Hold on to your hats, crypto enthusiasts! The world of Exchange Traded Funds (ETFs) just got a whole lot more interesting. WisdomTree, a giant in the ETF space managing a whopping $94 billion in assets, has made a groundbreaking move. They’ve become the very first to inject Bitcoin into a commodity ETF! This isn’t just a small step; it could be a giant leap for Bitcoin’s mainstream adoption. Let’s dive into what this means for you and the future of crypto investing.

WisdomTree Welcomes Bitcoin to the Commodity Club

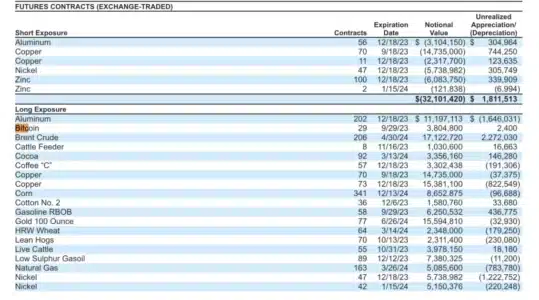

For those unfamiliar, the WisdomTree Enhanced Commodity Strategy Fund (GCC) is a big player. Previously, it focused its investments on the traditional commodity powerhouses: energy, agriculture, industrial metals, and precious metals. Think oil, wheat, copper, and gold – the usual suspects.

But things have changed! Now, GCC is opening its doors to the digital gold – Bitcoin. And not just a tiny sliver. Bitcoin will constitute a significant 5% of the fund’s total assets. That’s a bold statement in the world of traditional finance.

Currently, the GCC fund manages around $200 million in assets. With a 5% allocation, that translates to approximately $4 million directly invested in Bitcoin. Think about it – this ETF is now mixing cattle and copper with crypto! It’s a pioneering move that blurs the lines between traditional commodities and digital assets.

But the Bitcoin love doesn’t stop there. WisdomTree’s Managed Futures Strategy Fund (WTMF) is also getting a Bitcoin boost. WTMF is known for its diverse portfolio, spanning stocks, commodities, currencies, and interest rates. And guess what? It now holds around $4 million in Bitcoin as well, further diversifying its already broad investment spectrum.

Read Also: Bitrace Highlights Risks Associated With Telegram Exchange Bots

Bitcoin’s Quiet Infiltration into Major Funds: A Growing Trend

WisdomTree isn’t alone in recognizing Bitcoin’s potential. Earlier this year, we saw financial giants like BlackRock, Morgan Stanley, and Saba Capital quietly adding Bitcoin exposure to some of their major funds.

Consider these examples:

- BlackRock’s Global Allocation Fund: Now includes Bitcoin, signaling a broader acceptance of crypto in diversified portfolios.

- Morgan Stanley’s Europe Opportunity Fund: Has also incorporated Bitcoin, indicating a global trend.

- Saba Capital’s Income & Opportunities Fund: Another example of Bitcoin making its way into diverse investment strategies.

These funds are designed to mirror global economic expansion, aiming for diversification across various asset classes. Bitcoin’s inclusion, even at a seemingly small percentage, is a significant nod to its growing legitimacy as an investment asset.

Why the Minimal Bitcoin Allocation? It’s Still Early Days

While Bitcoin is making its way into these diverse funds, the allocation remains relatively small. Why? Because institutional fund managers are just beginning to explore and understand Bitcoin’s role in investment portfolios.

Academic research suggests that even a minimal allocation, like 1%, can significantly improve risk-adjusted returns in a diversified portfolio. Think of it as adding a dash of spice to your investment stew – it might be a small amount, but it can enhance the overall flavor profile (and potentially returns!).

The Untapped Potential of Commodity ETFs: A $2 Billion Bitcoin Opportunity?

The emergence of commodity ETFs embracing Bitcoin suggests a potentially massive market for passive crypto exposure. The commodity ETF market is estimated to be worth a staggering $200 billion. Let that sink in.

If commodity ETFs were to allocate just 1% to Bitcoin, that would translate to a $2 billion inflow into the cryptocurrency. WisdomTree, however, is taking it a step further with a 5% allocation. This is halfway between the initial 1% recommended by academic research and the now suggested 10% as understanding of Bitcoin’s role evolves.

At a 5% allocation across the entire commodity ETF market, Bitcoin could potentially see a massive $10 billion in inflows! Of course, this will be a gradual process, and WisdomTree is starting with cash-settled futures.

Cash-Settled Futures: WisdomTree’s Cautious Approach

WisdomTree clarifies their strategy:

“The Enhanced Commodity Strategy Fund (“GCC”) and Managed Futures Strategy Fund (“WTMF”) each invest up to 5% of its net assets in bitcoin futures contracts.

GCC and WTMF only invest in cash-settled bitcoin futures traded on the Chicago Mercantile Exchange, which is a futures exchange registered with the Commodity Futures Trading Commission.”

This means WisdomTree is using cash-settled Bitcoin futures traded on the regulated Chicago Mercantile Exchange (CME). This approach offers regulated exposure to Bitcoin without directly holding the digital asset itself, a common starting point for institutional investors.

Spot Bitcoin ETFs: The Next Frontier?

Interestingly, there are different approaches being taken. The Morgan Stanley Europe Opportunity Fund invests in GBTC (Grayscale Bitcoin Trust), which represents spot Bitcoin. BlackRock’s Global Fund, on the other hand, uses cash-settled futures, similar to WisdomTree’s initial strategy.

The game might change soon. GBTC, currently limited to accredited investors, has applied to convert to a freely traded spot Bitcoin ETF. BlackRock has also applied to launch its own spot Bitcoin ETF.

This suggests that some fund managers might be waiting for readily accessible spot Bitcoin ETFs before significantly increasing their Bitcoin allocations in diversified or commodity funds. A spot ETF would provide direct exposure to Bitcoin, potentially preferred by some institutions.

The Future is Bright for Bitcoin in Passive Funds

Bitcoin allocation in passive investment funds is undoubtedly a nascent trend. However, WisdomTree’s move, along with the actions of other major players, signals a clear direction. As institutional investors become more comfortable with Bitcoin and the regulatory landscape becomes clearer, we are likely to see Bitcoin integrated into more and more diversified and commodity-focused funds.

This is just the beginning. As institutional adoption grows, expect Bitcoin to become a standard component in portfolios aiming for diversification and exposure to the commodities market. WisdomTree’s pioneering step is a strong indication of things to come.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.