Bitcoin, the king of cryptocurrencies, has recently experienced a rollercoaster ride, dropping below the $65,000 mark. If you’re a crypto enthusiast, you’ve likely felt the tremors of this market movement. But what’s really behind this price dip? Is it just another market fluctuation, or are there deeper forces at play? Let’s dive into the factors driving Bitcoin’s recent downturn and explore what it means for the future of BTC.

As George from CryptosRUs breaks down in his latest YouTube update, several elements are converging to influence Bitcoin’s price. From miner behavior to government actions and strategic market plays, the crypto landscape is buzzing with activity. Let’s unpack these key drivers:

- Bitcoin (BTC) price has seen a noticeable fall, attributed to a combination of factors.

- Despite the current bearish trend, there are underlying positives and potential future catalysts that could swing the pendulum back.

- While recovery might not be immediate, the overall trajectory for Bitcoin remains optimistic, and the present price dip could be viewed as a strategic entry point for savvy investors.

Let’s get into the details and understand what’s happening in the Bitcoin market.

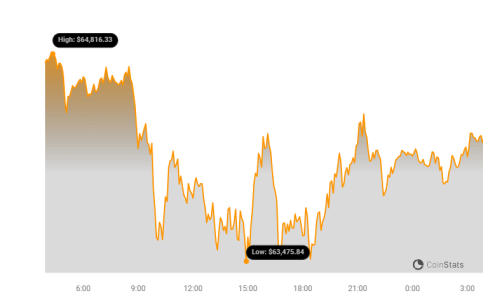

Bitcoin recently dipped below $65,000, touching a low of $64,544 after reaching a peak of $66,436. This price correction is significant and has caught the attention of the global crypto community. But what’s fueling this downturn? Let’s explore the primary factors at play.

Are Miners Fueling the Fire Sale?

One of the critical aspects highlighted by George is the role of Bitcoin miners in the recent price decline. Data reveals a significant uptick in sell-offs originating from older Bitcoin wallets, predominantly associated with mining operations.

Why are miners selling now? This surge in miner selling activity is largely a consequence of the recent Bitcoin halving event. The halving, a pre-programmed event that reduces the reward for mining new Bitcoin blocks, effectively cut daily Bitcoin production from 900 to 450 BTC. This reduction in revenue, coupled with the consistently high operational costs of mining – including electricity and hardware maintenance – is putting immense pressure on miners.

Especially vulnerable are miners using older, less efficient equipment. Post-halving, these operations are finding it increasingly difficult to remain profitable. As a result, many are faced with tough choices: either shut down their operations entirely or invest in costly upgrades to more efficient mining technology. To navigate this challenging period, many miners are selling off their Bitcoin holdings to cover expenses and fund necessary upgrades.

Government Sell-Offs: Another Headwind for Bitcoin?

Adding to the selling pressure, the German government has reportedly made substantial Bitcoin sales. According to Arkham Intelligence, Germany moved a significant $600 million worth of Bitcoin to cryptocurrency exchanges, with a notable $200 million liquidated in a single day. This action follows reports about the German government selling Bitcoin.

Considering that the German government holds approximately $3 billion in Bitcoin, this sudden and large-scale sell-off is noteworthy. While the exact reasons behind this move remain speculative, it’s plausible that economic pressures or fiscal needs are prompting the government to liquidate some of its cryptocurrency holdings. Such large-volume sales from government entities can exert considerable downward pressure on Bitcoin’s price, at least in the short term.

Short Positions: Market Makers Playing the Bearish Tune?

Furthermore, the market is currently seeing a high number of short positions against Bitcoin. These positions, essentially bets that the price of Bitcoin will fall, are likely being driven by major market players or market makers. The intention behind these large short positions could be to deliberately suppress Bitcoin’s price, potentially to accumulate BTC at lower levels or profit from the price decline.

However, it’s not all doom and gloom. Amidst this bearish sentiment, there are strong signs of long-term confidence in Bitcoin. Institutional investors like MicroStrategy, known for their bullish stance on Bitcoin, are reportedly using this price dip as an opportunity to increase their holdings. This indicates that major players with a long-term investment horizon view the current downturn as a temporary phase and a strategic buying opportunity.

Retail investors are also showing resilience and savvy. Many are actively buying the dip, leveraging the lower prices to accumulate more Bitcoin. This collective buying activity from both institutional and retail investors suggests a strong underlying belief in Bitcoin’s long-term value proposition.

Interest Rate Cuts: A Potential Tailwind for Bitcoin?

Looking ahead, there’s a potential macroeconomic factor that could swing in Bitcoin’s favor. Several countries are contemplating interest rate cuts as a measure to stimulate their economies. Historically, lower interest rates have often been beneficial for assets like Bitcoin and other cryptocurrencies. When interest rates are low, traditional savings and fixed-income investments become less attractive, prompting investors to seek higher-yield or alternative assets. Bitcoin, with its potential for significant returns, could become a more appealing investment in a low-interest-rate environment. This could potentially trigger a price rebound for Bitcoin and the broader crypto market.

Navigating the Bitcoin Dip: What’s the Playbook?

To summarize, Bitcoin’s immediate recovery might be delayed due to the confluence of miner sell-offs, government actions, and market manipulation through short positions. The post-halving market dynamics and shifts in investor behavior are creating a complex landscape.

However, it’s crucial to remember that market corrections are a natural part of any asset’s lifecycle, especially in the volatile world of cryptocurrencies. The current dip presents a strategic window for investors who believe in Bitcoin’s long-term potential. The fact that both retail and institutional investors are capitalizing on this price correction underscores a prevailing optimism about Bitcoin’s future.

So, are you viewing this Bitcoin dip as a buying opportunity, or are you waiting for more clarity in the market? Share your strategy and thoughts in the comments below!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.