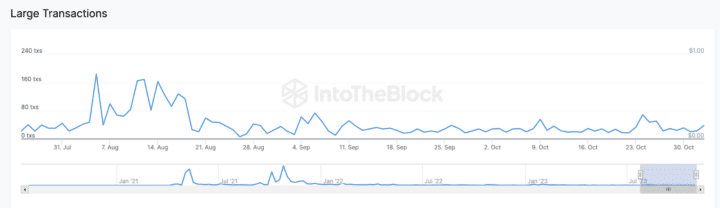

Are Shiba Inu Whales Losing Interest?

In late October, SHIB enjoyed a double-digit price increase, riding the wave of Bitcoin’s bullish momentum that spilled over into the memecoin market. However, on-chain data reveals a significant shift in whale behavior. Since SHIB faced rejection at the $0.000008 mark on October 24th, large investors, often referred to as ‘whales,’ have noticeably reduced their trading activity.

According to IntoTheBlock data, Shiba Inu whale transactions hit a two-month peak of 69 large transactions on October 24th. But, fast forward to November 2nd, and this number has dwindled to just 39 whale trades – a substantial 44% decrease! What does this mean for SHIB?

The ‘Large Transactions’ metric tracks the daily count of trades exceeding $100,000 in value. A sharp decline in these whale transactions is often seen as a bearish signal. Why? Because it suggests a cooling interest from large institutional investors. This lack of enthusiasm from big players can, in turn, influence retail traders to adopt a more cautious, or even negative, outlook. If this trend continues, SHIB might face reduced market demand in the short term.

Read Also: Near Protocol and Arweave Among Top Earners as InQubeta Blitzes Past $4.2 Million Raised

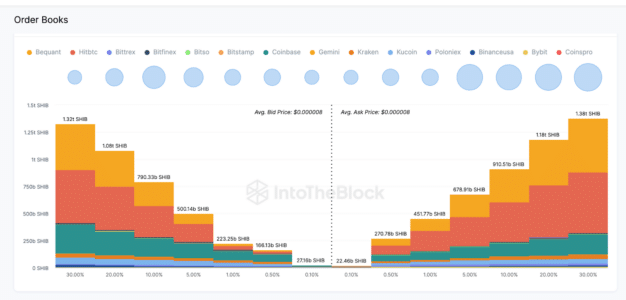

Is Sell Pressure Mounting for SHIB?

Another critical on-chain indicator pointing towards weakening demand for SHIB is the Aggregate Order Books. Analyzing the order books provides insights into the overall buy and sell pressure in the market. Currently, SHIB traders have placed active sell orders for a staggering 6.5 trillion tokens. Here’s the concerning part: this significantly outweighs the 6 trillion SHIB buy orders currently listed across 10 major cryptocurrency exchanges.

Exchange Aggregate Order Books offer a snapshot of the total active buy and sell orders for an asset. When sell orders heavily outweigh buy orders, it indicates increased selling pressure. In such a scenario, sellers may be compelled to lower their prices to attract buyers, potentially leading to a price decline.

Therefore, the combination of decreased whale trading activity and stronger sell-side pressure suggests a potential downward trajectory for SHIB’s price in the near future.

SHIB Price Prediction: Could We See a Drop to $0.000005?

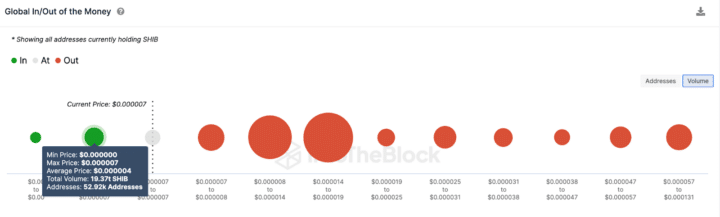

Current on-chain data suggests that Shiba Inu’s price might experience further declines in the coming days. Let’s delve deeper into the price prediction using another on-chain metric: the Global In/Out of the Money (GIOM).

The GIOM chart visualizes the entry price distribution of current SHIB holders, essentially showing price levels where a significant number of investors bought SHIB. It highlights the importance of the $0.000007 price level as a crucial support zone. If SHIB loses this support, it could trigger more substantial losses.

As the GIOM chart below illustrates, a substantial 52,920 addresses acquired 19.37 trillion SHIB at a maximum price of $0.000007. This represents the largest support cluster below the current price. These holders are highly likely to defend this level and attempt to ‘HODL’ to prevent further losses.

However, the critical question remains: will their efforts be enough to withstand the prevailing bearish pressure? If whale demand continues its downward trend, Shiba Inu’s price could potentially fall even further, possibly testing the $0.000005 level.

On the flip side, what would it take for SHIB to reverse this bearish outlook? If Shiba Inu can successfully reclaim the $0.00001 price level, it could invalidate the current negative prediction and signal renewed bullish momentum. However, this seems like an uphill battle at the moment. Data shows that a significant 153,700 addresses are holding a massive 68.5 trillion SHIB purchased at an average price of $0.000008. If SHIB manages to approach this level, these holders might be tempted to take profits, creating strong resistance and potentially triggering another price retracement.

Despite the challenges, if SHIB can break through this resistance zone around $0.000008, a move towards the $0.00001 range becomes a plausible scenario.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.