Buckle up, crypto enthusiasts! The Ronin (RON) token just took investors on a dizzying rollercoaster ride. After soaring to a glorious two-year peak, RON experienced a dramatic nosedive, plunging nearly 30% right after its highly anticipated listing on Binance. What happened? Was it a classic case of ‘buy the rumor, sell the news,’ or something more sinister at play? Let’s dive into the wild swings of RON and unpack this crypto drama.

Ronin’s Rocket Launch and Sudden Stop: What Happened?

February 5th was looking incredibly bright for Ronin. The token was riding high on a wave of positive momentum, fueled by a growing community and increased activity on the Ronin Network. Investors were clearly optimistic, and RON’s price responded with a stunning 15% surge, reaching a peak of $3.54. Trading volume exploded to $80 million, signaling strong market interest. It felt like Ronin was finally breaking free and ready for its next big leap.

See Also: Dymension (DYM) Gains 58% In First Day After Airdrop

But as they say in crypto, what goes up must come down, and in Ronin’s case, the descent was swift and steep. Just hours after the celebratory Binance listing announcement, the party ended abruptly. Approximately five hours after trading commenced on the world’s largest exchange, RON’s price began a sharp decline. The euphoria evaporated, replaced by a wave of selling pressure.

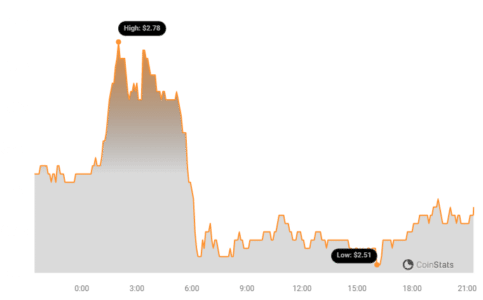

Fast forward to today, and RON is trading around $2.54, having lost almost 30% of its value. This drop is particularly significant because it broke through the $3 support level, a price point RON had fought hard to reclaim after a long 14-month struggle. Take a look at the price chart to visualize this dramatic turnaround:

Why the Sudden Shift? Decoding Market Sentiment

To understand the ‘why’ behind this price plunge, we need to look beyond just the charts and delve into market sentiment. Social media, often a reliable barometer of crypto moods, reflected the dramatic price action of RON. Data from Santiment paints a clear picture:

- Social Volume Spike: A massive 250% increase in social media mentions of RON within 24 hours. Everyone was talking about Ronin, but not all conversations were positive.

- Sentiment Flip: A concerning shift towards bearishness. Negative sentiment jumped from 0.87 to a worrying 5.58. This indicates a significant increase in fear, uncertainty, and doubt (FUD) surrounding RON.

This rapid shift in sentiment is clearly visible in the Santiment chart below:

The negative sentiment fueled a wave of selling pressure. Traders, spooked by the price drop and bearish chatter, rushed to liquidate their holdings. This resulted in:

- Trading Volume Surge: A staggering 275% increase in 24-hour trading volume, reaching a whopping $203 million. This signifies a massive sell-off as market participants scrambled to exit their positions.

Pump and Dump Accusations: Is Binance Under the Microscope?

The perfectly timed price surge followed by an equally dramatic crash has ignited speculation of a classic “pump and dump” scheme. The fact that the plunge occurred shortly after the Binance listing announcement has raised eyebrows and led some to question Binance’s role, or lack thereof, in preventing potential market manipulation.

While concrete proof of foul play is yet to surface, the crypto community is buzzing with theories and accusations. Even Yi He, co-founder of Binance, has publicly acknowledged these concerns. In a move to address the allegations and demonstrate Binance’s commitment to fair trading, she announced a substantial $5 million bounty program. This program aims to incentivize whistleblowers to come forward with information that could expose any corrupt employees potentially involved in insider trading or market manipulation activities. This is a significant step, but whether it will quell the speculation remains to be seen.

What’s Next for Ronin? Navigating Uncertain Waters

Despite the recent turbulence, it’s important to keep perspective. Even after the 30% drop, RON is still trading at levels not seen since February 2022, marking a 23-month high compared to that period. This suggests that underlying growth and interest in the Ronin Network still exist.

However, the road ahead is undeniably uncertain. The sharp price correction, the shift in market sentiment towards negativity, and the lingering questions of potential market manipulation have cast a shadow over Ronin’s immediate future. Here’s a quick summary of the key factors to consider:

| Factor | Impact on Ronin (RON) |

|---|---|

| Binance Listing | Initially positive, but triggered a sharp sell-off post-listing. Long-term impact depends on sustained trading volume and liquidity. |

| Price Plunge | Damaged investor confidence, broke crucial support levels, and created short-term bearish momentum. |

| Negative Sentiment | Could prolong price weakness and hinder future rallies if not addressed by the Ronin team and community. |

| Manipulation Allegations | Erodes trust in the market and potentially in Binance if not thoroughly investigated and addressed. |

Ultimately, Ronin’s long-term success will depend on its ability to:

- Rebuild Investor Confidence: Address concerns transparently and demonstrate the project’s fundamental strength.

- Foster Positive Sentiment: Highlight network growth, adoption, and future developments to shift market perception.

- Maintain Network Activity: Continue to grow its user base and address activity to support token utility and demand.

The crypto market is known for its volatility, and Ronin’s recent price action is a stark reminder of this. While the short-term outlook is clouded by uncertainty, the underlying potential of the Ronin Network remains. Whether RON can bounce back from this setback and resume its upward trajectory remains to be seen. Crypto investors will be watching closely.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.